Northern (NOG) Q1 Earnings & Revenues Outpace Estimates

Northern Oil and Gas, Inc. NOG reported first-quarter 2024 adjusted earnings per share of $1.28, which beat the Zacks Consensus Estimate of $1.15. The outperformance reflects strong production. However, the bottom line declined from the year-ago adjusted profit of $1.76 due to weaker oil realizations and an increase in costs.

The oil and natural gas sales of $532 million beat the Zacks Consensus Estimate of $506 million. The top line, however, improved from the year-ago figure of $426.2 million.

Adjusted EBITDA came in at $387 million compared with $325.5 million in the year-ago period.

After the completion of the Northern Delaware acquisition in the first quarter, NOG distributed $40 million in common stock dividends, bought back $20 million worth of common stock and cleared approximately $50 million in debt.

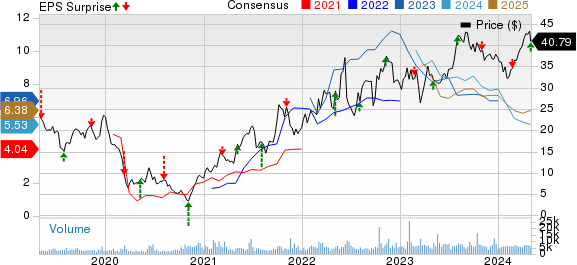

Northern Oil and Gas, Inc. Price, Consensus and EPS Surprise

Northern Oil and Gas, Inc. price-consensus-eps-surprise-chart | Northern Oil and Gas, Inc. Quote

Realizations

The first-quarter production increased 37% year over year to 119,436 barrels of oil equivalent per day (Boe/d). The figure also surpassed our estimate of 114,000 Boe/d.

While oil volume totaled 70,181 barrels per day (up 30% year over year), natural gas (and NGLs) amounted to 295,526 thousand cubic feet per day (up 47%). Our model estimate for oil volume and natural gas production was pegged at 69,600 Boe/d and 266,400 thousand cubic feet per day, respectively.

The average sales price for crude was $72.92 per barrel, indicating a 1% decrease from the prior-year quarter’s level of $73.31. However, the figure was above our expectation of $71.79 per barrel.

The average realized natural gas price was $2.47 per thousand cubic feet compared with $3.91 in the year-earlier period. Our model estimate for the same was pinned at $2.06 per thousand cubic feet.

Costs & Expenses

Total operating expenses in the quarter rose to $344 million from $221.6 million in the year-ago period. The figure was higher than our projection of $334.5 million. This was mainly on account of a surge in production expenses, production taxes and depletion, depreciation, amortization and accretion.

In particular, the company’s lease operating expenses decreased to $9.70 per Boe from the year-ago figure of $9.93. Meanwhile, depreciation outlay increased 33% year over year on a per-barrel basis.

Financial Position

Cash flow from operations totaled $392.1 million. When excluding changes in net working capital, cash flow from operations amounted to $352.5 million, up 19% from that recorded a year ago. The company’s free cash flow for the quarter totaled $54 million.

As of Mar 31, Northern had $32.5 million in cash and cash equivalents. As of the same date, it had a long-term debt of $1.9 billion, with a debt-to-capitalization of 49.2%.

Guidance

NOG expects a relatively flat production and roughly 22-25 wells turned in line in the second quarter. NOG expects to allocate approximately $240-$260 million for capital expenditures in the second quarter, and $825-$900 million for the entire year.

NOG expects its expenditure to fall within the middle to upper range of the guidance, assuming sustained high levels of oil prices and activity throughout 2024 after considering current commodity prices.

The company aims to maintain flexibility and prioritize returns. In the second quarter, NOG anticipates modestly improving crude oil differentials in the Williston Basin and significantly wider gas differentials in the Permian Basin, influenced by unfavorable field-level Waha hub prices.

NOG’s output is now anticipated in the 115,000-120,000 Boe/d range for 2024. It anticipates growth in the band of 67.5-72.5 for its 2024 well-spud count.

The company expects second-quarter production to fall in the range of 117,500-119,500 BOE per day, while annual production in the 115,000-120,000 BOE per day range. The company anticipates oil production to be in the range of 69,000-71,000 BOE per day. Annual oil production is projected to be in the 70,000-73,000 barrels per day range.

The company plans to allocate $825-$900 million for capital expenditures during 2024.

Important Energy Earnings so far

While it's still early in the earnings season, there have been a few key energy releases so far. Let’s take a look at these stocks.

SLB SLB, the largest oilfield contractor, announced first-quarter 2024 earnings of 75 cents per share (excluding charges and credits), which beat the Zacks Consensus Estimate of 74 cents. The bottom line also increased from the year-ago quarter’s level of 63 cents.

SLB’s strong quarterly earnings resulted from higher evaluation and stimulation activities in the international market. As of Mar 31, 2024, the company had approximately $3.5 billion in cash and short-term investments. It had a long-term debt of $10.7 billion at the end of the quarter.

Energy infrastructure provider Kinder Morgan KMI reported first-quarter adjusted earnings per share of 33 cents, a penny above the Zacks Consensus Estimate. The bottom line was favorably affected by increased financial contributions from the Natural Gas Pipelines, Products Pipelines and Terminals business segments. Moreover, KMI’s first-quarter discounted cash flow (DCF) totaled $1.42 billion, up from $1.40 billion reported a year ago.

As of Mar 31, 2024, Kinder Morgan reported $119 million in cash and cash equivalents. Its long-term debt amounted to $30.1 billion as of the same date. For full-year 2024, KMI anticipates a DCF of $5 billion ($2.26 per share) and an adjusted EBITDA of $8.16 billion, each indicating 8% growth from the previous year’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance