Beacon Roofing Supply (NASDAQ:BECN) Might Have The Makings Of A Multi-Bagger

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Beacon Roofing Supply (NASDAQ:BECN) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Beacon Roofing Supply is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = US$704m ÷ (US$6.8b - US$1.8b) (Based on the trailing twelve months to March 2024).

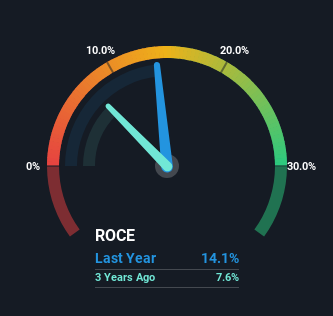

So, Beacon Roofing Supply has an ROCE of 14%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Trade Distributors industry average of 13%.

See our latest analysis for Beacon Roofing Supply

Above you can see how the current ROCE for Beacon Roofing Supply compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Beacon Roofing Supply .

What The Trend Of ROCE Can Tell Us

Beacon Roofing Supply is showing promise given that its ROCE is trending up and to the right. The figures show that over the last five years, ROCE has grown 217% whilst employing roughly the same amount of capital. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Essentially the business now has suppliers or short-term creditors funding about 27% of its operations, which isn't ideal. Keep an eye out for future increases because when the ratio of current liabilities to total assets gets particularly high, this can introduce some new risks for the business.

Our Take On Beacon Roofing Supply's ROCE

To bring it all together, Beacon Roofing Supply has done well to increase the returns it's generating from its capital employed. And a remarkable 147% total return over the last five years tells us that investors are expecting more good things to come in the future. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

Beacon Roofing Supply does have some risks though, and we've spotted 1 warning sign for Beacon Roofing Supply that you might be interested in.

While Beacon Roofing Supply isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance