Bull of the Day: Netflix (NFLX)

Netflix NFLX is considered a pioneer in the streaming space, evolving from a small DVD rental provider to a dominant streaming service provider. The stock has enjoyed positive earnings estimate revisions across the board, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Let’s take a closer look at how the streaming titan currently stacks up.

Netflix

Netflix shares faced selling pressure following its latest release but have since recovered, up 18% overall in 2024.

Image Source: Zacks Investment Research

Concerning headline figures in its latest print, Netflix posted a 17% beat relative to the Zacks Consensus EPS estimate and posted sales modestly ahead of the consensus, with both items showing considerable growth from the year-ago periods.

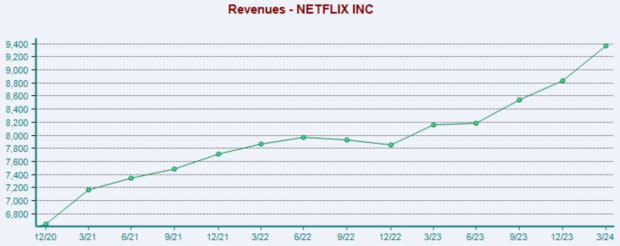

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Total subscribers were reported at 269.6 million, reflecting a 16% jump year-over-year. Still, the real surprise in the quarterly release was that the company will no longer report quarterly membership numbers starting next year in 2025 Q1, likely explaining the knee-jerk reaction post-earnings.

Nonetheless, Netflix enjoyed a solid quarter, posting $2.1 billion in free cash flow and seeing its year-to-date operating margin moving higher to 28.1% (20.6% in FY23). The company also maintained its free cash flow outlook of $6 billion for FY24 and repurchased 3.6 million shares throughout the period.

The company’s growth outlook remains bright, with consensus expectations for its current fiscal year suggesting 52% earnings growth on 15% higher sales. The stock sports a Style Score of ‘A’ for Growth.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Netflix NFLX would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance