Is the National Grid share price a once-in-a-decade opportunity?

The National Grid (LSE:NG) share price has managed a 7% gain since the beginning of January. But the stock still looks like a bargain.

The FTSE 100 has managed a 9% gain and National Grid has fared worse than some of its US counterparts. And a price-to-earnings (P/E) ratio of 5 isn’t exactly demanding.

Valuation

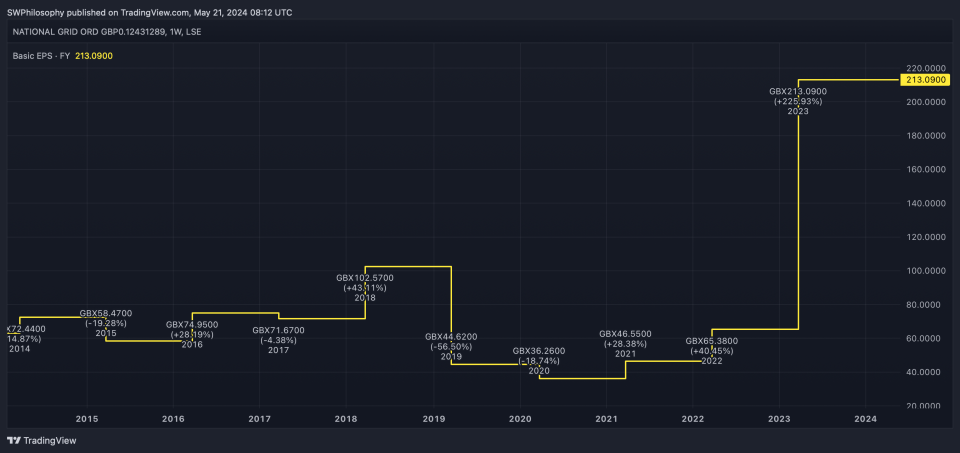

The P/E ratio is often a good way of assessing utilities stocks. But not always. Earnings multiples can be artificially low or high, making a stock look cheaper or more expensive than it actually is.

National Grid shares typically trade at a P/E ratio of between 10 and 20. A multiple of 5 makes the stock look like a once-in-a-decade opportunity, but investors should be careful here.

National Grid P/E ratio 2014-24

Created at TradingView

The firm sold off a US electric utilities subsidiary and a natural gas pipeline business. Those caused 2023 earnings to come in much higher than usual, but that isn’t going to be repeated.

National Grid Earnings per Share 2014-24

Created at TradingView

Adjusting for these, the stock trades at a P/E ratio closer to 15 – much closer to its historical average. And there’s another issue to consider with the company.

Debt

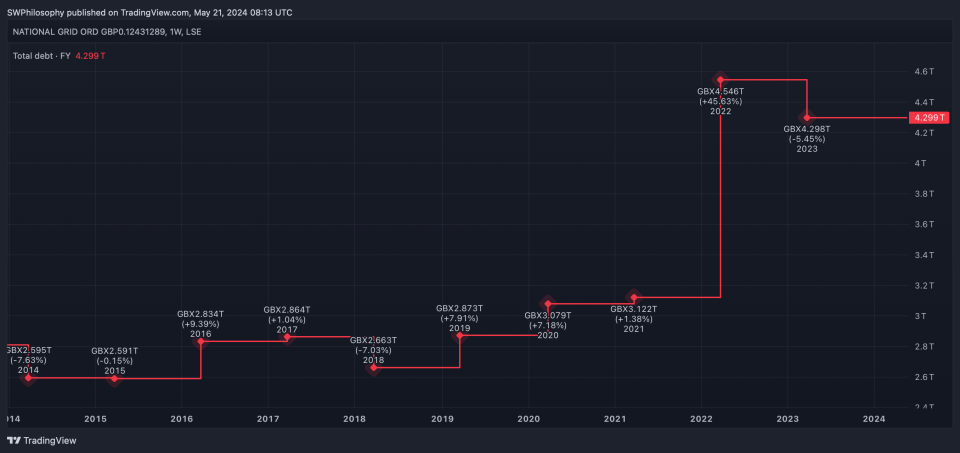

The company also has a lot more debt on its balance sheet than it did 10 years ago. This creates risk for investors – sooner or later, borrowings have to be repaid.

National Grid Total Debt 2014-24

Created at TradingView

Another way of measuring debt is by comparing net debt with cash earnings, or EBITDA. Again, National Grid looks like it has a lot of debt by this metric.

National Grid Net Debt to EBITDA 2014-24

Created at TradingView

Utilities companies often operate with significant debts. Demand for their products is steadier and more predictable than other businesses and this makes them unlikely to default on their obligations.

Nonetheless, National Grid’s debt metrics are high even compared to their historical levels. And this is something investors should take note of in trying to assess the firm’s future profitability.

Utilities and AI

In general, utilities stocks have been doing well recently – especially in the US. Since the start of the year, the S&P 500‘s up 12%, but the utilities sector as a whole has managed a 14% increase.

One reason for this is the emergence of artificial intelligence (AI). Increased AI capabilities require huge data centres that have significant energy requirements.

As a result, utilities companies that provide the power stand to benefit from much higher demand in future. And that’s why their shares have been doing well lately.

The building out of data centres isn’t limited to the US though. And increased power requirements in the UK should be a benefit to National Grid over the long term.

A stock to buy?

National Grid shares aren’t as cheap as they first seem. The company has a lot of debt, but there could be a big under-the-radar opportunity.

The need for power has always been relatively dependable. But the rise of AI is likely to provide a significant boost to this – and the companies that provide it.

The post Is the National Grid share price a once-in-a-decade opportunity? appeared first on The Motley Fool UK.

More reading

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance