Exploring Top ASX Dividend Stocks In May 2024

The Australian market has shown robust growth, climbing 1.5% over the last week and achieving a 7.3% increase over the past 12 months, with earnings expected to grow by 13% annually. In this context, selecting dividend stocks that offer consistent payouts and potential for capital appreciation can be particularly appealing to investors looking for both stability and growth in their portfolios.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.22% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.79% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.77% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.80% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.66% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.71% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.74% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.23% | ★★★★★☆ |

Macquarie Group (ASX:MQG) | 3.37% | ★★★★☆☆ |

Australian United Investment (ASX:AUI) | 3.57% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ampol

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited, operating in Australia, New Zealand, Singapore, and the United States, engages in the purchasing, refining, distribution, and marketing of petroleum products with a market capitalization of approximately A$8.68 billion.

Operations: Ampol Limited generates revenue through three primary segments: Z Energy (A$5.51 billion), Convenience Retail (A$5.99 billion), and Fuels and Infrastructure (A$33.63 billion).

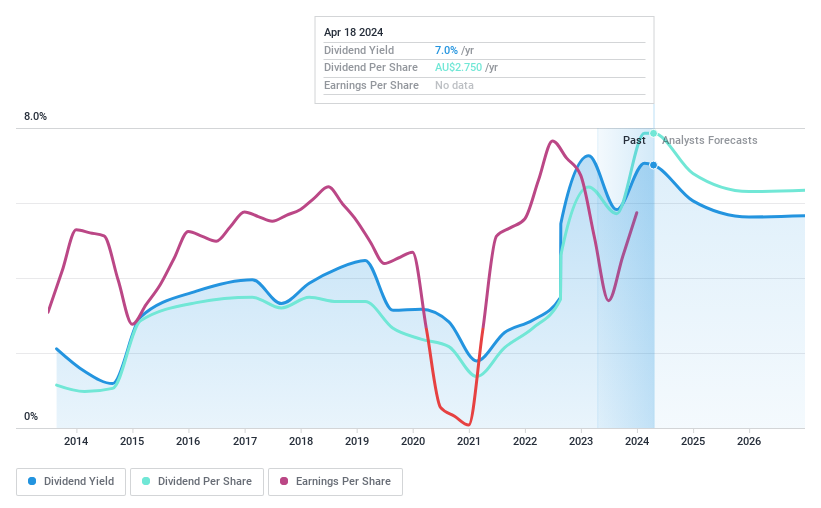

Dividend Yield: 7.6%

Ampol Limited, with a dividend yield of 7.55%, ranks in the top quartile of Australian dividend payers. Despite this attractive yield, the sustainability is questionable as its dividends are not well-covered by earnings, evidenced by a high payout ratio of 93.3%. Additionally, Ampol's dividend history has been inconsistent over the past decade with significant volatility and unreliable payouts. Recent financials show a decline in net income from A$795.9 million to A$549.1 million year-over-year, further challenging future dividend reliability despite trading at 33.6% below estimated fair value and upcoming Q1 sales results announcement on April 30, 2024.

Take a closer look at Ampol's potential here in our dividend report.

Upon reviewing our latest valuation report, Ampol's share price might be too optimistic.

NRW Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited operates in Australia, offering diversified contract services to the resources and infrastructure sectors, with a market capitalization of approximately A$1.28 billion.

Operations: NRW Holdings Limited generates its revenue primarily from three segments: Mining (A$1.49 billion), MET (A$739.07 million), and Civil (A$593.62 million).

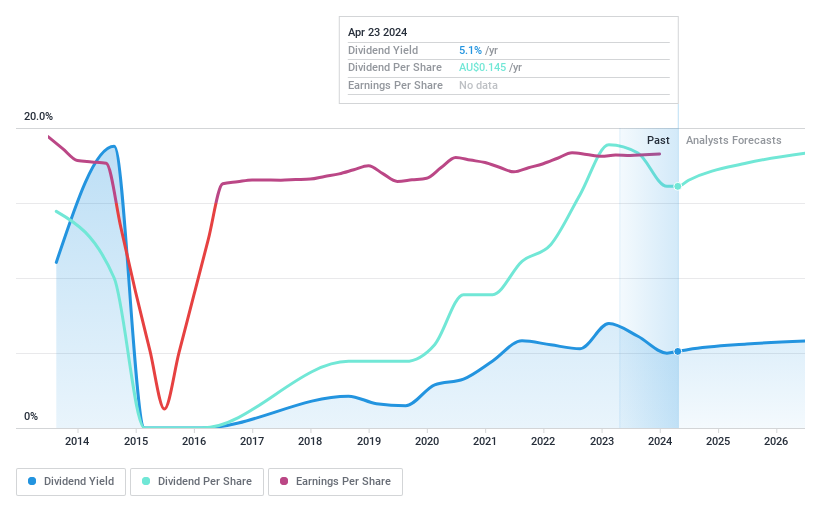

Dividend Yield: 5.2%

NRW Holdings has shown a modest increase in earnings, with sales rising to A$1.43 billion and net income reaching A$41.64 million as of December 2023. Despite a history of unreliable and volatile dividends, recent growth trends are positive, with earnings up 15.8% annually over five years and forecasts suggesting further growth at 14.05% per year. The dividend coverage is reasonable, supported by a payout ratio of 74% and cash flow coverage at 68.6%, though its dividend yield of 5.16% remains below the top Australian payers.

Sonic Healthcare

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sonic Healthcare Limited provides medical diagnostic services to medical practitioners, hospitals, and community health services, with a market capitalization of approximately A$12.98 billion.

Operations: Sonic Healthcare Limited generates revenue primarily through its laboratory and radiology segments, with A$7.12 billion from laboratory services and A$0.84 billion from radiology services.

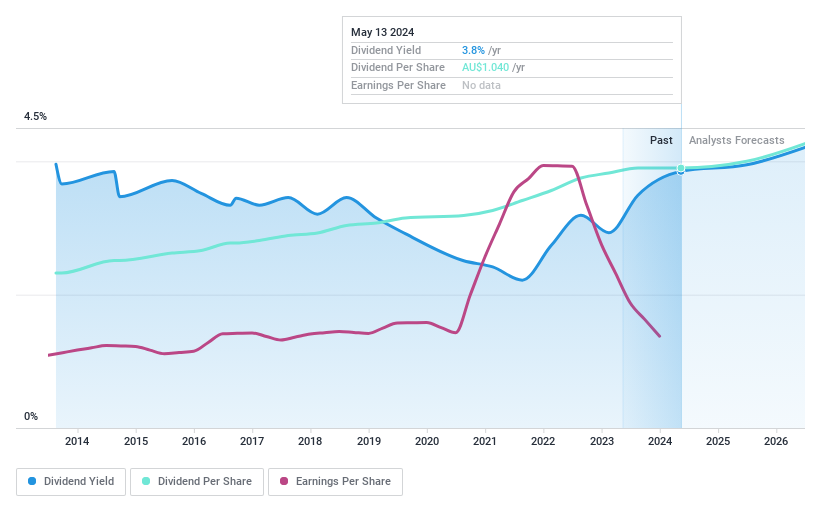

Dividend Yield: 3.8%

Sonic Healthcare has demonstrated consistent dividend growth over the past decade, although its current yield of 3.85% falls below the top quartile in Australia. Despite a stable historical payout, the dividends are poorly covered by both earnings and cash flow, with payout ratios at 98% and 87.5%, respectively. Recent financials show a decline in net income from A$382.35 million to A$202.31 million year-over-year, alongside reduced profit margins from 11.7% to 6%, suggesting potential pressure on future dividend sustainability.

Unlock comprehensive insights into our analysis of Sonic Healthcare stock in this dividend report.

Our valuation report here indicates Sonic Healthcare may be undervalued.

Seize The Opportunity

Click through to start exploring the rest of the 28 Top ASX Dividend Stocks now.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ALDASX:NWHASX:SHL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance