FM Mattsson Leads Three Key Dividend Stocks In Sweden

Amidst a backdrop of fluctuating global markets, Sweden's recent interest rate cut by the Riksbank reflects a broader trend of easing monetary policies aimed at supporting economic growth. As investors navigate these changing tides, dividend stocks like FM Mattsson remain appealing for their potential to offer steady income in an environment where traditional bonds and savings avenues may yield less due to lower interest rates.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.18% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.61% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.59% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.13% | ★★★★★☆ |

Duni (OM:DUNI) | 4.41% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.60% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.34% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.14% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.59% | ★★★★☆☆ |

Bahnhof (OM:BAHN B) | 4.11% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FM Mattsson

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FM Mattsson AB (publ) specializes in developing, manufacturing, and selling water taps and related products for bathrooms and kitchens across Sweden, Norway, Denmark, Finland, Benelux, the United Kingdom, Germany, and Italy with a market capitalization of SEK 2.34 billion.

Operations: FM Mattsson AB generates revenue primarily from two segments: SEK 1.12 billion from Nordic countries and SEK 783.23 million internationally.

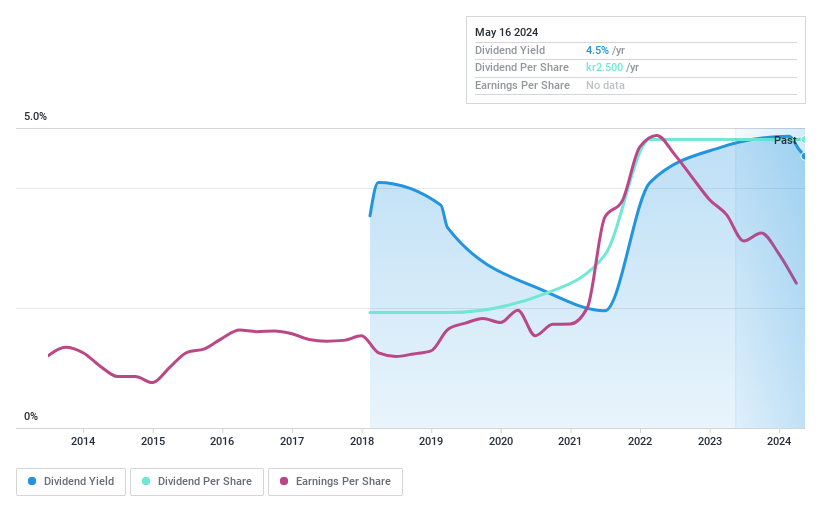

Dividend Yield: 4.5%

FM Mattsson's recent performance shows a decline in quarterly sales and net income, with Q1 2024 sales at SEK 493.4 million and net income at SEK 28.2 million, down from the previous year. Despite this, the company maintains a stable dividend history with a recent payout of SEK 1.25 and has proposed SEK 2.50 for the year ended December 2023. Trading at a significant discount to its estimated fair value, FM Mattsson offers dividends that are well-covered by both earnings (86.3% payout ratio) and cash flows (49.5% cash payout ratio), supporting sustainability despite its relatively short dividend-paying history of six years.

Husqvarna

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Husqvarna AB (publ) specializes in the production and sale of outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 51.74 billion.

Operations: Husqvarna AB's revenue is primarily generated from three segments: Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

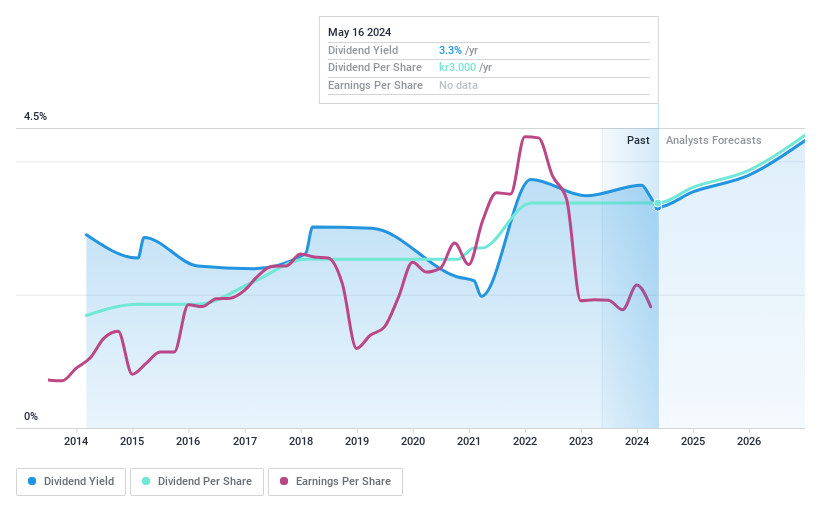

Dividend Yield: 3.3%

Husqvarna AB's dividend yield stands at 3.31%, which is below the top quartile of Swedish dividend stocks. Despite a long history of stable and reliable dividends, its payout ratio is high at 92.8%, indicating that earnings do not adequately cover dividend payments. Furthermore, recent financials show a decline in sales and net income, with Q1 2024 sales dropping to SEK 14.72 billion from SEK 17.17 billion year-over-year, and net income falling to SEK 1.32 billion from SEK 1.65 billion, potentially stressing future dividends amidst significant insider selling over the past three months.

Delve into the full analysis dividend report here for a deeper understanding of Husqvarna.

Our valuation report here indicates Husqvarna may be undervalued.

Skandinaviska Enskilda Banken

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ), commonly known as SEB, offers a range of financial services including corporate, retail, investment, and private banking, with a market capitalization of approximately SEK 312.93 billion.

Operations: Skandinaviska Enskilda Banken AB generates revenue through diverse segments, including Corporate & Private Customers at SEK 25.42 billion, Large Corporates & Financial Institutions at SEK 31.98 billion, Baltic operations at SEK 13.55 billion, Private Wealth Management & Family Office at SEK 4.46 billion, Life insurance services at SEK 3.75 billion, and Investment Management at SEK 3.16 billion.

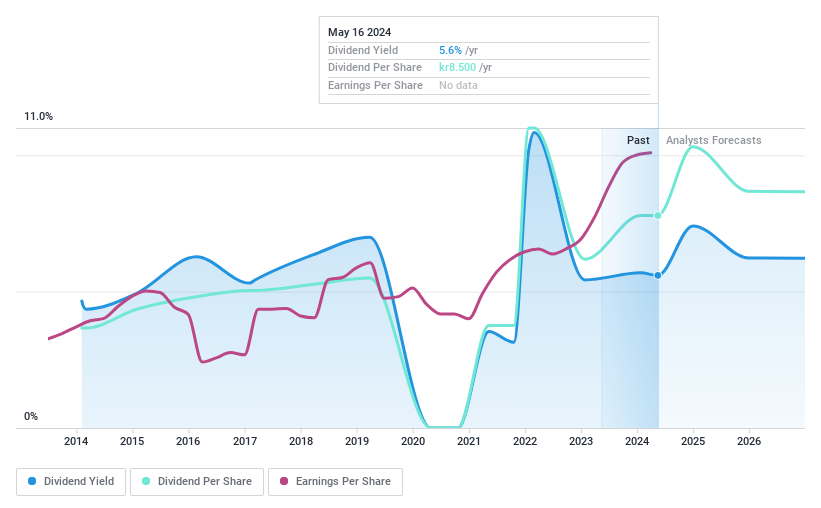

Dividend Yield: 5.6%

Skandinaviska Enskilda Banken (SEB A) offers a dividend yield of 5.6%, ranking in the top 25% in Sweden. While its dividends are currently covered by earnings with a payout ratio of 46.3%, future forecasts suggest coverage at 58.8%. Despite this, SEB A has experienced unstable and unreliable dividend payments over the past decade, with no consistent growth pattern. Recent financials show slight increases in net interest income and net income for Q1 2024, alongside ongoing share repurchase programs aimed at shareholder returns, including a recent buyback worth SEK 2 billion ending July 12, 2024.

Summing It All Up

Reveal the 22 hidden gems among our Top Dividend Stocks screener with a single click here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:FMM B OM:HUSQ B and OM:SEB A.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance