Genesis Energy LP (GEL) Q1 2024 Earnings: Consistent with Analyst Projections

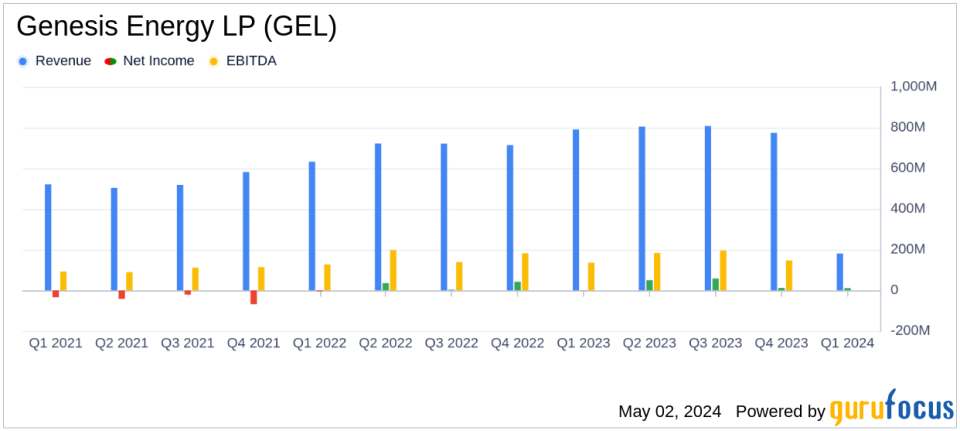

Net Income: Reported $11.4 million for Q1 2024, a significant improvement from a net loss of $1.6 million in Q1 2023.

Cash Flows from Operating Activities: Increased to $125.9 million in Q1 2024 from $97.7 million in the same period last year.

Total Segment Margin: Reached $181.1 million in Q1 2024.

Adjusted EBITDA: Amounted to $163.1 million for Q1 2024.

Available Cash before Reserves: Stood at $54.0 million for Q1 2024, providing 2.94X coverage for the quarterly distribution of $0.15 per common unit.

Revenue: Declined to $770.1 million in Q1 2024 from $790.6 million in Q1 2023.

Net Loss per Common Unit: Recorded at $0.09 in Q1 2024, compared to a loss of $0.21 in the same quarter the previous year.

On May 2, 2024, Genesis Energy LP (NYSE:GEL) disclosed its first quarter financial results through its 8-K filing. The company reported a net income of $11.4 million, a significant improvement from a net loss of $1.6 million in the same quarter the previous year. This performance aligns closely with analyst expectations of an earnings per share of $0.02 for the quarter.

Genesis Energy, a pivotal player in the midstream segment of the oil and gas industry, operates primarily through segments including offshore pipeline transportation, sodium minerals and sulfur services, onshore facilities and transportation, and marine transportation. The company's strategic operations in the Gulf of Mexico and various onshore locations play a crucial role in servicing both upstream producers and downstream entities.

Financial Highlights and Segment Performance

The company's financial resilience is evident from its increased cash flows from operating activities, which rose to $125.9 million from $97.7 million year-over-year. Total segment margin stood at $181.1 million, with notable contributions from each operational segment. Despite facing operational challenges, particularly in the offshore pipeline transportation and soda ash businesses, Genesis Energy has managed to maintain robust segment margins and cash flows.

The offshore pipeline transportation segment, although slightly underperforming due to field downtimes, benefited from high volumes from BPs Argos facility. The marine transportation segment exceeded expectations due to favorable market conditions and high utilization rates, contributing positively to the overall segment margin.

Strategic Developments and Future Outlook

CEO Grant Sims highlighted the strategic milestones approaching in the near future, including the completion of major capital projects which are expected to significantly enhance the financial performance of the company's offshore assets. The anticipated recovery in the soda ash segment and the completion of the SYNC pipeline and CHOPS expansion projects are pivotal developments likely to bolster future cash flows.

The company's forward-looking statements suggest a strong focus on capital allocation and returning value to shareholders as these projects come online. The management's strategy revolves around optimizing capital structure, managing debt, and potentially increasing shareholder returns through strategic capital distributions.

Challenges and Mitigations

Despite the positive outlook, Genesis Energy faced several challenges during the quarter. Operational issues in the soda ash segment led to reduced efficiencies and lower production volumes, impacting the segment's financial results. However, the company is optimistic about resolving these issues promptly, with no additional costs expected due to covered manufacturer warranties.

The delay in the Shenandoah development project also poses a temporary setback, expected to impact the financial performance in the fourth quarter. However, the contractual agreements in place ensure that the financial impact will be mitigated starting mid-2025.

Conclusion

Genesis Energy's first quarter of 2024 paints a picture of a company at a strategic inflection point, with significant capital projects nearing completion and potential market recoveries on the horizon. While operational challenges persist, the proactive strategies and robust segment performance provide a stable foundation for future growth. Investors and stakeholders may look forward to enhanced cash flows and potential capital returns as the company progresses through these pivotal developments.

For detailed insights and ongoing updates, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Genesis Energy LP for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance