Here's Why You Should Retain Molson Coors (TAP) Stock Now

Molson Coors Beverage Company TAP seems well-poised for growth, thanks to its robust business strategies. The company has been gaining from brand strength as well as strong performances across its portfolio and both geographical segments. Smooth progress on its Acceleration Plan also bodes well.

Buoyed by such strengths, shares of this beer and other beverage products’ manufacturer have gained 9.7% compared with the industry’s 6.3% growth over the past year.

Delving Deeper

Molson Coors is on track with its revitalization plan focused on achieving sustainable top-line growth by streamlining the organization and reinvesting resources into its brands and capabilities. The company intends to invest in iconic brands and growth opportunities in the above-premium beer space; expand in adjacencies and beyond beer without hampering the support for its existing large brands; and create digital competencies for commercial functions, supply-chain-related system capabilities and employees. The company is also building on the strength of its iconic core brands.

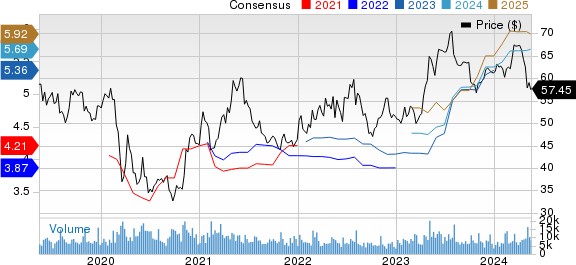

Molson Coors Beverage Company Price and Consensus

Molson Coors Beverage Company price-consensus-chart | Molson Coors Beverage Company Quote

Molson Coors delivered against its revitalization plan on a global basis by increasing its dollar share in the United States. Strength in Coors Light, Miller Lite and Coors Banquet together resulted in total industry share growth in the United States, driven by brand positionings and better marketing. Molson Canadian and Carling beer in the U.K.

The company is one of the largest brewers in the world and boasts a strong portfolio of well-established brands. It remains committed to growing its market share through innovation and premiumization. To accelerate portfolio premiumization, the company has been aggressively growing its above-premium portfolio in the past few years.

The company highlighted that it is making efforts to change the shape of its product portfolio and expand in growth areas. Its U.S. above-premium portfolio witnessed sales that outpaced its U.S. economy portfolio, driven by the rapid growth of its hard seltzers, the successful launch of Simply Spiked Lemonade, and the continued strength in Blue Moon and Peroni’s.

Molson Coors has been gaining from brand strength and strong performances across its portfolio and both geographical segments. This led to impressive first-quarter results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate and improved year over year. Net sales grew 10.7% year over year on a reported basis, while the metric rose 10.1%, driven by a positive price and sales mix, increased financial volumes, and the positive impacts of foreign currency.

The quarterly results have gained from brand strength and favorable shipment timing in the United States. Also, significant progress against the Acceleration Plan aided the quarterly performance. The above premium portfolio, encompassing both beer and beyond beer, benefits from continued growth from successful innovations like Madri in the U.K. and Simply Spiked in the United States and Canada.

For 2024, net sales are projected to grow year over year in the low-single digits on a constant-currency basis. Underlying EBT is likely to grow in the mid-single digits on a constant-currency basis. Underlying earnings per share are likely to rise in the mid-single digits from that reported in 2023.

To wrap up, Molson Coors seems to be a decent investment bet given all the aforementioned positives. A Momentum Score of A further adds strength to this current Zacks Rank #3 (Hold) company.

Stocks to Consider

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal year sales and earnings suggests growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank of 2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The consensus estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.6% and 35.6%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse portfolio of salty snacks, currently carries a Zacks Rank of 2. UTZ has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 15.8% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance