Reasons to Hold ManpowerGroup (MAN) in Your Portfolio Now

ManpowerGroup MAN is leveraging strong pricing, cost control and technological investments to boost efficiency and productivity, as well as acquiring Ettain and Tingari to diversify its business mix. It has an expected long-term (three to five years) EPS growth rate of 23.5%.

The stock has risen 4.7% in the past month, outperforming the 3.3% and 2.7% growth of the industry it belongs to and the Zacks S&P 500 composite, respectively.

Factors That Auger Well

ManpowerGroup has implemented front office systems, cloud-based and mobile applications and improved its global technology infrastructure globally.

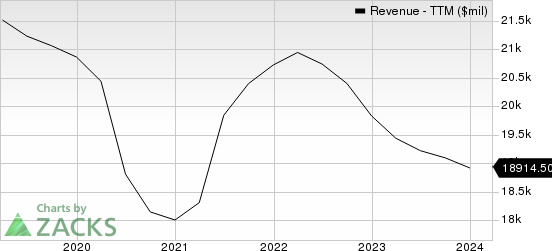

ManpowerGroup Inc. Revenue (TTM)

ManpowerGroup Inc. revenue-ttm | ManpowerGroup Inc. Quote

MAN’s top line benefited from acquisitions. It acquired Tingari in 2022 and Ettain Group in 2021. These acquisitions have accelerated the diversification strategy of its business mix. Ettain has become part of Experis, boosting the strength of financial services, Government and Healthcare clients.

ManpowerGroup’s commitment to shareholder returns is an effective strategy for investors to compound wealth over the long term. The company returned $179.8 million, $270 million and $210 million through share repurchases and made dividend payments of $144.3 million, $139.9 million and $136.6 million in 2023, 2022 and 2021, respectively. These initiatives positively impact the bottom line. Partly due to these upsides, shares have rallied 2.1% in the past six months.

Some Risks

Increasing expenses due to investments in digital initiatives and restructuring might hurt the company’s bottom line. In 2023, ManpowerGroup’s selling, general and administrative expenses increased 3.7% year over year.

ManpowerGroup's current ratio at the end of the fourth quarter of 2023 was pegged at 1.16, lower than 1.21 reported in the preceding quarter and year-ago quarter. A decreasing current ratio does not bode well.

Zacks Rank and Stocks to Consider

ManpowerGroup currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are AppLovin APP and Jamf JAMF.

AppLovin sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

APP has a long-term earnings growth expectation of 20%. It delivered a trailing four-quarter earnings surprise of 26.5%, on average.

Jamf carries a Zacks Rank of 2 (Buy) at present. It has a long-term earnings growth expectation of 42.7%.

JAMF delivered a trailing four-quarter earnings surprise of 49.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

Jamf Holding Corp. (JAMF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance