UK Growth Companies With High Insider Ownership in May 2024

As the FTSE 100 continues its record-breaking trajectory, reflecting robust investor confidence in the UK market, it's an opportune time to examine certain segments that might benefit from these conditions. High insider ownership in growth companies can be a marker of management's faith in their own business strategies, potentially aligning well with current market optimism and stability.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 54.6% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 19.7% | 94.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

Velocity Composites (AIM:VEL) | 29.5% | 140.5% |

Judges Scientific (AIM:JDG) | 11.6% | 25.3% |

We'll examine a selection from our screener results.

Gulf Keystone Petroleum

Simply Wall St Growth Rating: ★★★★★★

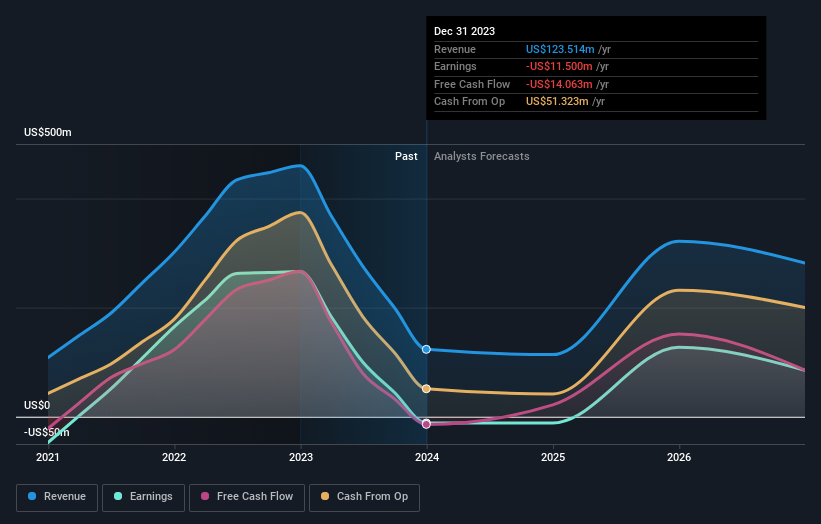

Overview: Gulf Keystone Petroleum Limited is an oil and gas company focused on exploration, development, and production in the Kurdistan Region of Iraq, with a market capitalization of approximately £289.76 million.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, amounting to $123.51 million.

Insider Ownership: 10.6%

Gulf Keystone Petroleum, despite a challenging financial year with sales dropping to US$123.51 million and a net loss of US$11.5 million, is positioned for recovery with expected revenue growth at 24.1% per year and profit growth forecasts promising profitability within three years. The company's high forecasted return on equity at 31.8% signals strong potential upside, although recent shareholder dilution raises concerns. This blend of rapid anticipated growth coupled with significant insider ownership underscores its appeal as a growth-oriented investment in the UK market.

IWG

Simply Wall St Growth Rating: ★★★★☆☆

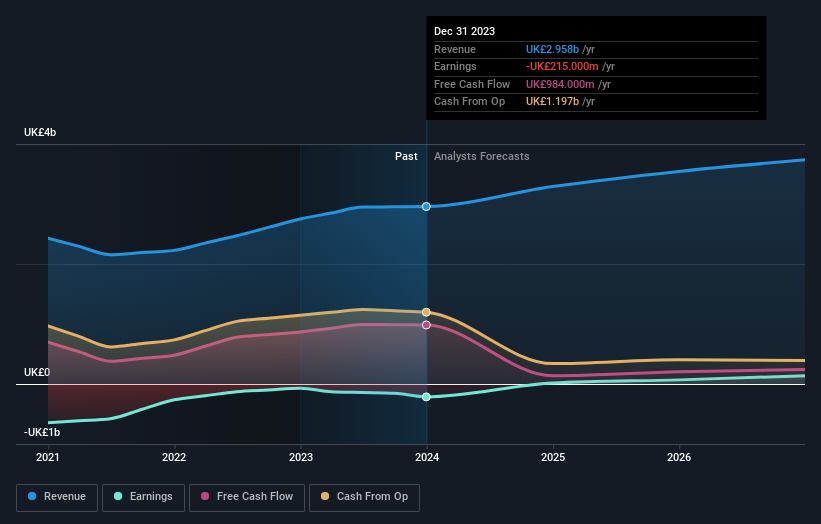

Overview: IWG plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately £2.06 billion.

Operations: The company generates revenue primarily from three geographical segments: £1.32 billion from Europe, the Middle East, and Africa (EMEA), £1.05 billion from the Americas, and £0.27 billion from Asia Pacific.

Insider Ownership: 28.9%

IWG plc, while trading at a good value relative to its peers, shows modest revenue growth forecasts of 7.8% per year, slightly ahead of the UK market average. Despite recent struggles with a net loss reported for the full year ending December 2023, IWG is expected to turn profitable within the next three years with earnings forecasted to grow significantly. This potential for profitability and above-average market growth in revenue positions IWG as a growing entity in its sector.

Unlock comprehensive insights into our analysis of IWG stock in this growth report.

Upon reviewing our latest valuation report, IWG's share price might be too pessimistic.

Kainos Group

Simply Wall St Growth Rating: ★★★★☆☆

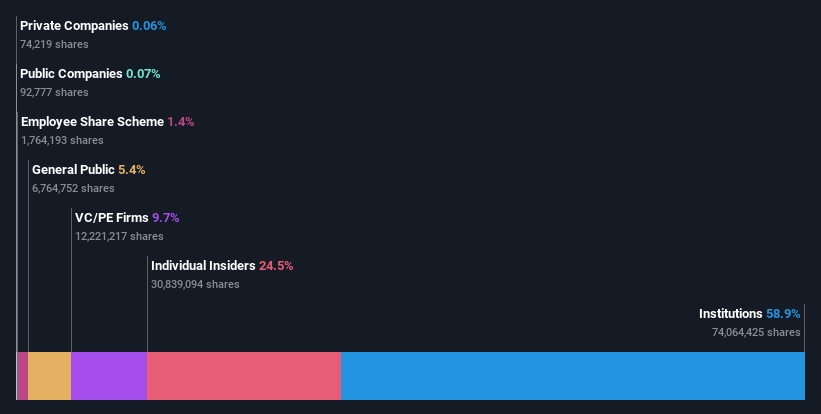

Overview: Kainos Group plc is a provider of digital technology services operating across the UK, Ireland, North America, and Central Europe, with a market capitalization of approximately £1.32 billion.

Operations: The company generates revenue through three primary segments: Digital Services (£223.12 million), Workday Products (£50.49 million), and Workday Services (£114.67 million).

Insider Ownership: 24.5%

Kainos Group, a UK-based growth company, exhibits high insider ownership and robust future prospects. Despite an unstable dividend track record, its earnings have increased by 11.3% over the past year and are expected to grow at 16.75% annually. Significantly undervalued at 43.9% below fair value, Kainos also forecasts a revenue growth of 8.7% per year—outpacing the UK market average of 3.7%. However, there is no recent insider trading activity to report.

Seize The Opportunity

Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 61 companies by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:GKP LSE:IWG and LSE:KNOS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance