Volatility Watch: Eyeing a Pair of Blue Chips With Unusual Earnings Dates

Last week, we took a broad view of the domestic economy through the lens of two consumer companies. This time, let's zoom in on a pair of companies that have weathered idiosyncratic volatility. PG&E (NYSE:PCG) and 3M (NYSE:MMM) have each found themselves dealing with litigation concerns in the last few years. The former regarding a slew of issues related to its products, perhaps the most notorious one being its combat arms earplugs, while the latter faced financial liability following the devastating 2018 California wildfires.[1]

Earnings date outliers

Both companies popped up on our radar with unusual earnings events over the next week, according to Wall Street Horizon data. PG&E reports on Thursday, April 25 BMO, with a conference call later that morning and 3M issues its first-quarter 2024 financial results on Tuesday, April 30 BMO, with an earnings call the same morning before the bell.

The two companies hold annual shareholder meetings during the middle of May, so we could see volatility flare up in either or both stocks then too. Let's take a closer look at what's happening at MMM and PCG and why they are outliers according to our data tracking.

Controversy cools with PCG

PG&E stands out with a first-quarter earnings date that is significantly earlier than usual. The California-based Utilities sector company normally issues first-quarter results on May 2, but on March 27, 2024, it confirmed its Q1 24 earnings release to take place on April 25.[2]

Seven days earlier than the historical trend, it scores a 2 DateBreaks Factor. Our research suggests that when an earnings date occurs earlier than usual, there are typically positive returns in the aggregate.

Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

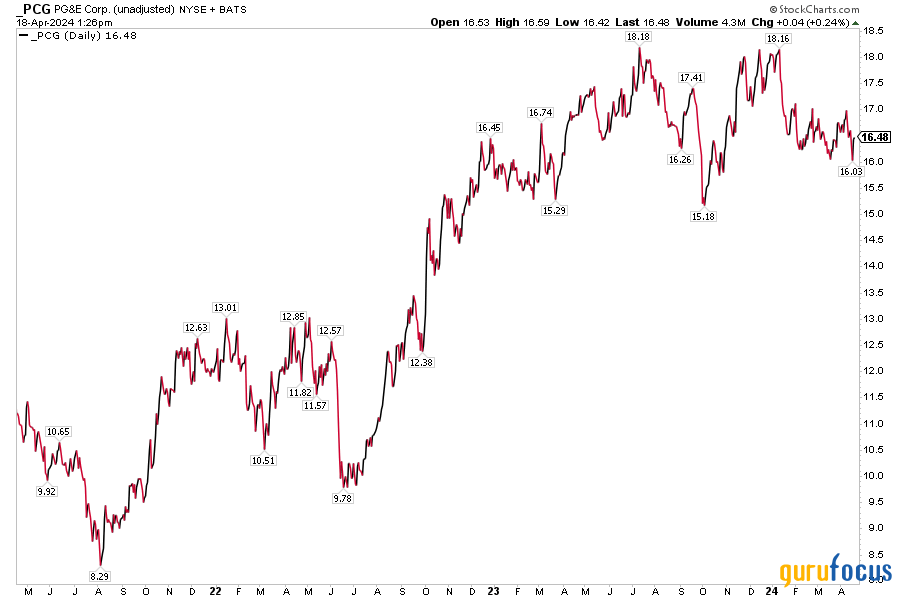

PCG shares up from two years ago, but wavering in 2024

Well, its performance thus far on the year doesn't exactly light up any technical screens. Through April 18, shares are down 9% in total return compared to a 2% positive performance for the Utilities sector. The S&P 500 was up 6%, dividends included, over the same time.[3]

Another downer is that, according to Goldman Sachs, if former President Trump is re-elected, then PG&E, seen as a potential clean energy play, could be negatively impacted if the 45th POTUS pursues changes to theInflation Reduction Act(IRA).[4] And while PCG topped earnings estimates back in February, the company announced a mixed shelf equity offering, though the amount was not disclosed.

The options angle

The good news is that wildfires out west are largely behind the $34 billion market cap Electric Utilities industry player. That's evidenced by a corporate announcement on Nov. 28, 2023, confirming that a cash dividend would be reinstated after a five-year hiatus, but the current payout is just 1 cent per quarter.[5] As it stands, the options market has priced in a small 2.80% earnings-related stock price swing when analyzing the at-the-money straddle, according to data from Option Research & Technology Services (ORATS).

PG&E three-year stock price history: Shares rebound as wildfire risks subside

Source: Stockcharts.com

3M stands out in the industrials sector

While PG&E sports an earlier-than-usual earnings date, 3M first-quarter numbers to be released on April 30 would be a week later than normal. The resulting DateBreaks Factor is -3. 3M shares have been a roller coaster ride in the last year, but the bears have generally been in control.

The stock has met selling pressure on a few occasions in the $109 to $113 range since July of 2023. Earnings events, new information regarding various lawsuits and settlement updates have cast clouds on the Industrials sector large cap. Maybe indicative of the times, 3M's market cap has fallen to $50 billion, below that of S&P 500-newcomer Super Micro Computer (NASDAQ:SMCI), which is now worth more than $55 billion.[6]

A tempting dividend yield

Income-focused investors might be drawn to 3M's high 5.6% forward dividend yield, but caution is warranted given the uncertainty around liability payouts over the years ahead. Still, the Minnesota-based Industrial Conglomerates industry stock features a trailing free cash flow yield of 10%.

C-suite changes

Analysts will parse through the full package of first-quarters numbers, and with an unexpected CEO transition in the works (William M. "Bill" Brown was appointed chief executive officer, effective May 1, 2024), volatility could come about next week.[7] Perhaps it's not surprising that 3M has a later-than-normal reporting date given so much corporate news recall that it completed the spin-off of Solventum back on April 1.[8]

ORATS data show a consensus operating earnings per share estimate of $1.97, which would be unchanged from a year ago, while the options market has priced in a 4.50% expected stock price change.

3M three-year stock price history: Shares wobbling around the $100 mark

Source: Stockcharts.com

The bottom line

Earnings season has broadened out, and results so far have been decent. Volatility has perked up across sectors, however, and both PG&E and 3M are dealing with their own issues. Identifying unusual earnings dates can help investors spot potentially significant stock price moves, but keeping abreast of other macro and micro factors is critical.

[1] Combat Arms Earplugs Settlement Set to Exceed 98% Participation Milestone, 3M, January 29, 2024,https://investors.3m.com[2] PG&E Corporation Schedules First Quarter 2024 Earnings Release and Conference Call, PG&E Corporation, March 27, 2024, https://www.pge.com[3] XLU, PCG, SPY Stock Chart, StockCharts, April 19, 2024, http://stockcharts.com[4] Stock losers of Republican policy if Trump wins - GS, Seeking Alpha, Monica L. Correa, April 5, 2024, https://seekingalpha.com[5] Shareholders FAQ, PG&E Corp., April 19, 2024, https://investor.pgecorp.com[6] Super Micro Computer Inc, Google Finance, April 19, 2024, https://www.google.com/finance[7] 3M Announces New Leadership Appointments, 3M, March 12, 2024, https://investors.3m.com[8] 3M Completes Spin-off of Solventum, 3M, April 1, 2024, https://investors.3m.comCopyright 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance