Snowflake Is Still Priced for Perfection

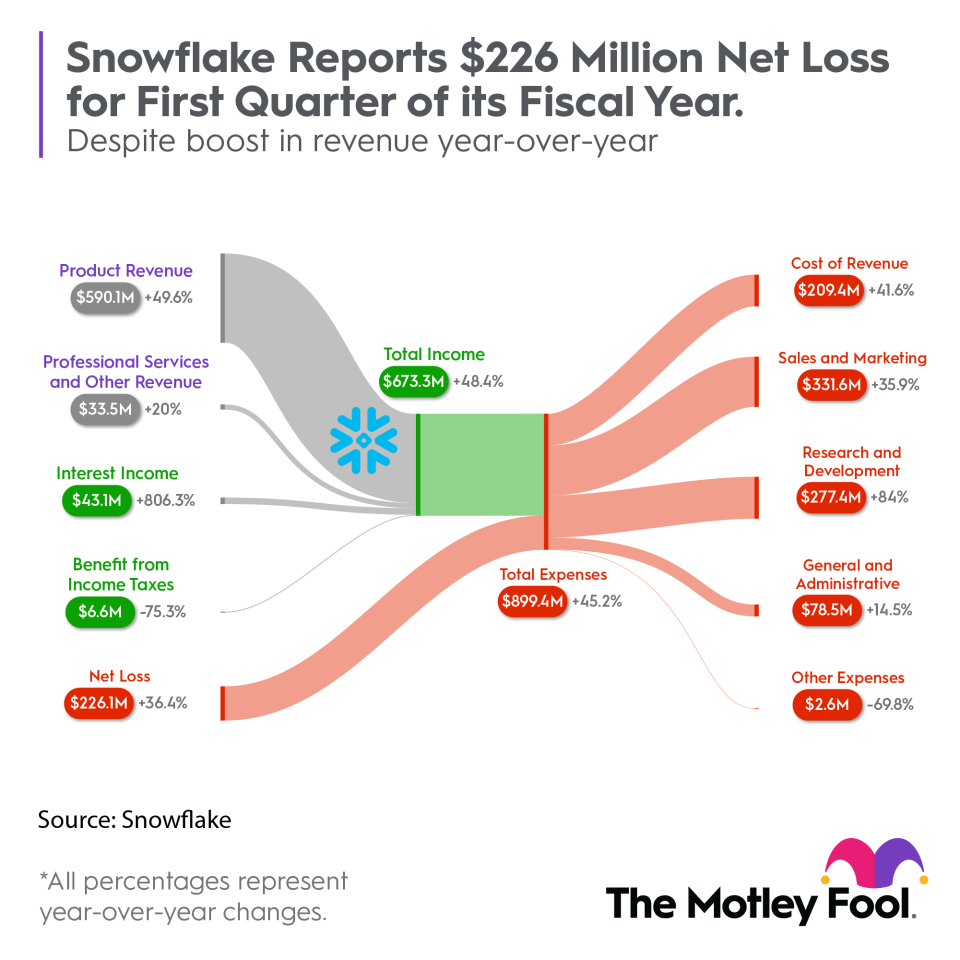

The data warehousing specialist had long been among the fastest growers in cloud computing, but its first-quarter earnings report shows that it can't escape the broader challenges in the sector. Snowflake offered disappointing guidance in its first-quarter earnings report, sending the stock down 17% on the news as the company forecast a significant decline in revenue growth over the remainder of the year. Product revenue in the first quarter grew 50% to $590.1 million, and overall revenue rose 48% to $623.6 million, which topped estimates at $608.4 million.

Yahoo Finance

Yahoo Finance