100 Ways To Live a Rich Life in Retirement — Without Spending All of Your Savings

You may have more free time when you retire, but retirement certainly isn’t free.

Around half of retirees report that their overall spending is higher than they anticipated, according to the Employee Benefit Research Institute. At the same time, the top concern of retirees is that the increased cost of living is making it harder to save money.

Check Out: 4 Things Boomers Should Never Sell in Retirement

Learn More: The Surprising Way You Can Get Guaranteed Retirement Income for Life

Ideally, you’ll have started preparing for retirement well before you hit the magic number. But even if you haven’t saved as much money as you would have liked, there are a multitude of ways to make your savings last.

While you may not be able to eat out at fancy restaurants every night or take big vacations every year, you can still live a rich, fulfilling life on a modest budget. Being smart with your money and taking advantage of free activities and experiences are keys to maintaining a satisfying lifestyle and healthy bank account balance.

Also see mistakes that will keep you from retiring wealthy.

Design Your Ideal Lifestyle

Before you make all the small decisions that will affect your quality of life in retirement, you need to take a step back and think about the big picture. How would you design your ideal life, within reason, given your current finances?

How do you envision your post-working life? Is it filled with new experiences, activities and travel to exotic locations? Or is it simpler, quieter and closer to home? Do you dream of moving to a sunnier climate, or would you want to downsize to a smaller house?

You don’t have to stick to your initial vision forever, but it’s helpful to think through your standard of living before planning your budget, as it will inform your purchasing decisions and lifestyle choices.

Wealthy people know the best money secrets. Learn how to copy them.

Know the 4% Rule

One common calculation for estimating how much money you’ll need in retirement is known as the 4% rule. This generalized guideline suggests that you should spend roughly 4% of your retirement savings every year if you expect your savings to last 30 years.

For example, if you have a retirement fund of $750,000, you could take out $30,000 as your budget for the first year. The next year, multiply that $30,000 by the inflation rate to find your annual budget.

Of course, this is more of a suggestion than a rule. Your individual circumstances will vary, but you can use this calculation as a starting point for thinking about your retirement budget.

Make a Budget and Stick to It

Budgeting is the key to saving money. Start by listing groceries, rent, insurance, utilities and other essentials. Then, review your past spending to see how much you typically spend on other expenses. Don’t forget to factor in taxes and annual inflation rates, and include room in the budget for fun and relaxation.

Currently, Social Security retirement benefits average $1,867 per month. Calculate how this will impact your budget and see whether you can cut down spending in nonessential areas.

Trick Your Mind Into Saving by Paying Yourself a Salary

After decades of receiving a paycheck, it can be challenging to shift your saving and spending mindset to one that’s not based on a regular salary. To combat this, give yourself a weekly, bi-weekly or monthly salary based on your budget. This will help ensure that you’re not withdrawing more from your savings account than you can afford. You can even structure monthly or yearly bonuses if that will help incentivize you to stick to the plan.

Plan for Variations in Your Retirement Spending

You won’t spend the same amount of money every single year. In the first few years of retirement, perhaps you’ll have more expenses related to traveling, entertainment and enjoying your new-found freedom. After that, your spending may even out and become predictable for a period before rising again due to medical or long-term care expenses toward the end of life.

Track Your Spending — All of It

It can be tempting to feel like you have an unlimited budget when you see a large lump sum in your bank account balance. But that nest egg can quickly shrink if you’re not carefully tracking what you buy each month.

Set Aside an Emergency Fund

It’s a good idea to keep a portion of your retirement savings reserved for large, unexpected expenses. Not only does this help cover you financially in the case of sudden repairs or medical bills, but it will also provide the peace you need to fully enjoy your retirement years.

Hire a Financial Advisor

Financial advisors aren’t just for the super wealthy. Think of hiring one for a one-time meeting as an investment in a more secure financial future. They can help you decide when to file for Social Security, how to structure your finances in preparation for retirement and how to think through all the costs associated with retirement that you may not have considered.

Evaluate Your Insurance Needs

You may not need to pay for all of your current insurance policies when you hit retirement. For instance, it may make sense for some people to stop paying for a life insurance policy once they’re retired. Talk to your insurance advisor to learn more about what types of insurance are necessary for retirees.

Decrease Your Debt

It’s tempting to make big spending decisions that could help you enjoy retirement to the fullest. But when you’re planning for life without additional income, it’s wise to avoid adding to your debt load.

Be Aware of Potential Healthcare Costs

Fidelity estimates that retirees may expect to spend around $157,000 on health and medical costs over a 20-year retirement period. For women, who tend to live longer, the estimate is around $165,000. If you’re still working, consider opening a health savings account, which can help save for these costs while offering tax advantages.

Take Advantage of Retiree Tax Breaks

If you’re over 65, you can claim an additional $1,850 on top of the regular standard deduction when filing your tax return. You also have a higher filing threshold than younger people and can claim certain tax credits that lower your bill. If you have expensive healthcare bills, itemizing them rather than claiming the standard deduction can provide a significant tax advantage.

Join the AARP

It costs $12 to join AARP, and membership comes with benefits for everything from saving money on gas and groceries to discounts on cruises, flights and vacation packages. Putting up the small initial investment for membership can pay off in a wide variety of ways throughout your retirement.

Consider Earning Extra Income

Just because you’ve retired doesn’t mean you have to stop working entirely. One study found that 20% of retirees work at least part time. While some people may feel pressured to work to make ends meet due to insufficient life savings, others simply find that working offers a sense of fulfillment and keeps them busy.

Whether you go back to work full time or start earning some money through a side hustle that you had put on the back burner, make sure you consider how that extra income will affect your benefits. Unretiring can lead to some penalty deductions on Social Security if you make over a certain amount after retirement age.

Improve Your Financial Literacy

Spend a small portion of your extra free time brushing up on your financial knowledge. By learning more about smart saving and investing strategies, you can stretch your retirement budget and perhaps even increase it.

Live Below Your Means

This rule encompasses all of the other lifestyle habits. If you spend less than you can afford, you’ll have more money saved for those out-of-pocket expenses that catch you by surprise. If you keep this goal at the front of your mind, it will make other financial choices more straightforward.

Practice Meal Planning for a Cheaper, Healthier Lifestyle

Planning a week’s worth of meals ahead of time is a great way to make sure that your grocery budget stays within bounds. Not only that, it forces you to be more conscious about what you’re eating and could have positive effects on your mood and health. If you decide to go the extra mile and prepare meals ahead of time in bulk, you could be saving yourself a lot of time and effort as well.

Limit Credit Card Use

About 41% of households headed by someone in the age group of 65-74 carry credit card debt, with the median amount reaching $2,580. Relegating purchases you can’t afford to the credit card doesn’t match the previous maxim of living below your means. Credit card debt can quickly spiral out of control and wipe out a large chunk of your budget.

Think About Purchases in Terms of Hours Worked

Now that you’re not earning a steady paycheck, those hours that you spent hard at work become even more valuable. When you’re considering whether to make a $100 purchase at the department store, think about how long it took you to earn that amount.

Stop Buying Bottled Water

Investing in a water filter will save you money in the long run. It also is better for the environment and reduces grocery store runs. But this rule doesn’t apply just to water. Use it to inspire you to rethink other recurring purchases that you could shave off the budget with a little extra thought and effort.

Cancel Unnecessary Subscriptions — They Add Up

Subscription creep is a real issue that could affect your retirement budget in a big way. A poll found that the average American estimated they spent $86 on subscription services each month but actually spent $219. Make a list of all your subscriptions and cancel everything except for those that truly bring value to your life.

Look For Secondhand Options First

If you’re looking for clothes or furniture, check out thrift stores or online secondhand marketplaces. It’s a more sustainable option, and you can often find incredible deals on high-quality items in great condition.

Take Advantage of Senior Discounts

In addition to membership programs like the one offered by the AARP, retirees can find discounts everywhere if they know where to look. When booking a ticket or making a reservation, it doesn’t hurt to ask whether the company offers special programs for seniors.

Limit Eating Out at Restaurants

The average American household spends around $3,600 a year on eating out. Going to a restaurant is an enjoyable experience that gets you out of the house, so there’s no need to cut it out of your budget entirely. But if you’re looking for ways to save, consider spending your money at your favorite spots just a few times a month.

Be More Frugal When Grocery Shopping

It’s not just eating out that eats into your budget. Try shopping for groceries at wholesale clubs, farmers’ markets, dollar stores and other discount stores, especially for staple items that don’t require fancy packaging or flashy branding.

Cut Down on Transportation Costs

Now that you’re retired, take a closer look at your transportation situation. Do you really need a second or third vehicle? Could you trade in your old gas guzzler for a newer car that’s more fuel efficient? Is it possible to negotiate reduced auto insurance payments?

Use Coupons and Discount Codes for Additional Savings

You can still find coupons and discounts in catalogs and magazines, but the rise of online shopping means that a lot of the best deals can be found by signing up for mailing lists or loyalty programs on your favorite websites.

Use Public Transportation

If you live in an area with safe, reliable public transportation, use it. Riding the bus or the train is an efficient way of getting around that can save money, reduce your vehicle’s wear and tear and even beat traffic during rush hour.

Move to a More Tax-Friendly State

Your tax bill in retirement will most likely be lower than when you were working. But if you’re looking for ways to reduce it even further, consider moving to a state that doesn’t charge income tax or sales tax.

Take a Road Trip Instead of Flying

When you can take only so much time off work, flying is fast and convenient. But it isn’t cheap. Retirement gives you a more flexible schedule, so you can take your time and enjoy the open road. By staying in budget hotels or camping at state parks along the way, you can turn the trip to your destination into a mini vacation in itself.

Look For Seasonal Travel Deals

Now that your travel schedule isn’t restricted to seasonal holidays, you can buy tickets during the offseason to save money. If traveling abroad, research the peak tourist seasons and avoid these times. Not only will this cut down on your travel expenses, you can enjoy your dream vacation without battling the crowds.

Enjoy a Staycation

Imagine you’re a tourist in your own town or city. What would you do, and where would you stay? Maybe there’s a gallery you’ve always wanted to visit or a charming bed and breakfast that you passed every day on the way to work. Staycations help you avoid expensive travel costs and provide a refreshing take on the local scenery and attractions.

Switch to Lower-Tier Plans

Switching phone plans or dropping down to a lower pricing tier could potentially save you hundreds or thousands of dollars per year.

Set Aside Days When You Don’t Spend Any Money

Designate one day a week when you’re not allowed to spend any money. Getting into this habit can help you be more conscious of your spending on other days as well.

Sell Your Unwanted Items Online

You might be able to make extra money by clearing out your attic or garage. Antique furniture, vintage records or collectibles in good condition can be sold on online marketplaces or auction sites like eBay.

Downsize To Save Money

Moving to a smaller home is one of the most cost-effective strategies for lowering your budget in retirement. When you live in a smaller home, you’ll buy fewer things, spend less money on utilities, enjoy lower property taxes and reduce the time and money that go to repairs.

Sell Your House and Reinvest the Earnings

Even if you’re not necessarily downsizing, you can consider selling your house to use a portion of the earnings to pay off debts or build your savings and investment accounts.

Move to a More Affordable Area

Major metropolitan areas typically have higher costs of living compared to rural or suburban districts. Food, transportation, healthcare and entertainment are just a few categories that are likely to cost more in city centers. If you’re looking for a slower, more affordable lifestyle, relocating to a less populated area could be a savvy move.

Keep Up on Repairs To Save Costs Down the Road

Just like when it comes to your health, prevention is better than a cure. Fix minor leaks and holes before they become large, costly headaches in the future. Investing in preventative measures like covers for outdoor furniture and choosing weather-resistant materials will help keep replacement costs down.

Rent Out Your Unused Living Space

Do you have a finished basement that you never use or an attached guesthouse that stays vacant except for holidays? Renting out these living spaces to tenants or as short-term rentals on sites like Airbnb can help cover other housing costs and provide an additional source of income.

Convert Your Home Equity Into Cash

Home equity conversion mortgages allow homeowners age 62 or older to withdraw a portion of their home equity. You can choose whether to withdraw as a fixed monthly amount, a line of credit or a combination. If selling your house doesn’t appeal to you, but you need more income, an HECM could be a viable option.

Shop for Holiday Decorations Post-Holiday

Wait until after the holiday has passed to buy decorations for next year. You’ll be surprised as the savings add up.

Modify Your Home To Suit Your Aging Needs

It’s best to plan ahead and make renovations that you’re likely to need later in your retirement years, such as installing a more accessible shower or putting in new handrails throughout the house.

Consider Renting Instead of Homeownership

While it may be difficult to leave a home that you’ve grown to love, there are many benefits to renting in your retirement years. You can move to a smaller, more manageable house or apartment located in a more convenient area and have the homeowner take care of expensive repairs. If you sell your home to make the lifestyle change, you’ll be able to add a significant amount to your savings account.

Refinance Your Mortgage

Renegotiating the terms of your mortgage can potentially help you secure lower monthly payments. Saving a couple hundred dollars a month will add up to thousands that you can spend on other areas of your budget.

Move In With Your Kids

Many people find that multigenerational households reduce costs and lower the workload for everyone involved. Grandparents may have more time to spend on child care, while working adults can help manage costs related to elder care.

Move Into a Senior Independent Living Community

If you’d like more support for your aging needs, such as a communal dining room or activity rooms, but still want your own living space, consider an independent living community. Costs range from around $1,000 to over $16,000 per unit, so shop around to find something suited to your budget.

Move Into an Assisted Living Facility

Assisted living still offers a level of independence with the addition of personal care services for things like bathing, dressing and housekeeping. The median monthly cost sits at around $4,500. While it may seem like a large expense, it could be a sensible option for balancing independence with healthcare.

Move Into Low-Income Senior Housing

If you qualify for subsidized senior housing, it will cost 30% of your monthly adjusted gross income. This is a great option for people living on limited budgets, but there often are long wait lists.

Move Into a 55+ HOA Community

Active retirees who don’t need personal care services or medical assistance may still struggle with the costs and effort of maintaining their property. Moving to a senior-focused community with an HOA can offload all of those concerns to the association as long as you can afford the monthly fees and dues.

Grow a Garden

There are plenty of documented health benefits to gardening and spending more time in nature, including lowered stress levels, a healthier diet and increasing your amount of daily exercise. Taking up gardening can also be good for your wallet if you grow enough fresh food to reduce your grocery bill.

Participate in Community Gardening

Community gardening has all the benefits of growing a garden at home but with the added benefits of connecting with others. Share your produce with family, friends and neighbors to strengthen the social ties that become ever more valuable during retirement.

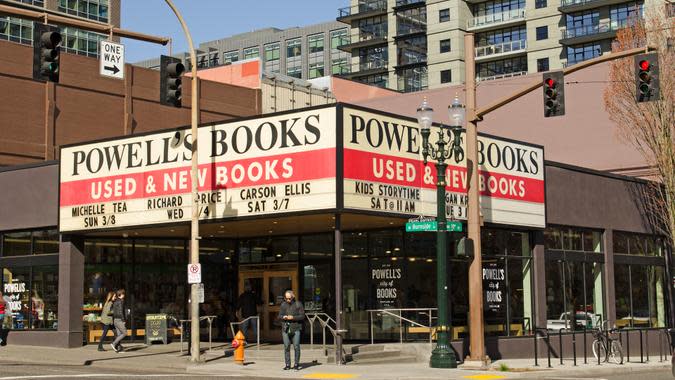

Join a Book Club

Reading supports mental health, and book clubs can stimulate engaging conversations while building social connections or new friendships. Used books can be found at heavily discounted prices or even for free at your local bookstore.

Visit Museums on Free Days

Use your newfound spare time to soak up art and culture at museums. Many museums already offer discounts for seniors. But if they don’t, you can often visit on certain days of the month for free.

Start Birdwatching

There are reasons birdwatching is so popular among older generations. It’s a fun, relaxing hobby that gets you out into nature without breaking the bank or requiring too much exertion. Grab a pair of binoculars and head out to the park by yourself or join your local birdwatching club.

Attend Free Outdoor Concerts

When the weather gets warmer, most towns and cities will host outdoor concerts in the park. This is a great way to meet people or relax with friends while supporting your local music scene.

Head to the Library

There are a lot of things to do at the library besides check out books. Many libraries host classes and events for free or at an affordable cost.

Join Local Tours

You’d be surprised by how many new things you can discover about your city when you join a tour. Enjoy the freedom of retirement and act like a tourist for a few days each year. You might find a bunch of new spots that you overlooked while locked into your old routine.

Take Up Photography

You don’t need to invest in high-end camera equipment to enjoy photography. Even if you have only a phone camera, photography is an excellent creative outlet that gets you moving and teaches you to find beauty in everyday life. If you don’t know where to start, join your local photography club to meet others with a similar interest.

Start Sketching

Drawing is another artistic hobby, and it only requires a pencil and a sketchbook. Head out to your favorite park or sit across from a piece of architecture you admire and start sketching.

Join Free Cooking Classes

Learning how to cook new dishes can bring extra flavor to your life. Sometimes, grocery stores and community centers will offer free cooking classes and demonstrations.

Spend More Time Crafting

Crafts like knitting and crocheting can be inexpensive hobbies that provide mental stimulation and preserve dexterity. An added benefit to making crafts is that you can give them away to your loved ones.

Take Part in Your Local Choir or Band

Whether you join your church choir or a local jazz band, singing or playing an instrument offers a meaningful way to connect with others in your community and allows you to showcase the talents that you may not have been able to show off pre-retirement.

Try Stargazing

When you get caught up in the stress of everyday life, it’s easy to forget about the natural beauty that’s right in front of you. Grab a telescope or just spread out a blanket on the grass on a clear night and reconnect with nature. If you get hooked, joining a local astronomy club can help you learn more about the constellations.

Start Scrapbooking

As we get older, preserving memories takes on greater significance. Collecting and curating a lifetime of memories into photo albums or scrapbooks forges deeper connections between you and your loved ones and gives you something to pass down to future generations.

Attend Free Outdoor Plays and Movie Screenings

Many cities put out a schedule of free outdoor performances and screenings every year. If you’re looking to save money, these events can be a great source of entertainment during retirement.

Volunteer

Giving back to your community is one of the best ways to lead a more fulfilling life. Take up a cause that you’re passionate about and volunteer at your local organization. You’ll make a difference and meet like-minded people along the way.

Go to the Beach

Put on some sunscreen and head to the beach for a free activity that can lift your mood and reenergize your body.

Camp Out in a National or State Park

Forgo an expensive hotel and bring your RV or tent to one of the country’s many beautiful parks. It doesn’t cost much and creates lasting memories.

Try Your Hand at Calligraphy

If you’re not keen on outdoor activities, practicing calligraphy is the perfect activity to get your creative juices flowing. You can make beautiful cards to send to your loved ones that they’ll cherish forever.

Tour Your Local Vineyard, Winery or Brewery

This is a fun social activity that won’t break the bank, as most tours include free or discounted drinks as a part of the package.

Learn To Paint

Painting requires a small initial investment in brushes and paints, but it’s a fulfilling hobby with lots of room for growth and improvement.

Make Your Own Candles

Making candles doesn’t cost much in materials and brings a cozy ambiance to any living space. Once you make your own, you’ll wonder why you spent so much money on buying them in the past.

Start Baking Your Own Bread

Freshly baked homemade bread is healthier, tastier and more affordable than bread from the supermarket. From sourdough to ciabatta, you’ll never run out of new recipes to try.

Go Fishing

You can finally use your newfound freedom to relish in quiet solitude by the nearest lake or fishing hole. You probably already have some fishing equipment in the garage, so just dig up some fresh worms and enjoy a relaxing hobby that doesn’t have to cost much beyond the license.

Host Potlucks

Build a stronger community by hosting potlucks for your neighborhood or with friends and family. Since everyone brings their own dish, there’s less pressure on your grocery budget.

Go to a Comedy Club

It’s a cliche, but laughter is the best medicine for lifting your spirits. Watching a comedy show is an affordable date night idea that sparks great conversations.

Try Your Hand at Woodworking

A classic retirement hobby, making your own furniture is incredibly satisfying. Woodworking can be made more affordable by using reclaimed or found materials so your projects don’t eat up too much of your budget.

Take a Tai Chi Class in the Park

Tai chi is an ancient Chinese martial art that guides you through gentle, flowing movements while you focus on deep breathing. It’s the perfect activity for practicing mindfulness and improving your mobility.

Join a Water Aerobics Class

Water aerobics is an excellent way to get exercise while minimizing the wear and tear on your joints. Check out your local pool for classes and see whether it offers discounts for seniors.

Shop Around for Low-Cost Health Insurance

Take your time comparing various health insurance plans before you settle on the option that works best for your needs. There are many public and private plans on the market that suit different health conditions and budgets.

Use All Your Medical Benefits

The cost of Medicare Part B starts at $174.70 per month. It covers many types of doctor’s tests, outpatient care, medical equipment, preventative care, prescription drugs and other medical services, so make sure you know what you’re paying for and use it to the fullest.

Go for Generic Over Name-Brand Medications

You should talk to your doctor before making any medical decisions, but many generic medications contain exactly the same ingredients as their name-brand counterparts. Switching to the generic versions of some or all of your medication is an easy way to save a significant amount on healthcare costs in retirement.

Walk or Ride Your Bike Instead of Driving

If you just need to make a short trip to the grocery store that’s only a few blocks away or you’re visiting a friend down the road, walking or riding a bike will help you get some fresh air as you exercise — and save you gas money.

Order Water When You Eat Out at a Restaurant

Cutting back on your consumption of sugary drinks and alcohol isn’t just good for your health — it will save you a lot of money in the long run as well. Drinks are often the most marked-up items on the menu. Make ordering a special drink a treat, not a habit.

Join a Yoga Class To Improve Mobility

Many studies demonstrate yoga’s positive effects on cellular aging, balance and prevention of cognitive decline. It’s a low-impact activity that doesn’t require any equipment besides a yoga mat. Look for free or affordable beginner classes at your local gym or community center.

Take More Walks in the Park

Walk alone, walk with a friend or partner, or join a park walker group made up of other retirees. It’s great for circulation and can help you meet new people.

Go for a Hike

Take your walks up a notch and go for a hike. There’s nothing better than the feeling you get once you make it to the top and are rewarded with a stunning view.

Start a Journal or Diary

Mental health is just as important as physical health at any age, but it’s especially important as you get older and transition to a new phase of life, deal with the passing of loved ones or experience health issues. Writing your thoughts down in a journal or diary could be the cathartic outlet you need.

Join Your Local Rec Center or Sports League

Recreation centers offer access to low-cost or free gyms, pools, classes and other activities. If you’ve always wanted to try a new sport like tennis or learn how to swim, there’s no better time than the present.

Attend a Fitness Class or Work With a Personal Trainer

If you have a more focused fitness plan in mind, look for free or discounted classes for retirees. This will help you get the most out of your workouts and keep you more accountable.

Learn How To Dance

Take a salsa class or take to the ballroom floor. Dancing is an excellent way to stay fit and active in a fun, social atmosphere.

Take Up Zumba

If you enjoy dancing but are looking for something more high energy and fitness focused, sign up for a Zumba class.

Buy Frozen Fruit and Vegetables

Freezing produce is often cheaper than purchasing fresh produce. It preserves nutritional value, so you can buy in bulk and store it for future meals.

Make Your Own Cleaning Products

You can cut down on your shopping budget by making many household cleaners from common ingredients like vinegar and lemon juice. Homemade cleaners are also typically safer than commercial products with harsh chemicals.

Audit Courses at Your Local University or Community College

Plenty of universities allow you to audit courses for free or for a small fee. While you won’t receive any academic credit, learning new things in an intellectually stimulating environment will keep you sharp and encourage you to interact with a diverse group of people.

Learn Almost Any New Skill Through an Online Course

There are a wealth of online learning platforms that offer free or affordable courses for anything from graphic design to playing the guitar. Take advantage of the extra time in your schedule to pick up a new skill.

Attend Free Lectures at the Museum or Library

If you check your local university or library website, you’ll probably find that there’s a schedule of upcoming lectures on various topics. Try attending a talk on a topic you know nothing about. It may inspire you to take your retirement life in a new direction.

Visit Your Local Bookstore or Coffee Shop for a Free Author Reading

There’s a chance that an interesting author is giving a book or poetry reading at your local bookstore. Attending could be the perfect way to meet people who share your interests and forge new friendships.

Volunteer at the Museum

If you love museums, volunteering will get you free admission and a behind-the-scenes look at some of the exhibits.

More From GOBankingRates

6 Things to Try This Week if You're Behind on Your Savings Goals

4 Reasons Retired Women Need More Money Than Men -- And What To Do About it

This article originally appeared on GOBankingRates.com: 100 Ways To Live a Rich Life in Retirement — Without Spending All of Your Savings

Yahoo Finance

Yahoo Finance