1,000 jobs are at risk at M&S — it's just the start of a massive retail jobs cull this year

Marks & Spencer (MKS.L) has put just over 1,000 jobs in its shops on the line, signalling the start of what is set to be a brutal year for retail staff.

M&S on Tuesday announced plans to close a further 17 stores nationwide as part of its plan to return to growth. The move affects 1,045 jobs. While some staff may be re-deployed elsewhere within the company, there will likely be cuts. 300 staff have already lost their jobs as a result of M&S’ turnaround plan.

These job losses could be the start of a brutal cull of front-line shop staff across the retail sector this year. The Centre for Retail Research (CRR) estimates that there will be over 160,000 jobs lost in UK retail this year, nearly 20% more than were lost in 2018.

The Retail Gazette quoted professor Joshua Bamfield from the CRR as saying: “We expect to see a worsening of conditions in 2019, caused by the high costs of running retail stores and continuing weak demand.”

Christmas trading updates have done nothing to assuage fears. Debenhams (DEB.L), Next (NXT.L), Marks & Spencer (MKS.L), Moss Bros (MOSB.L), Mothercare (MTC.L), and B&M (BME.L) all reported falling sales over Christmas.

Separate figures showed the High Street suffered its lowest December footfall since the financial crisis. Independent retail analyst Richard Hyman told Yahoo Finance UK that it’s “the toughest retail market anyone’s ever seen.”

The issues troubling the High Street are numerous. For years physical shops have been battling with the rise of online-only retailers who can undercut them on price because they employ fewer staff and don’t have to maintain a network of shops.

The rise of online shopping has only accelerated in recent years and rising business rates — a tax on the value of the land where businesses are based — are seen as only accelerating the woes of traditional retailers. Leading shops such as Debenhams (DEBS.L), River Island, Topshop, Sports Direct (SPD.L), and Iceland are reportedly planning an action group to challenge business rate rises.

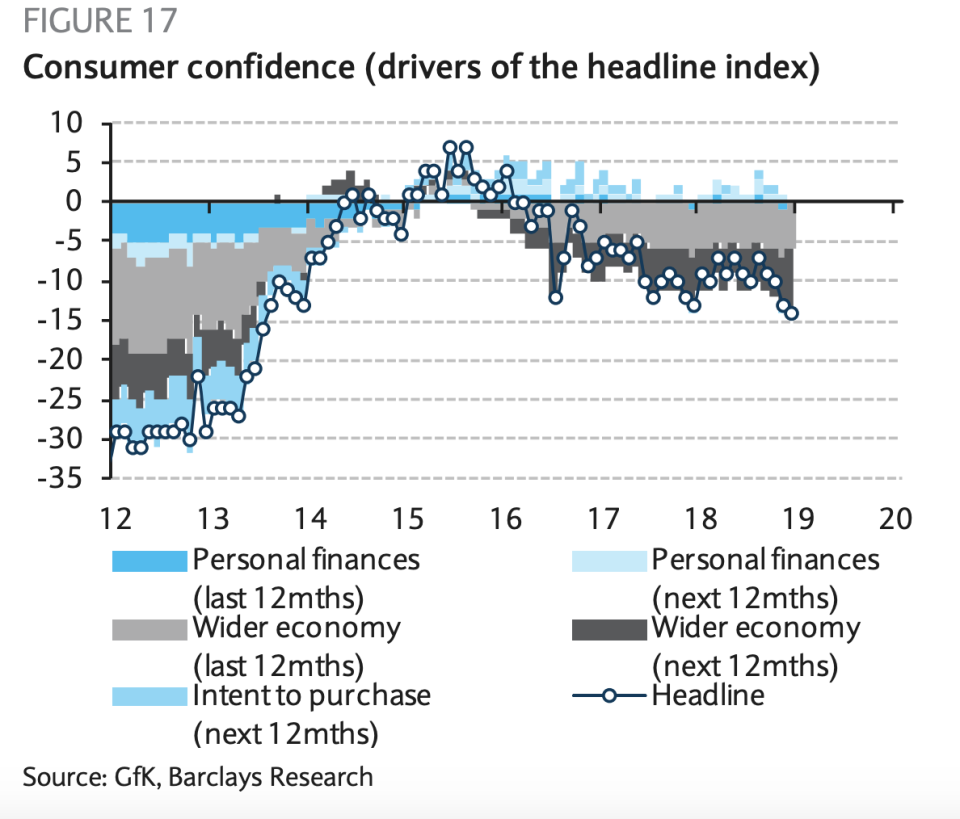

If this wasn’t enough, consumer confidence is falling in the run up to Brexit, which is pushing people to save money rather than spend it. Unusual weather patterns have also disrupted usual seasonal sales patterns.

These two overarching problems led Asos (ASC.L), the most well-established online retailer in the UK, to issue a profit warning in November. It highlighted the fact that it’s not only traditional retailers who are struggling.

However, traditional retailers are the most at risk. Current conditions threaten to create a death spiral that online vendors avoid. Faced with falling sales, increasing competition, and fixed costs, management teams at High Street brands are focusing on cutting costs rather than improving their products, according to analyst Richard Hyman. Product lines are suffering as a result and customers are noticing, leading to lower sales.

This death spiral led to a string of historic retailers collapsing in the last few years. BHS collapsed after 88-years in 2016, House of Fraser went under last year after 169 years of business, Toys R Us and Maplins both went bust in 2018, and HMV fell into administration just before Christmas.

Sports Direct founder and Debenhams investor Mike Ashley claimed last month that Debenhams is on the brink of collapse and the department store is likely to be the next major retailer to announce job cuts. The company is reportedly considering shutting 90 stores and axing as many as 10,000 jobs in a bid to stem losses.

It is unlikely to be the last retail to make such cuts this year.

———

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Investment banks radically scaling back estimates of Brexit job losses

This chart shows the EU countries most reliant on trade with the UK

What a second Brexit referendum might look like

Yahoo Finance

Yahoo Finance