13F Season: 3 Whales to Follow

What is a 13F Filing?

A 13F is a quarterly filing required by the U.S. Securities and Exchange Commission (SEC), which mandates institutional investment managers with assets exceeding $100 million to disclose their equity holdings. The filing provides a detailed snapshot of a fund’s portfolio, including the stocks it owns and their respective quantities.

13F filings are due 45 days after the end of the quarter. Investors and analysts use 13F Filings to gain insights into the investment strategies of large institutional investors, such as hedge funds and mutual funds. Tracking 13F filings Is crucial for market participants seeking to understand trends, identify potential investment opportunities, and monitor the transactions of Wall Street’s most influential investors.

Top 3 13Fs to Watch

Nvidia

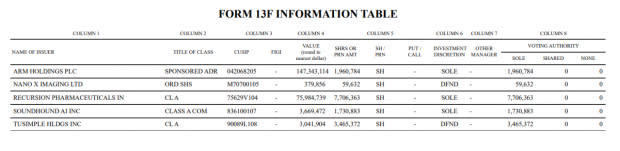

Nvidia (NVDA) filed its first 13F this week.The leading chipmaker, which became the third largest U.S. company, is worth monitoring because it has a ton of cash (which will likely allow it to increase its stake in investments) and has its finger on the pulse of all things AI.

Image Source: Nvidia

Unsurprisingly, hot IPO ARM Holdings (ARM) is Nvidia’s top holding. Nvidia, previously tried to purchase ARM in the past, owns nearly $150 million worth. Though the stock is flying high, it’s worth watching its IPO lockup date, which expires on March 12th. After the lockup period expires, insiders who hold massive profits in the stock can sell.

NVDA is looking to diversify beyond “selling the picks to the AI gold rush” and profit from AI-centric investments. Though the public is infatuated with Chatbots, NVDA sees an opportunity in Recursion Pharmaceuticals (RXRX). RXRX, which is NVDA’s second-largest investment, leverages AI to make new drug discoveries.

Finally, SoundHound AI (SOUN), a voice assistant AI platform, and Nano-X Imaging (NNOX), an Israeli-based X-ray company, each jumped more than 50% on NVDA’s 13F disclosure. Though each investment is small relative to NVDA’s cash hoard, investors are encouraged by the leading chipmaker’s blessing.

Warren Buffett

Warren Buffett is arguably the best 13F to track. Because the “The Oracle of Omaha” has high conviction investments, a long holding period, and a dependable history, Buffett’s 13F provides value unlike any other filing.

Image Source: HedgeVision

This report, Buffett’s 10 million share trim of Apple (AAPL) will likely get all the headlines. However, the trade only resulted in a 1% decrease in Buffett’s AAPL holdings, and Berkshire Hathaway still holds a gargantuan 50% position in the stock.

The most notable additions to the portfolio were in energy plays like Chevron (CVX) and Occidental Petroleum (OXY). Though energy stocks have been out of favor, Buffett has maintained his unrivaled conviction and has continued to accumulate shares. The buys make sense, considering names like OXY are dirt cheap and have Price-to-Book Values at multi-year lows.

Image Source: Zacks Investment Research

David Tepper

When deciding on who to follow, a foolproof method is to follow those investors who have been correct. Over the past several quarters, Appaloosa’s David Tepper correctly loaded up on tech stocks. Based on the recent 13F filing, Tepper remains bullish. He started a fresh position in Amazon (AMZN) while more than doubling his position in high-growth database software firm Elastic (ESTC).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

Elastic N.V. (ESTC) : Free Stock Analysis Report

Nano-X Imaging Ltd. (NNOX) : Free Stock Analysis Report

Recursion Pharmaceuticals, Inc. (RXRX) : Free Stock Analysis Report

SoundHound AI, Inc. (SOUN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance