17 States Where Property Tax Rates Are Lower Now Than a Decade Ago

Nobody is exactly thrilled about paying property taxes, but most accept it as the price of owning a home. Depending on where you live, property taxes can be a major budget item or a relatively minor one. In most states, you will pay a higher rate the longer you stay in a home, but that’s not always the case.

Learn: 5 Presidents Who Raised Taxes the Most, and 5 Who Lowered Them

Find: Become a Real Estate Investor for Just $1K Using This Bezos-Backed Startup

All 50 states and the District of Columbia charge property taxes to homeowners based on the value of a property. Local governments typically impose property taxes on city, county and school district residents. But state governments are the typical entities that levy personal property taxes. Property tax bills are almost always issued once a year.

To get an idea of how location plays a major role in your property tax bill, just look at the different rates you have to pay. New Jersey has the highest effective property tax rate in the country, at 2.23% of the assessed value of a home. Hawaii has the lowest, at 0.32%. What this means is that if you own a $500,000 home, you will pay about $11,150 in property taxes in New Jersey and about $1,600 in Hawaii.

In 2023, the average New Jersey property-tax bill topped $9,800, according to New Jersey Spotlight News. In contrast, the median property tax bill in Alabama — which has the second-lowest rates in the country — was only $646, according to data cited by CNBC.

The following 10 states have the highest property tax rates:

State | Effective Property Tax Rate |

New Jersey | 2.23% |

Illinois | 2.08% |

New Hampshire | 1.93% |

Vermont | 1.83% |

Connecticut | 1.79% |

Texas | 1.68% |

Nebraska | 1.63% |

Wisconsin | 1.61% |

Ohio | 1.59% |

Iowa | 1.52% |

Here are the 10 states with the lowest property tax rates:

State | Effective Property Tax Rate |

Hawaii | 0.32% |

Alabama | 0.40% |

Colorado | 0.55% |

Wyoming | 0.56% |

Louisiana | 0.56% |

South Carolina | 0.57% |

West Virginia | 0.57% |

Utah | 0.57% |

Nevada | 0.59% |

Delaware | 0.61% |

About two-thirds of the states have either raised property taxes over the past decade or left them as is, according to a study from GOBankingRates, which pulled data from the Federal Reserve Bank of St. Louis from both 2024 and 2014. But there are some exceptions that have gone in the other direction.

Here are 17 states where property tax rates are lower this year than they were a decade ago:

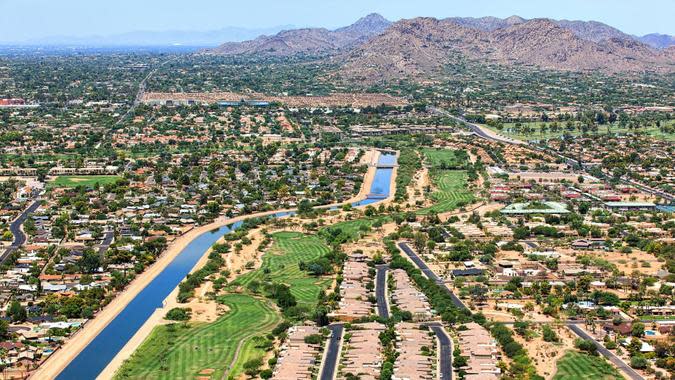

Arizona

2014 property tax rate: 0.66%

2024 property tax rate: 0.63%

Barbara Corcoran: 3 Cities To Invest In Real Estate Now Before Prices Skyrocket

Read More: 8 States To Move to If You Don’t Want To Pay Taxes on Social Security

Colorado

2014 property tax rate: 0.59%

2024 property tax rate: 0.55%

Beware: 10 Dangerous Cities You Shouldn’t Buy a Home in No Matter the Price

Florida

2014 property tax rate: 0.98%

2024 property tax rate: 0.91%

Idaho

2014 property tax rate: 0.73%

2024 property tax rate: 0.67%

Indiana

2014 property tax rate: 0.86%

2024 property tax rate: 0.84%

Dave Ramsey: Why You Shouldn’t Pay Off Your Mortgage Early Even If You Can

Montana

2014 property tax rate: 0.75%

2024 property tax rate: 0.74%

Nebraska

2014 property tax rate: 1.65%

2024 property tax rate: 1.63%

Nevada

2014 property tax rate: 0.71%

2024 property tax rate: 0.59%

Discover: Don’t Buy a House in These 5 US Cities That Have Shrinking Populations and Fewer Buyers

New Hampshire

2014 property tax rate: 1.99%

2024 property tax rate: 1.93%

North Carolina

2014 property tax rate: 0.84%

2024 property tax rate: 0.82%

Oregon

2014 property tax rate: 1.01%

2024 property tax rate: 0.93%

See: Cheapest Places To Buy a Home in Every State

Rhode Island

2014 property tax rate: 1.46%

2024 property tax rate: 1.40%

South Dakota

2014 property tax rate: 1.22%

2024 property tax rate: 1.17%

Tennessee

2014 property tax rate: 0.75%

2024 property tax rate: 0.67%

I’m a Real Estate Investor: 10 Places I Would Never Buy Property

Utah

2014 property tax rate: 0.63%

2024 property tax rate: 0.57%

Washington

2014 property tax rate: 0.94%

2024 property tax rate: 0.87%

Wisconsin

2014 property tax rate: 1.74%

2024 property tax rate: 1.61%

More From GOBankingRates

In Less Than a Decade, You Won't Be Able To Afford Homes in These 20 Arizona ZIP Codes

These 10 Used Cars Will Last Longer Than an Average New Vehicle

This article originally appeared on GOBankingRates.com: 17 States Where Property Tax Rates Are Lower Now Than a Decade Ago

Yahoo Finance

Yahoo Finance