2 Business Services Stocks to Buy After Pullbacks From 52-week Highs

Of course, investors hate to see large pullbacks in the market even if corrections can be healthy for the long term. Amid the call for the market to correct itself, some of the strongest-performing stocks can cool and then continue their extended rallies.

Given the strong performance of the Zacks Business Services sector over the last year this could be the case for Distribution Solutions Group DSGR and TriNet TNET which have been two of the top performers.

Performance Overview

Distribution Solutions Group’s value-added distribution solutions extend to products and services for maintenance and repair operations, original equipment manufacturers, and the industrial technologies markets. Notably, DSGR has pulled back 11% from a 52-week high of $36.61 seen earlier in the month.

As for TriNet, it also has an extensive reach offering a comprehensive suite of human payroll solutions to the banking and financial services markets along with technology, non-profits, venture capital, and advertising and marketing industries. TNET has dipped 3% after touching 52-week highs of $134.67 in early April as well.

The selloff does look healthy considering DSGR and TNET are still up +2% and +10% YTD respectively and have soared over +50% in the last year to impressively outperform the broader indexes and the Zacks Business Services Market’s +19%.

Image Source: Zacks Investment Research

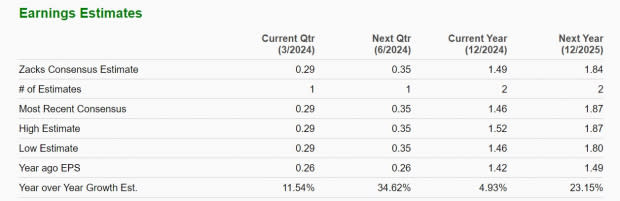

EPS Growth & Revisions: Buying their recent dip looks enticing as Distribution Solutions Group and TriNet both check an “A” Zacks Style Scores Grades for Growth.

DSGR is expecting 5% EPS growth this year and more compelling is that earnings estimate revisions have soared 37% over the last 60 days from estimates of $1.09 a share to $1.49 per share. Even better, while fiscal 2025 EPS estimates have dipped -1% in the last month, annual earnings are still projected to climb another 23% next year to $1.84 per share.

Image Source: Zacks Investment Research

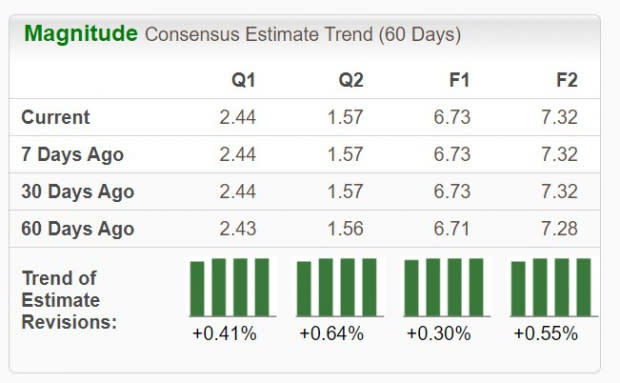

Turning to TNET, after reaching a multi-year EPS peak of $7.81 in 2023, annual earnings are expected to dip to $6.73 per share in FY24. However, FY25 EPS is projected to rebound and rise 8%. More importantly, FY24 and FY25 EPS estimates are slightly up over the last 60 days.

Image Source: Zacks Investment Research

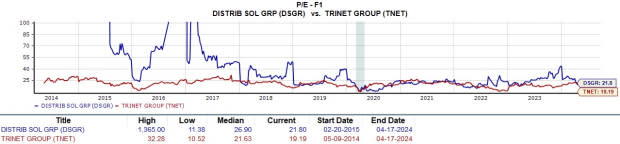

Reasonable Valuations: More appealing is that Distribution Solutions Group and TriNet both trade at discounts to the Business Services Market’s forward weighted P/E average of 26.4X. They trade closer to the S&P 500’s 21.2X with TNET nicely beneath the benchmark at 19.1X and DSRG at 21.8X.

Furthermore, Distribution Solutions Group and TriNet’s stock trade well below their decade-long P/E highs and are still at discounts to their medians during this period as well.

Image Source: Zacks Investment Research

Bottom Line

There will be an abundance of stocks to choose from that might serve as viable buy-the-dip candidates amid recent market volatility and investors may want to consider DSRG and TNET. At the moment, Distribution Solutions Group and TriNet's stock both sport a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TriNet Group, Inc. (TNET) : Free Stock Analysis Report

Distribution Solutions Group, Inc. (DSGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance