2 Top Conservative Dividend Stocks for Retirees

A collection of reliable market metrics, including the Shiller P/E, a cyclically adjusted price-to-earnings ratio, suggest that stocks are extremely expensive today. Although overvaluation can go on for a long time, so long as investors remain bullish, retirees might want to shift gears a little and start moving into more-conservative dividend stocks. Utilities Duke Energy Corp. (NYSE: DUK) and Dominion Energy Inc. (NYSE: D) are two names that should be on your dividend short list today. Here's why.

Nice yield, relatively modest growth

Duke Energy is one of the largest regulated electric and natural gas utilities in the United States. It currently boasts a 4.5% dividend yield. It's increased its dividend every year for 13 consecutive years. Also, Its beta, a measure of relative volatility compared to the broader market, is a very modest 0.26. That suggests that it's only 26% as volatile as the market, a nice attribute if stocks start to head sharply lower.

Image source: Getty Images.

Rising bond yields have put downward pressure on utility stock prices lately, pushing Duke's yield higher. The spread between Duke's yield and the market's yield hasn't been this wide since the early part of the decade -- when stocks were recovering from the bear market associated with the deep 2007-2009 recession.

To be fair, Duke has faced some negatives in recent years, which have also helped to push its yield higher. For example, it ran into troubles with a coal gasification plant that strained its normally constructive relationship with regulators and led to customer refunds in 2016. And some industry watchers believe it may have overpaid when it bought Piedmont Natural gas to expand beyond electricity. However, it looks like these issues are already priced into the shares and that the recent downdraft might have left Duke at bargain prices today.

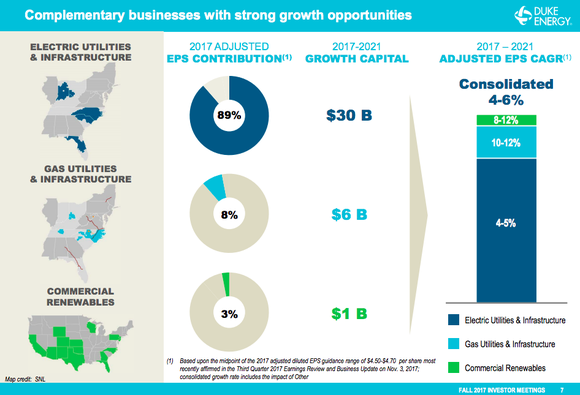

As for the future, Duke believes it will be able to grow earnings by around 5% a year through 2021. Dividends should head higher by a similar amount, which would beat the historical growth rate of inflation by about 2 percentage points. To get there, the company plans to spend $30 billion on its regulated electric utility and electric distribution assets, $6 billion within its natural gas business, and $1 billion on renewable energy projects.

An overview of Duke's spending plans. Image source: Duke Energy Corp.

The key here is the spending on regulated assets -- an area in which the government has to approve customer price hikes. Generally speaking, the more Duke invests in these assets, the more it will be able to charge its customers. All in all, Duke's future looks pretty solid right now for a largely conservative stock.

More growth, but some near-term uncertainty

Dominion Energy is another of the largest U.S. electric and natural gas utilities. Its yield is currently around 4.4%. Dominion has increased its dividend annually for 15 consecutive years. And its beta is 0.30, suggesting that the stock is roughly 30% as volatile as the broader market.

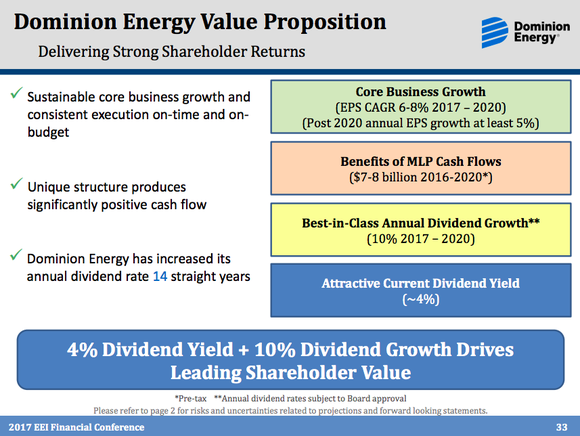

Dominion has big spending plans across its diversified business, which includes electric generation, electric transmission, natural gas pipelines, and renewable power. Management is calling for earnings growth of around 6% a year through 2020, with "at least" 5% growth in the years after that. The dividend, meanwhile, is expected to grow an impressive 10% a year through 2020. While the tale here is largely similar to Duke's story, the higher dividend growth makes Dominion relatively more attractive.

Dominion Energy's "value proposition" -- without SCANA. Image source: Dominion Energy Inc.

The only problem is that Dominion has just offered to buy SCANA Corporation (NYSE: SCG). This utility is dealing with the consequences of its decision to stop building a nuclear power plant following the bankruptcy of Westinghouse, its construction contractor. If the merger deal goes through, Dominion believes its earnings growth will move to 8% as it adds customers in high-growth southern states. The problem, of course, is that Dominion would be taking on SCANA's nuclear troubles. But it has put forth a plan to deal with the issue, and management says it won't go through with the purchase if regulators reject the plan.

Although this would be a bolt-on deal for giant Dominion, which is about eight times the size of SCANA, it adds notable uncertainty to Dominion's near-term future. If the deal gets scuttled, I'd expect Dominion's shares to go up since it will no longer have to pay for the acquisition. And if the purchase gets approved, the company's earnings could increase by as much as 33%. Neither one is a bad outcome, and for most retirees, the benefits here likely outweigh the risks. The long-term outlook for Dominion also remains strong either way.

Cornerstone investments

Duke and Dominion aren't particularly exciting companies, even taking into consideration Dominion's merger news. But that's exactly the point: No matter what's going on in the stock market, people will need electricity and gas. With long histories of rewarding investors via dividend increases, yields that are high relative to the market, and low betas, these stocks should let shareholders sleep well at night through good markets and bad.

Bottom line: With the market at extreme heights, now might be a good time to consider fortifying your retirement portfolio's foundation. Duke and Dominion are conservative investments that can help you do just that.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Dominion Energy, Inc. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance