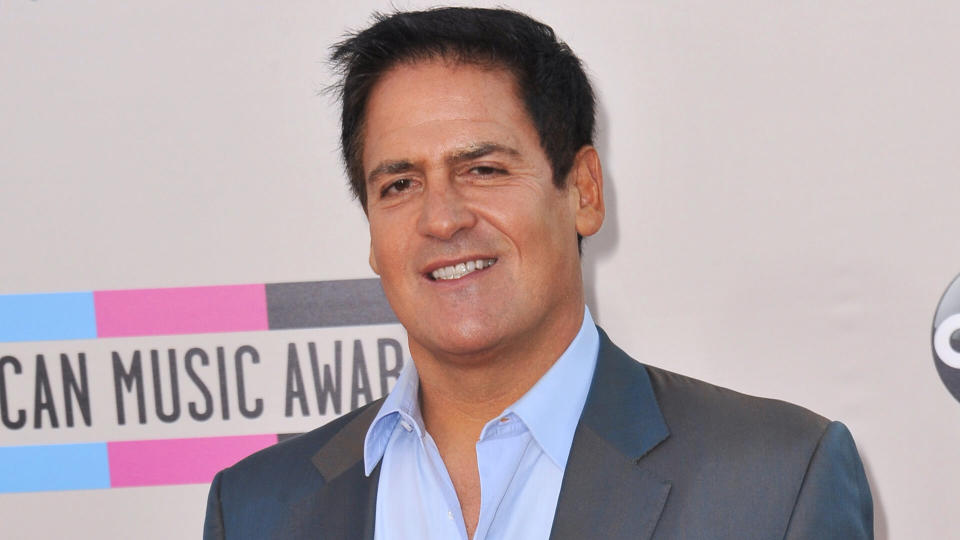

20 Ways Mark Cuban Makes Money Off AI

With a net worth of nearly $7.5 billion, Mark Cuban is an expert on making money. He often does so by building companies around emerging technology. For example, he secured his initial fortune by selling the internet streaming service Broadcast.com to Yahoo in 1999 — well before the rise of streaming platforms.

That’s why it’s no surprise that many of Cuban’s most promising investments currently involve artificial intelligence. Here are 20 companies he’s partnered with to build the future with AI.

Also see why Mark said mastering AI is the key to building wealth.

Be Aware: 5 Frugal Habits of Mark Cuban

Learn More: 4 Genius Things All Wealthy People Do With Their Money

Wealthy people know the best money secrets. Learn how to copy them.

DIRT

DIRT is an AI-powered predictive engine that focuses on audience engagement. It helps businesses understand what’s relevant to consumers based on neuroscientific technology and the principles behind emotions. Cuban, however, hasn’t said what percentage of the company he owns or how he supports its founders.

DIRT tries to go beyond current audience research strategies to unlock deeper insights for businesses to use in their marketing campaigns. If effective, it could be the AI play that helps Cuban earn his next billion.

Find Out: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Samaya AI

Cuban is also an investor in Samaya AI, which is trying to create a new platform for knowledge discovery. The service will use AI and large language models like ChatGPT to unlock deeper insights into knowledge-intensive domains like the hard sciences.

Samaya could help society break through difficult knowledge barriers and invent new solutions to tough problems. It’s unclear exactly how this will make Cuban money today, but the potential applications are enormous.

That’s why Cuban has said that “the world’s first trillionaires are going to come from somebody who masters AI and … applies it in ways we never thought of,” as reported by Yahoo! Finance. Companies that use AI to power breakthroughs have incredible upside because the technology is so new.

Phaidra

Next is Phaidra, a company that creates AI-powered control systems for the industrial manufacturing sector. Phaidra’s cloud-based intelligence service uses AI to automatically learn and self-improve based on sensor data.

This helps businesses improve their energy efficiency and sustainability, among other benefits. For example, Phaidra recently helped Google reduce its cooling energy usage by 40% in its data centers.

Cuban participated in a 2021 funding round for Phaidra, which raised a collective $4 million. He gave the money to help the company “build the future of industrial automation.”

Percepto

Cuban is also an investor in Percepto — a computer vision platform designed for drones. Percepto uses AI to help drones automatically monitor industrial sites. This keeps those facilities and the assets they hold more secure.

Cuban has been an investor in Percepto since 2015. However, he hasn’t shared what percentage of the company he owns or how he supports its leadership.

Genetesis

Genetesis makes an AI-powered imaging device for faster and less invasive cardiovascular screenings. It can detect ischemic heart disease in as little as five minutes with a form of testing that’s faster and easier for patients.

That’s how the company and its under-30 founders managed to raise $40 million from investors like Cuban. It’s another example of a business that’s using AI to try to shake up long-standing industry practices.

You’ll find that this is a theme of Cuban’s investments in artificial intelligence. “Artificial intelligence … if you don’t understand it — learn it,” he said. “Because otherwise you’re going to be a dinosaur within three years.”

Alethea AI

Mark Cuban also invests in a variety of blockchain and cryptocurrency projects. He’s especially interested in the intersection of AI and non-fungible tokens (NFTs), as his investment into Alethea AI shows.

Alethea is a decentralized protocol that embeds AI animations, interactions and generative capabilities into NFTs. If you aren’t familiar with NFTs, think of them like digital collectibles. They’re images or animations that exist only online and can be owned by only one person.

This could become important as the world continues digitizing. As more and more of our lives happen online, digital collectibles like NFTs could gain wider acceptance. Cuban is well-positioned to profit from this thanks to his investments in companies like Alethea AI.

ASI (Formerly Digest.AI)

Cuban’s next AI play focuses on how technology can change the way we learn. ASI, formerly called Digest.AI, uses artificial intelligence to create better learning plans for students, employees and others.

The platform creates personalized tutors through AI for a more immersive learning experience. It can make it easier for a student to learn tough new concepts and remember the material for life.

Learners can upload content like documents, image files and PDFs and the platform automatically develops study sets, summaries and review questions based on the materials provided. Plus, it’s entirely free to use.

That may not be great for Cuban’s bottom line today, but the new technology and data insights that platforms like this generate can be incredibly valuable. It’s the kind of material that prompts new discoveries, which may lead to other income-generating opportunities.

FORT Robotics

Robotics is one of the most intriguing fields for AI applications. If technology continues improving, we could eventually have fully autonomous, highly intelligent robots everywhere.

That’s why it’s no surprise that Cuban has an AI play in this sector, too. He’s invested in FORT Robotics, which has built a new security platform for smart machines and autonomous systems.

The security platform adds an important layer of protection to AI-powered robotic systems. This reduces risk and accelerates development timelines.

FORT already serves hundreds of customers and counts dozens of Fortune 1,000 companies as its clients. Its solutions are used across the world in warehouses, at agricultural businesses, on manufacturing floors and elsewhere.

Cuban is a huge believer in the field of robotics and its potential for the U.S. “I’m looking at investments in robotics because I’m a big believer that for America 2.0; the only way we’re going to be able to take jobs back from overseas is by advancing beyond them technologically,” he said to Breitbart News.

Sportlogiq

AI isn’t just going to impact critical industries like healthcare and manufacturing. Like the internet, it’s a technology that could improve most aspects of our lives. Sports are a great example of this.

As a long-time owner of the Dallas Mavericks, Mark Cuban is a huge sports fan. He’s invested in a company called Sportlogiq, which is using AI to change the way we engage with the games we love.

Sportlogiq uses publicly available broadcast feeds to analyze in-game player movement. It takes that data and generates deep insights into players, teams and games.

Professional sports teams can use the insights to make more informed strategic decisions and media organizations can use Sportloqic to deliver more engaging sports-related content.

Spontivly

Cuban has invested in many companies that focus exclusively on artificial intelligence. He’s also invested in some that use AI to supplement another tool or platform. Spontivly is an example of the latter.

It’s a data visualization solution that leverages AI to generate more actionable insights, graphs and charts. This makes it easier to share complicated insights across teams and areas of expertise.

Spontivly integrates with a company’s suite of community tools to help them talk to one another. It brings insights from Slack, Zoom and other media platforms together to help companies uncover more powerful analytics-based insights.

Neither Cuban nor Spontivly has said what percentage of the business he owns, but he was the company’s second-biggest investor as recently as 2022, according to Axios Tampa Bay.

TransCrypts

Cuban is also an investor in TransCrypts, a tool that automates the issuance of employment and income verification documents for HR departments. TransCrypts uses blockchain and AI technology to make it easier for individuals to access and share important records on demand.

The company is also working on a financial AI model called Castello. It’s similar to ChatGPT, in that it responds to real-language search requests. However, it goes beyond simple answers to give users detailed graphs and personalized technical analyses to inform investing decisions.

The company was recently in the news for helping Ukrainian refugees securely access their health records, according to BetaKit. It’s another example of the widespread impact AI is already starting to have.

Toggle Robotics

FORT isn’t the only AI robotics play that Cuban has made. He’s also an investor in Toggle Robotics — a company that develops hardware, software and services to make construction faster, safer and more affordable.

Toggle is especially focused on rebar but offers several services, including:

Offsite preassembly

Digital construction tools and operating systems

Industrial robotics for manufacturing

Solutions like these reduce on-site costs, complexities and hazards. This makes job sites safer and helps speed up the construction process.

Strella Biotechnology

Researchers say 40% of fresh produce is wasted before it’s consumed in the U.S., but Cuban is invested in a company that’s trying to change this through AI-powered solutions: Strella Biotechnology.

Strella has patented sensing technology that predicts the ripeness of fruits and vegetables. This opens new opportunities for optimization in the supply chain, helping companies decrease their waste.

Some of the services that Strella offers include:

Real-time food maturity monitoring

Reducing shrink and improving quality for grocers

Predictions for container maturity and slotting decisions

Scoutible

Next up is Scoutible — a game-based hiring platform that helps companies find better candidates. The platform uses gameplay to measure an applicant’s strengths and weaknesses. Then it uses AI to compare those strengths and weaknesses to the top team members.

For example, Scoutible could show an employer that its top-performing employees are highly independent, yet outgoing. The employer could then use Scoutible during its hiring process to find candidates who fit this mold.

Scoutible also has an AI career coach for individuals called Hero Mode. It offers 24/7 professional advice, support and motivation from AI models based on real professional leaders like Steve Jobs. The app gamifies professional growth to help employees reach their goals faster.

Bold Metrics

Cuban’s next AI investment is focused on improving the online shopping experience. Bold Metrics uses AI to gather and analyze customer intelligence. This helps it calculate a full set of body measurements in seconds, which guides customers toward better clothing size decisions and reduces return rates by 20% or more.

The data that clothing designers get from Bold Metrics can be helpful elsewhere, too. For example, more detailed consumer fit data can reshape how brands design and manufacture their clothes. This can drive sustainability improvements while improving the customer experience.

Fiscal Note

Fiscal Note is another Cuban investment that’s leveraging AI to change an industry, but it’s the first business on the list to apply artificial intelligence to the government sector.

The platform offers real-time government analytics on:

Legislative text

Regulations

Filings

Court cases

Speeches

The resulting insights can be helpful for different groups of people. For example, politicians can use Fiscal Note to build stronger constituent relationships through more effective communication strategies. Companies can use the platform to achieve their sustainability goals and make faster decisions about their market or geopolitical risks.

Hirebotics

Hirebotics is another interesting Cuban investment at the intersection of robotics and artificial intelligence. It sells cobots, which are robots that can work safely alongside humans in shared workspaces.

The company stands out from others in the industry with its Beacon cloud platform. This runs on a smartphone and lets metal workers set custom weld and cut parameters in minutes.

With Beacon, robots can adjust to production changes in minutes instead of hours or days. That can lead to huge efficiency improvements — especially for companies that jump back and forth between different types of welds throughout the day.

HomeCourt

Next, we have HomeCourt — an app that uses AI to help basketball players improve. HomeCourt’s mobile AI captures a player’s performance during practice and presents the data in a visual way that’s easy to digest.

For example, you can use your iPhone’s camera to track the shots you make on different parts of the court. This could show you your strongest and weakest zones so you can better decide where to practice next.

The app also lets users:

Compete against NBA players in challenges

Get instant feedback

Participate in pro-level drills

Join virtual teams and classes for group-based improvement

Preflect

Cuban is also an investor in the AI startup Preflect, which used to be called Pricestack. It’s leveraging AI to help companies run more effective digital marketing campaigns.

Preflect specializes in AI-driven targeting. This is an automatic process that ensures every ad you pay for is shown to a member of your optimal target audience. It helps companies get more value out of the money they spend on their digital campaigns.

The app also uses AI to transform basic images into beautiful ads. For example, you can take a picture of a folded shirt and the app will use AI imaging technology to turn it into a professional-quality ad in minutes.

Overplay

Finally, let’s wrap up Cuban’s list of AI investments with a “Shark Tank” favorite: Overplay was featured on the popular investing show’s March 15, 2024, episode. It’s an app that takes your photos and videos and helps you turn them into playable video games through the power of AI.

There’s also a social element to the app. Users can share the games they make with others, comment on games and climb leaderboards. It’s a great example of how artificial intelligence is opening up new opportunities for the average person.

Key Takeaways From Cuban’s AI Investments

As the above list shows, Cuban has partnered with many companies that are leveraging AI to build the future. His investing decisions illuminate a few key takeaways that are worth considering as you decide how to invest in AI with your portfolio.

Cuban Believes in and Supports AI

First, it’s important to note just how big of a believer Mark Cuban is in artificial intelligence. He doesn’t just think it will be an important technology in the future. He believes it will be foundational — perhaps as vital as the internet is today.

Cuban’s many AI investments underscore these beliefs, but he’s also given some strong quotes about artificial intelligence. These two stand out:

“There will be two types of companies in the future: those who are great at AI and everybody else,” as reported by Fortune.com.

“If you don’t know AI, you are going to fail. Period. End of story,” as Cuban shared on CNBC.

Remember, Cuban built his fortune by creating an internet streaming platform before that idea really existed in the public consciousness. The fact that he’s talking this strongly about AI today is a sign that it could have a similar growth trajectory.

AI Applications Are Diverse

Cuban’s investments show that he believes AI can impact more than traditional technology businesses. For example, he’s invested in Bold Metrics, which is using AI to change the way people shop for clothes online. Another Cuban investment, Strella Biotechnology, is leveraging AI to reduce food waste.

When people want to invest in artificial intelligence, they often gravitate toward hardware and software companies, where the impact of AI is easy to see. For example, Nvidia is the most popular AI investment because it makes the hardware that enables AI use cases for other businesses.

Cuban’s portfolio shows that you can think a little broader than that when investing in artificial intelligence. Companies that don’t make AI hardware or software can nonetheless be transformed by the technology. These under-the-radar opportunities sometimes have more upside because there are fewer investors interested in them today.

Cuban Is Especially Focused on Robotics, Marketing and Health

Although Cuban has a diversified portfolio of AI investments, he shows clear favoritism toward certain applications. For example, many of his AI investments are in the fields of:

Robotics

Marketing and sales

Health

Sports

This doesn’t necessarily mean you should invest in AI applications in these industries, but it’s something to consider. Cuban built a multibillion-dollar portfolio, in part, by consistently making smart investing decisions, so his preference for AI investments in these sectors is at least noteworthy.

Is Cuban Making Money From His AI Investments?

You might be wondering how Cuban’s AI investments have performed. But there’s not much data available to analyze this. Every business on the list is privately owned, which means they don’t have to share as much financial information with the public.

This could be meaningful. For example, there are plenty of publicly listed companies that are valued for their AI applications. However, Cuban chooses to invest in private businesses that are still in their early stages of growth.

That might be because it’s a profile Cuban looks for when evaluating new AI investments. He could choose private companies because they have lower valuations and, therefore, more upside. This is speculation, but it’s a tactic to consider when you’re looking for your own AI investments.

There’s Much To Glean From Cuban’s AI Investments

Mark Cuban has a huge portfolio of AI investments, which spans many industries. This proves that he’s a believer in the technology and the potential it has to transform the world.

However, we don’t know how much of Cuban’s wealth is in AI investments. Since he’s worth around $7.5 billion, even $100 million put into these opportunities would represent a small fraction of his net worth.

That’s important to remember before investing in AI companies. Even though Cuban believes in their transformative power, he hasn’t put all of his money into them. You’ll want to diversify similarly based on your portfolio’s size.

That way, when the AI industry experiences setbacks — as all sectors do — your net worth won’t be impacted too severely. That’ll make it easier to hold your AI investments and benefit from their long-term growth, just like Cuban.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 20 Ways Mark Cuban Makes Money Off AI

Yahoo Finance

Yahoo Finance