2024 Q1 Market Recap: Bullish Momentum Persists Despite Challenges

The First Quarter is in the Books

They say that “time flies when you’re having fun.” If that adage is true, the first quarter of 2024 flew by for equity bulls. Year-to-date, the major U.S. indices are all well into the green, with the Nasdaq 100 ETF (QQQ) and the S&P 500 Index ETF (SPY) leading the way with gains of about 10% each. Despite much higher interest rates, a regional banking scare, “stagflation” worries, and geopolitical escalations, the bull market is climbing the proverbial “wall of worry.”

As investors, it can be easy to get caught up in the present or look ahead to the future in an attempt to extract money from the market. However, savvy investors understand that pausing and looking back at what has already happened can also be fruitful because trends tend to persist further than most anticipate. With that in mind, here are three key takeaways from the Q1 2024, including:

Tech Dominated, but Energy Stabilized

The technology sector picked up where it left off in 2023 and continued to dominate.

Image Source: FinViz

Below are a few takeaways:

· The technology sector enjoyed the best performance of all sectors, with a 12.11% gain.

· Financials were the third-best sector performer despite regional banking and commercial real estate concerns.

· Real estate was the worst-performing sector due to the Fed’s “higher for longer” interest rate policy.

· “Old economy” sectors like energy and basic materials lagged early in the quarter but stormed back to have the best performance in the final month of Q1.

S&P 500 Displays Rare Strength

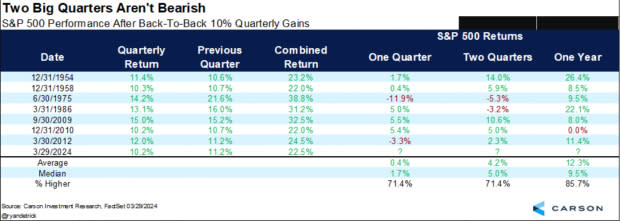

The S&P 500 Index just posted back-to-back 10% quarters for only the eighth time since 1950. To put the impressive gains in perspective, the S&P 500 Index has averaged 10% for the entire year over the past thirty years. More importantly, what does such strength mean for investors? Luckily for us, Ryan Detrick of Carson Research ran the numbers. Judging by the historical data, bulls should feel confident. A year later, the S&P 500 Index is up 12.3% on average and has only been lower once in seven times (it lost less than a percent the one time it was lower).

Image Source: Ryan Detrick, Carson Research

Winners & Losers

The AI Revolution showed no signs of stalling. Super Micro Computer (SMCI) saw mind-blowing gains of more than 200% for the quarter after pre-announcing earnings results early in Q1. Crypto-related stocks like MicroStrategy (MSTR) and Coinbase (COIN) soared after Bitcoin ETFs like the iShares Bitcoin Trust (IBIT) were approved.

Tesla (TSLA) fell nearly 30%, weighed down by higher rates and increased Chinese competition. Boeing (BA) was among the worst performers in the S&P 500 Index as safety concerns spooked investors.

Bottom Line

The first quarter of 2024 showcased remarkable resilience amidst various challenges. Despite concerns such as higher interest rates and geopolitical tensions, the major U.S. indices surged, with technology leading the charge.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

iShares Bitcoin Trust (IBIT): ETF Research Reports

Yahoo Finance

Yahoo Finance