3 Attractive Large-Caps Worth Investors' Attention

There is a wide variety of investing styles out there, whether that be value-focused or targeting a specific industry.

Of course, some also prefer to tailor their investing style to target primarily large-cap stocks.

Large-cap stocks are a staple in almost every portfolio. They are well-established, have more analyst coverage, and frequently pay dividends, all undeniably significant benefits that make them so popular among investors.

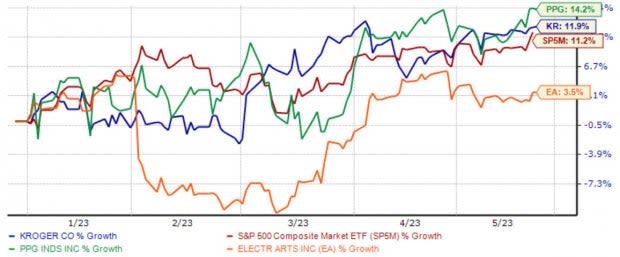

For those with an appetite for large-caps, three companies – Kroger Co. KR, PPG Industries PPG, and Electronic Arts EA – have all seen their near-term earnings outlook shift positively and carry solid projected growth.

Below is a chart illustrating the performance of each year-to-date, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Kroger Co.

Founded in 1883, the long-time retailer operates approximately 2,700 retail stores under various banners and divisions in 35 states. The stock presently carries a favorable Zacks Rank #2 (Buy).

Shares aren’t stretched in terms of valuation, with the current 10.9X forward earnings multiple sitting nicely beneath the 12.4X five-year median and the Zacks Retail and Wholesale sector average.

KR sports a Style Score of “A” for Value.

Image Source: Zacks Investment Research

For those seeking an income stream, KR shares have that covered; the company’s annual dividend currently yields 2.1%, with its payout growing by an impressive 15% over the last five years.

Image Source: Zacks Investment Research

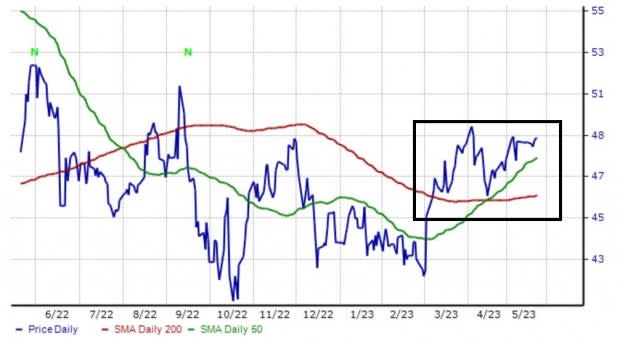

KR shares have also recently experienced the ‘Golden Cross,’ as we can see illustrated in the chart below. The Golden Cross occurs when the shorter 50-day moving average rises above the 200-day moving average.

Image Source: Zacks Investment Research

Electronic Arts

Electronic Arts is a leading developer, marketer, publisher, and distributor of video game software and content. Currently, the stock is a Zacks Rank #2 (Buy).

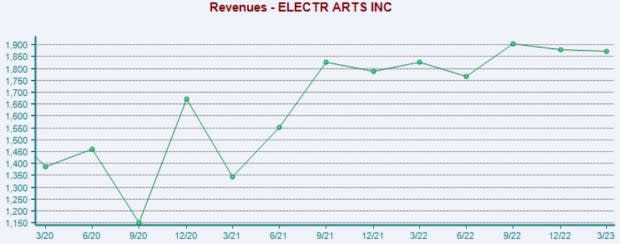

EA posted better-than-expected results in its latest release, snapping a streak of negative surprises. The company reported earnings per share of $1.77 on $1.9 billion in revenue, reflecting a 35% EPS beat and a 13% sales surprise.

Image Source: Zacks Investment Research

In addition, it’s hard to ignore the company’s growth profile, with earnings forecasted to soar 23.5% in its current fiscal year (FY24) and an additional double-digit 10.4% in FY25. Top line growth is also apparent, with sales forecasted to climb 3.7% and 7.5% in FY24 and FY25, respectively.

PPG Industries

PPG Industries is a global supplier of paints, coatings, chemicals, specialty materials, glass, and fiberglass. Shares have recently broken out of a year-long range, with prior resistance now becoming a support level.

Image Source: Zacks Investment Research

Like Kroger, PPG has had little issue increasingly rewarding its shareholders, boosting its dividend payout by nearly 7% over the last five years. Shares currently yield 1.7% annually, below the Zacks Basic Materials sector average by a fair margin.

Image Source: Zacks Investment Research

Bottom Line

Large-cap stocks can help bring stability to a portfolio, as these stocks are typically less volatile. In addition, they commonly pay dividends and carry a well-established nature, further perks that make them beloved among investors.

And all three above – Kroger Co. KR, PPG Industries PPG, and Electronic Arts EA – could be considerations for those seeking large-caps with improved near-term earnings outlooks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance