3 of "The Big Short's" New Purchases

A Legend is Born

Michael Burry is an American hedge fund manager considered to be one of the sharpest minds on Wall Street. Burry soared to prominence after his bold and correct prediction that the subprime mortgage market would collapse in 2007. Not only did Burry correctly predict the subprime mortgage crisis would unfold (which very few other investors predicted), but he also profited handsomely. Through the purchase of credit default swaps from Goldman Sachs GS (an agreement that the seller of CDS will compensate the buyer in the event of a default) and other big banks on the mortgage bond market, Burry made a windfall profit of $100 million in the months following the housing crisis of 2008. Because of Burry’s rapid ascent and unique personality, Hollywood took notice. In the blockbuster film “The Big Short”, movie star Christian Bale played Michael Burry.

While Burry is best known for his bold short bets, he has also found success on the long side. For example, Burry owned around 5% of GameStop’s GME shares before it went on its spectacular run.

Image Source: Zacks Investment Research

Though Burry sold before the Reddit-induced meme frenzy sent shares soaring by thousands of percent (Burry likely left nearly a billion dollars on the table), he still came away with around a $100 million profit on the trade.

13F Can Provide Investor Insight

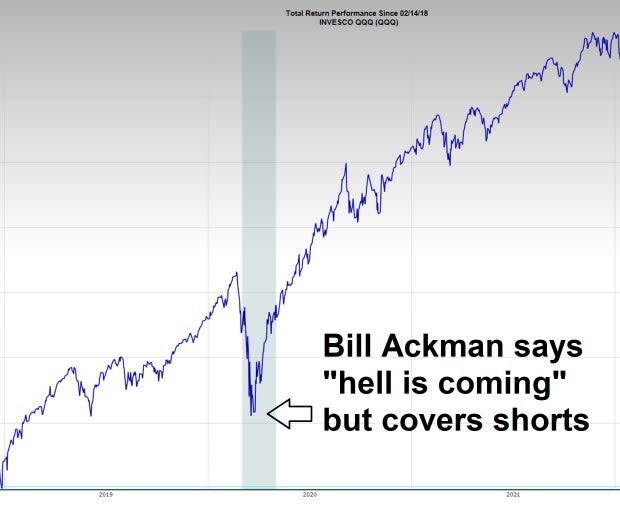

Often, there is a big difference between what an investor says in public and what an investor is actually trading. For instance, in the heat of the pandemic bear market, hedge fund manager Bill Ackman famously warned investors on TV that “hell was coming. Contrary to his warning, Ackman covered his market shorts for a profit of more than $2 billion and bought millions of dollars’ worth of shares in hospitality stocks such as Hilton Worldwide H. On the same token, Burry often tweets cryptic messages such as the word “sell” and “this time is different.”

Image Source: Zacks Investment Research

Fortunately, investors can cut through the noise and gain valuable insights into what the “smart money” is doing by looking at a 13F. A 13F is a mandatory form filed with the Securities and Exchange Commission by institutional investors who manage more than $100 million in assets. The goal of the 13F is to provide the public with transparency by disclosing the positions held by the institution. Though the 13F offers valuable insight into institutional investor mindset and strategy, 13Fs should be taken with a grain of salt. The form is only required to be filed quarterly so it is not necessarily real-time data.

What is Michael Burry’s Scion Asset Management Buying?

Chinese Equities

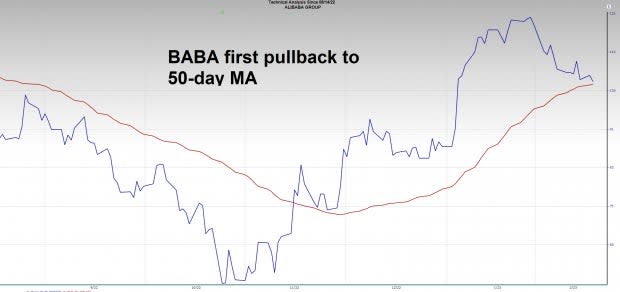

The biggest surprise to emerge from Michael Burry’s new purchases is his big bet on China. 18% of the portfolio is allocated to Chinese stocks such as JD.com JD and Alibaba Group BABA. After a huge run to close 2022 and start the new year, BABA shares are pulling back to the 50-day moving average for the first time (an attractive zone for those who missed the initial move. BABA is slated to report earnings later this month on February 23rd.

Image Source: Zacks Investment Research

Travel & Leisure

Two of Burry’s newest purchases are bets on the travel and leisure space – hospitality and casino operator MGM Resorts MGM and airline Skywest Inc SKYW. (In case you missed our recent airline piece click here)

Software

The largest new purchase for Burry was Black Knight Financial Services BKI. Black Knight is a workflow automation, data, and analytics provider to the mortgage and real estate industries.

Meanwhile, Burry's filing showed that he unloaded shares of REIT GEO Group Inc (GEO). The news sens shares plummeting by more than 20% on Tuesday's session.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

GameStop Corp. (GME) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Black Knight Financial Services, Inc. (BKI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance