3 Fast-Growing Small Caps to Consider

- By Alberto Abaterusso

Investors who target growth may want to consider investing in the following small-cap stocks as they represent companies whose trailing 12-month pro forma earnings per share advanced significantly on a year-over-year basis.

Furthermore, Wall Street sell-side analysts are forecasting that these stocks will continue increasing their earnings over the next several years, which has encouraged them to issue optimistic recommendation ratings.

Mitek Systems

The first stock to consider is Mitek Systems Inc. (NASDAQ:MITK), a San Diego-based developer and seller of mobile image capture and digital identity verification solutions in the U.S. and internationally. The stock has a market capitalization of $532.62 million.

Mitek Systems' trailing 12-month pro forma earnings were 62 cents per share as of the third quarter, which ended on June 29, up 72.2% from 36 cents as of the same quarter in fiscal 2019.

Wall Street sell-side analysts predict that Mitek Systems will continue to see its pro forma earnings increase by an average growth rate of 15% per annum over the next five years.

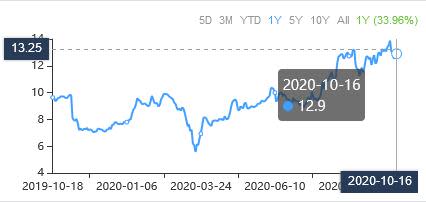

The share price ($12.9 as of Oct. 16) has gained nearly 34% over the past year for a 52-week range of $5.26 to $14.5.

As of October, on Wall Street, the stock has a two strong buy recommendation ratings and three buy recommendation ratings, for an average target price of $12.13 per share.

BioDelivery Sciences International

The second company to be under consideration is BioDelivery Sciences International Inc. (NASDAQ:BDSI), a Raleigh, North Carolina-based developer and commercializer of specialty pharmaceutical products for several illnesses. The stock has a market capitalization of around $372.45 million.

BioDelivery Sciences International's trailing 12-month diluted pro forma earnings were 36 cents per share as of the second quarter, representing a positive turnaround from a net loss of 28 cents per share as of the comparable period in 2019.

Wall Street sell-side analysts predict that BioDelivery Sciences International will continue to grow its diluted pro forma earnings by approximately 25% on average every year over the next five years.

The share price ($3.69 as of Oct. 16) has fallen by 28.47% over the past year, determining a 52-week range of $2.85 to $7.21.

As of October, on Wall Street, the stock has three strong buy recommendation ratings and four buy recommendation ratings, for an average target price of $8 per share.

A10 Networks

The third company to consider is A10 Networks Inc. (NYSE:ATEN), a San Jose, California-based provider of software and hardware solutions. The stock has a market capitalization of $571.22 million.

A10 Networks' trailing 12-month pro forma earnings were 26 cents per share as of the second quarter, which was a positive shift from a net loss of 1 cent as of the comparable quarter in 2019.

Wall Street sell-side analysts predict that A10 Networks' pro forma earnings will grow by an average rate of 23% per annum over the next five years.

The share price ($7.33 as of Oct. 16) has climbed 10.23% over the past year for a 52-week range of $3.43 to $9.21.

As of October, on Wall Street, the stock has three strong buy recommendation ratings and two hold recommendation ratings, for an average target price of $13.25 per share.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance