3 High Insider Ownership Growth Companies On Chinese Exchange With Up To 28% Revenue Growth

Amid a backdrop of economic deceleration and heightened caution, Chinese markets have shown some vulnerability, with indicators such as the Shanghai Composite Index experiencing slight declines. In such an environment, growth companies with high insider ownership can offer investors a unique blend of growth potential and aligned interests, making them particularly compelling considerations.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Songcheng Performance DevelopmentLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Songcheng Performance Development Co., Ltd is a company based in China, specializing in the performing arts industry, with a market capitalization of approximately CN¥21.51 billion.

Operations: The company generates revenue primarily from its operations in the performing arts sector in China.

Insider Ownership: 14.5%

Revenue Growth Forecast: 15.6% p.a.

Songcheng Performance Development Co., Ltd is trading 39.7% below its estimated fair value, with analysts predicting a significant price increase of 59.5%. The company's earnings are expected to grow by 48.9% annually, outpacing the Chinese market average of 22.3%. However, its revenue growth forecast at 15.6% per year is modest compared to other high-growth companies in China. Recent substantial increases in quarterly sales and net income highlight strong operational performance, despite a low return on equity forecast and undercovered dividends indicating potential financial strain or reinvestment strategies.

Hubei Century Network Technology

Simply Wall St Growth Rating: ★★★★★☆

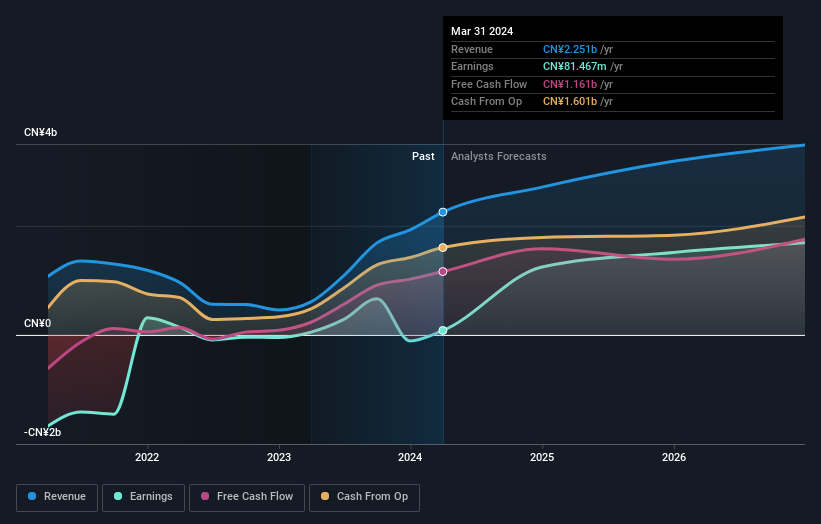

Overview: Hubei Century Network Technology Inc. operates an online entertainment platform in China and internationally, with a market capitalization of approximately CN¥4.96 billion.

Operations: The company generates revenue through its online entertainment platform, both domestically and internationally.

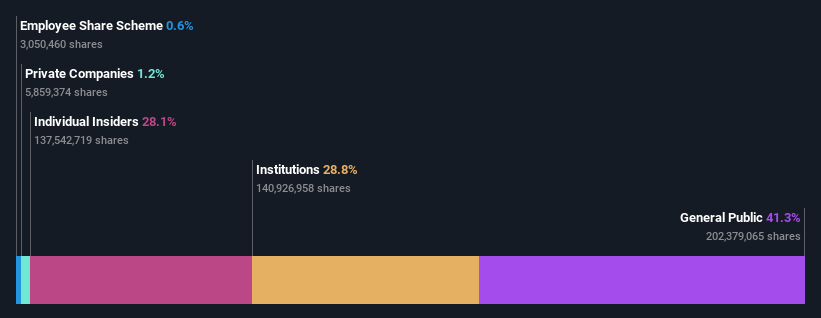

Insider Ownership: 28.1%

Revenue Growth Forecast: 23% p.a.

Hubei Century Network Technology, despite a recent dividend decrease and lower first-quarter earnings compared to the previous year, is positioned for robust growth. The company's revenue is expected to grow by 23% annually, surpassing the Chinese market forecast of 13.7%. Additionally, earnings are anticipated to increase significantly at a rate of 34.3% per year, outperforming the market's expectation of 22.3%. However, challenges such as reduced profit margins and a low forecasted return on equity at 12.8% highlight areas for caution.

Sineng ElectricLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Sineng Electric Co., Ltd. operates in the research, development, manufacturing, maintenance, and trading of power electronic products both domestically in the People's Republic of China and internationally, with a market capitalization of approximately CN¥8.27 billion.

Operations: The company generates revenue through the research, development, manufacturing, maintenance, and trading of power electronic products.

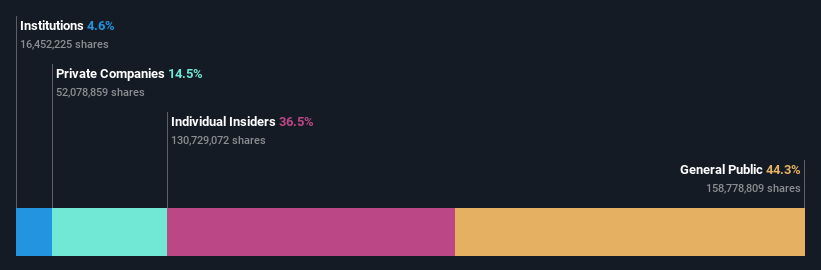

Insider Ownership: 36.5%

Revenue Growth Forecast: 28.6% p.a.

Sineng Electric Co., Ltd. is demonstrating strong growth potential, with its revenue and earnings forecast to expand at 28.6% and 39.8% per year respectively, outpacing the Chinese market averages of 13.7% and 22.3%. Despite the absence of recent insider trading data, the company's substantial profit increase by nearly threefold over the past year underscores its robust financial health. Trading at a price-to-earnings ratio slightly below market average suggests relative value, complemented by high-quality earnings largely comprised of actual cash flows rather than accounting adjustments.

Seize The Opportunity

Investigate our full lineup of 365 Fast Growing Chinese Companies With High Insider Ownership right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:300144 SZSE:300494 and SZSE:300827.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance