3 High-Yield Dividend Stocks On The Japanese Exchange With Up To 3.7% Yield

Amid a backdrop of strengthening economic indicators, Japan's stock markets have recently shown robust performance, with key indices like the Nikkei 225 and TOPIX reaching all-time highs. This positive momentum makes it an opportune time to consider the potential stability offered by high-yield dividend stocks, particularly for investors looking to capitalize on current market conditions while seeking regular income streams.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.75% | ★★★★★★ |

Tsubakimoto Chain (TSE:6371) | 3.69% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.51% | ★★★★★★ |

Globeride (TSE:7990) | 3.80% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.42% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.55% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 4.37% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.57% | ★★★★★★ |

Innotech (TSE:9880) | 4.02% | ★★★★★★ |

Click here to see the full list of 382 stocks from our Top Japanese Dividend Stocks screener.

We'll examine a selection from our screener results.

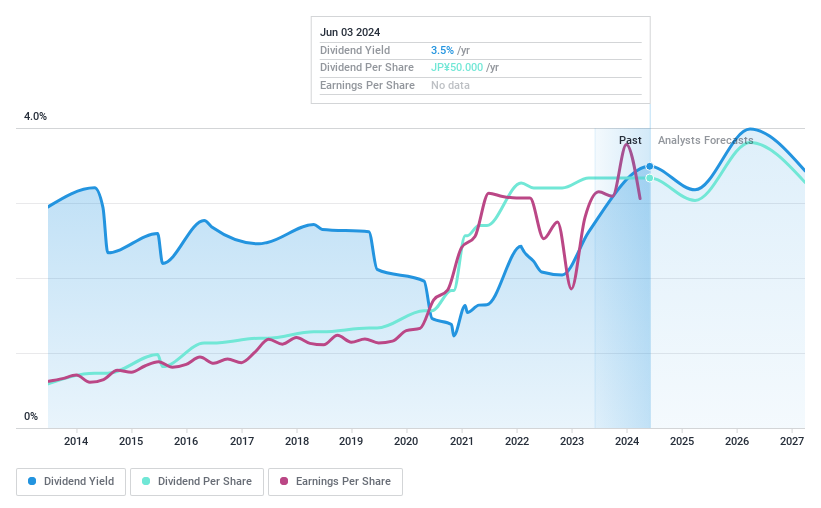

ValueCommerce

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ValueCommerce Co., Ltd. operates as a provider of marketing solutions both in Japan and internationally, with a market capitalization of approximately ¥39.51 billion.

Operations: ValueCommerce Co., Ltd. offers marketing solutions across domestic and global markets.

Dividend Yield: 3.4%

ValueCommerce Co., Ltd. has recently increased its dividend guidance, signaling a positive shift in its distribution policy with mid-year dividends rising from JPY 22.00 to JPY 25.00 and year-end dividends from JPY 20.00 to JPY 29.00 as of May 2024. Despite a historically unstable dividend track record, current dividends are well-covered by earnings and cash flows, with payout ratios at 52.1% and cash payout ratios at 35.3%, respectively. The stock trades below our estimated fair value by 25.3%, presenting potential value amidst modest earnings growth projections of approximately 4% annually.

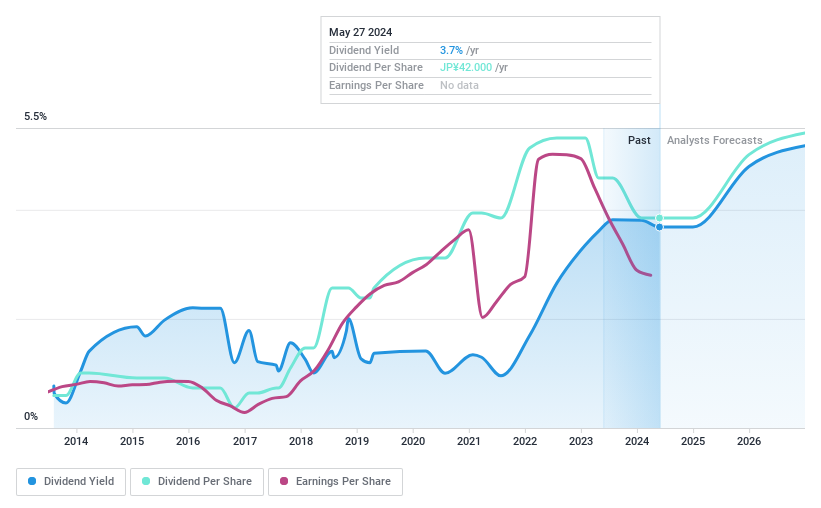

Koei Tecmo Holdings

Simply Wall St Dividend Rating: ★★★★★★

Overview: Koei Tecmo Holdings Co., Ltd. operates globally as an entertainment company with a focus on video game development and publishing, boasting a market capitalization of approximately ¥459.54 billion.

Operations: Koei Tecmo Holdings Co., Ltd. generates revenue primarily through its Entertainment segment, which brought in ¥79.49 billion, supplemented by its Amusement and Real Estate segments, which contributed ¥3.92 billion and ¥1.21 billion respectively.

Dividend Yield: 3.7%

Koei Tecmo Holdings offers a solid dividend yield of 3.71%, ranking in the top 25% of Japanese dividend payers. Its dividends are sustainably backed by a payout ratio of 50.4% and cash flows, with a cash payout ratio at 49%. Despite its high volatility in share price recently, it trades at an attractive P/E ratio of 13.6x, below the market average. However, earnings are expected to decline slightly by an average of 1.6% annually over the next three years.

Navigate through the intricacies of Koei Tecmo Holdings with our comprehensive dividend report here.

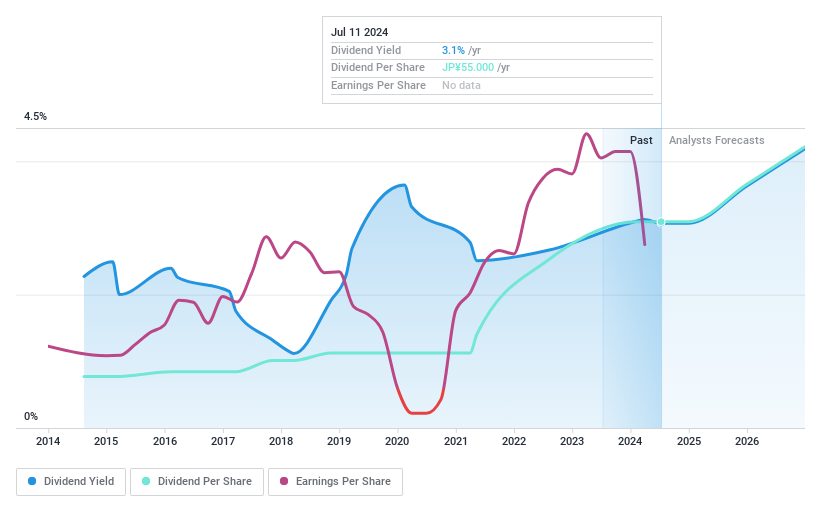

OAT Agrio

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OAT Agrio Co., Ltd. is a Japanese company specializing in the research, development, manufacturing, and sale of agrochemicals and fertilizers, with a market capitalization of ¥18.41 billion.

Operations: OAT Agrio Co., Ltd. generates its revenue primarily from the agrochemicals and fertilizers sector in Japan.

Dividend Yield: 3.1%

OAT Agrio maintains a stable dividend history, with dividends well-supported by both earnings and cash flows, evidenced by payout ratios of 38.3% and 44.5% respectively. Dividend growth has been consistent over the past decade, although its current yield of 3.07% trails the top quartile of Japanese dividend stocks. The company is trading below its estimated fair value, offering potential value to investors despite concerns over decreased profit margins from last year and high share price volatility recently.

Unlock comprehensive insights into our analysis of OAT Agrio stock in this dividend report.

Our valuation report unveils the possibility OAT Agrio's shares may be trading at a discount.

Turning Ideas Into Actions

Access the full spectrum of 382 Top Japanese Dividend Stocks by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2491 TSE:3635 and TSE:4979.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance