3 High Yield Dividend Stocks In Hong Kong Offering Up To 8.5%

As global markets navigate through varying economic signals, the Hong Kong market has shown resilience, with the Hang Seng Index recently gaining 3.11%. This backdrop sets a compelling stage for investors considering high-yield dividend stocks in this region. In light of current market conditions, a good dividend stock typically offers not just attractive yields but also stability and strong fundamentals to withstand economic fluctuations.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.02% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 8.94% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.73% | ★★★★★☆ |

China Construction Bank (SEHK:939) | 7.32% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 7.72% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.96% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.50% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.44% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.11% | ★★★★★☆ |

Click here to see the full list of 87 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

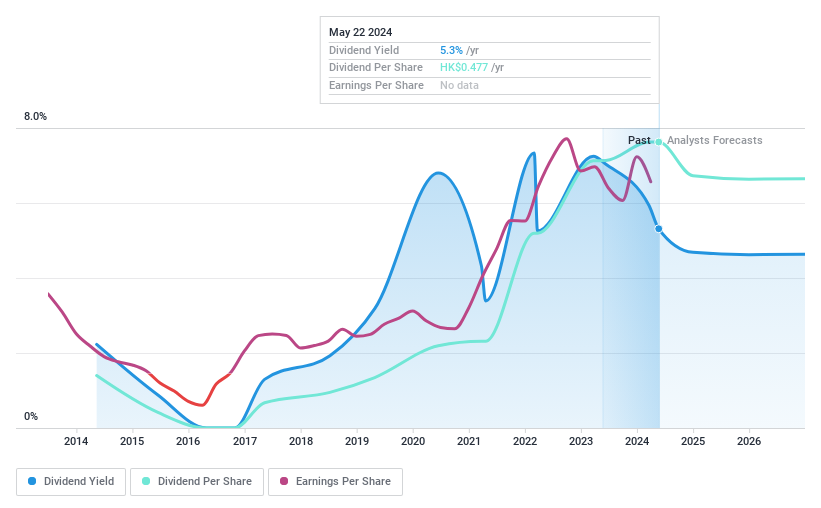

China Coal Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Coal Energy Company Limited operates mainly in coal production and trading, as well as coal chemical sectors both domestically within the People’s Republic of China and internationally, with a market capitalization of approximately HK$160.84 billion.

Operations: China Coal Energy Company Limited generates revenue primarily from coal production and trading, as well as coal chemical operations.

Dividend Yield: 5.3%

China Coal Energy, a significant player in the energy sector, reported a decline in both sales and production volumes of key products like commercial coal and methanol for April 2024 compared to the previous year. Despite this downturn, the company maintains a stable dividend, recently declaring RMB 0.442 per share for year-end 2023. Financially, Q1 2024 saw reduced earnings with net income dropping to CNY 4,969.52 million from CNY 7,155.27 million year-over-year. This performance raises concerns about sustainability but is somewhat mitigated by a conservative payout ratio of around 33%, suggesting that current dividends are well supported by earnings and cash flow.

Navigate through the intricacies of China Coal Energy with our comprehensive dividend report here.

Our valuation report here indicates China Coal Energy may be undervalued.

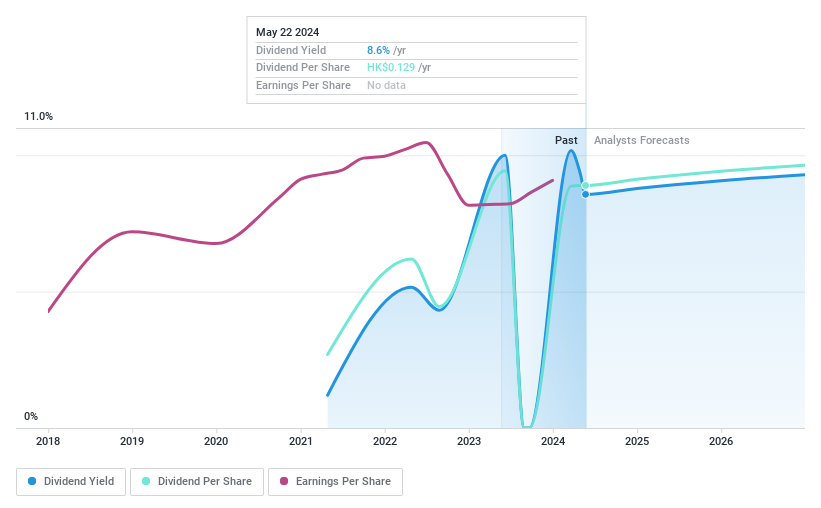

E-Star Commercial Management

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: E-Star Commercial Management Company Limited, operating in the People's Republic of China, offers commercial property operational services to owners and tenants, with a market capitalization of approximately HK$1.53 billion.

Operations: E-Star Commercial Management Company Limited generates its revenue primarily through the provision of operational services for commercial properties, totaling CN¥635.01 million.

Dividend Yield: 8.6%

E-Star Commercial Management proposed a final dividend of HKD 0.13 per share for 2023, reflecting its commitment to returning value to shareholders despite a volatile dividend history. The company's dividends are supported by earnings and cash flows, with a payout ratio of 70.1% and a cash payout ratio of 40.8%. However, it has only been paying dividends for three years with fluctuating payments, indicating potential instability in its dividend policy moving forward. Recent executive changes could also influence future financial strategies and stability.

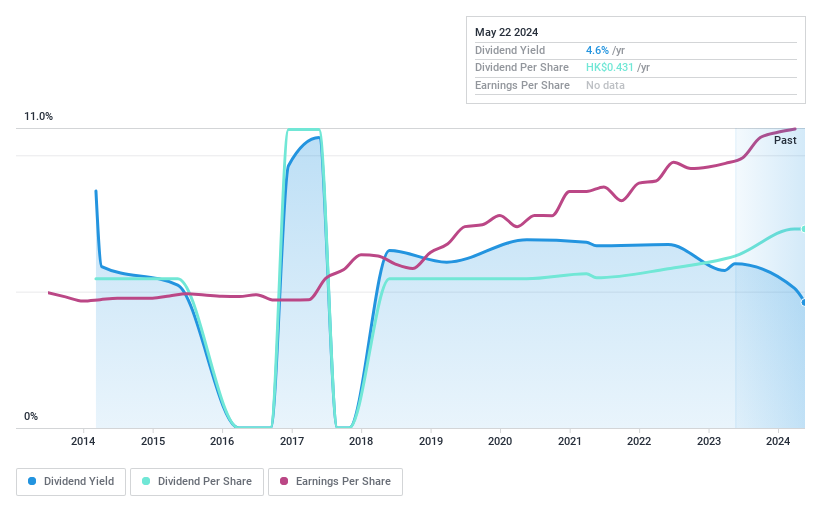

Xinhua Winshare Publishing and Media

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. operates in publishing and distribution across the People's Republic of China, with a market capitalization of approximately HK$16.84 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates its revenue primarily from publishing and distribution activities across the People's Republic of China.

Dividend Yield: 4.6%

Xinhua Winshare Publishing and Media has demonstrated a consistent dividend policy, supported by a sustainable payout ratio of 30.9% and cash flows with a cash payout ratio of 23.1%. However, its dividend yield at 4.6% remains below the top quartile in Hong Kong's market. Despite an unstable dividend history over the last decade, recent financial performance shows promising signs with an increase in quarterly sales to CNY 2,473.84 million and net income rising to CNY 206.29 million as of Q1 2024. Recent governance activities include shareholder proposals and executive changes that could impact future operations and investor relations.

Summing It All Up

Explore the 87 names from our Top Dividend Stocks screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1898 SEHK:6668 and SEHK:811.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance