3 Highly-Ranked Stocks Crushing the S&P 500 in 2022

The market’s performance over the last month has been stellar. Stocks have soared, and investors have fully welcomed the rally with open arms.

While many stocks still reside in the red year-to-date, there is a handful of them that have provided investors a solid return in 2022, including Archer Daniels Midland ADM, Advanced Drainage Systems WMS, and Arch Capital Group ACGL.

Below is a year-to-date chart of all three companies’ share performances with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three stocks have displayed remarkable relative strength, easily beating the S&P 500’s year-to-date decline of 9%.

In addition, all three companies sport either a Zacks Rank #2 (Buy) or the highly-coveted Zacks Rank #1 (Strong Buy), making them appear that much more appealing.

Let’s take a closer look at all three stocks to see how they currently stack up.

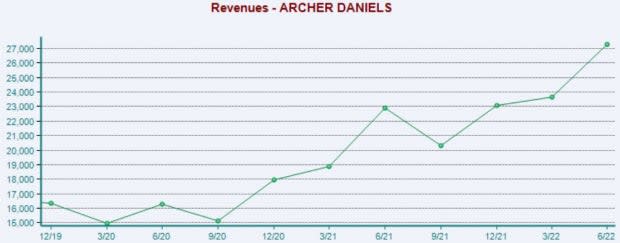

Archer Daniels Midland

Archer Daniels Midland ADM is a leading producer of food and beverage ingredients as well as goods made from various agricultural products. The company sports a Zacks Rank #2 (Buy) with an overall VGM Score of an A.

Analysts have upped their earnings outlook across several timeframes over the last 60 days, undoubtedly a positive.

Image Source: Zacks Investment Research

In addition, ADM shares trade at enticing multiples, further displayed by its Style Score of an A for Value.

The company’s forward earnings multiple of 12.9X is well below its five-year median of 14.4X and represents a steep 32% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Archer Daniels Midland has been on a blazing hot earnings streak, exceeding the Zacks Consensus EPS Estimate in 12 consecutive quarters. Top-line results have also been remarkable, with ADM penciling in seven consecutive top-line beats.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

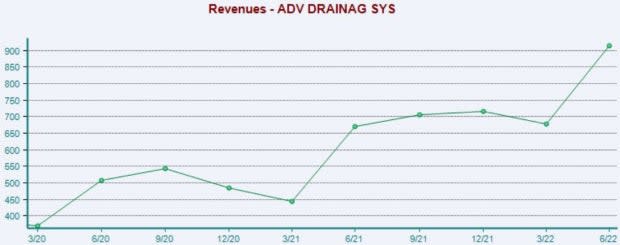

Advanced Drainage Systems

Advanced Drainage Systems WMS is a manufacturer of thermoplastic corrugated pipe, providing a comprehensive suite of water management products and drainage solutions for use in the construction and infrastructure marketplace.

Analysts have been bullish across the board over the last 60 days, helping push the company into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

However, shares trade at high multiples, perhaps steering value investors away. The company’s forward price-to-sales ratio resides at 3.9X, representing a 67% premium relative to its Zacks Sector. However, the value is still well below 2021 highs of 4.2X.

Image Source: Zacks Investment Research

In addition, WMS has reported strong quarterly results as of late, exceeding both top and bottom-line estimates in back-to-back quarters. Just in its latest print, the company recorded a massive 103% bottom-line beat and an 11% top-line beat.

Image Source: Zacks Investment Research

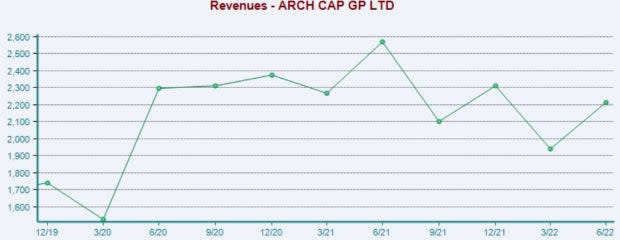

Arch Capital Group

Arch Capital Group ACGL writes insurance, reinsurance, and mortgage insurance worldwide. The company rocks the Zacks Rank #1 (Strong Buy) with an overall VGM Score of a B.

Like WMS, analysts have been bullish across all timeframes over the last 60 days, pushing the company into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Arch Capital Group carries enticing valuation levels, bolstered by its Style Score of an A for Value. The company’s 10.4X forward earnings multiple is well beneath its five-year median of 13.2X and represents an enticing 35% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

In addition, the company has repeatedly beat bottom-line expectations, exceeding the Zacks Consensus EPS Estimate in eight of its previous ten quarters. ACGL’s top-line results have left some to be desired, but in its latest print, the company registered a 2% top-line beat.

Image Source: Zacks Investment Research

Bottom Line

Investors have thoroughly enjoyed the market’s rally as of late. After a brutal start to the year, any sight of green is pleasant.

While the general market has struggled, the shares of all three companies have been much more substantial, providing shareholders with considerable gains.

Relative strength is always highly sought after, and these companies have provided precisely that. In addition, earnings estimates have gone up, and the companies have had strong quarters as of late.

To put the cherry on top, all three companies either sport a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Advanced Drainage Systems, Inc. (WMS) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance