3 Hotels & Motels Stocks to Watch Despite Industry Challenges

The Zacks Hotels and Motels industry performance in 2024 is likely to be impacted by high costs, heightened geopolitical risks and persistent macroeconomic uncertainty. However, industry participants focus on expansion efforts, hotel conversions, strategic partnerships and loyalty programs bode well. The industry has exhibited resilience behind cost-saving initiatives and digital enhancements. Hotel owners continue to focus on maintaining a balance between maximizing hotel profitability and driving guest satisfaction. Industry players, namely Hilton Worldwide Holdings Inc. HLT, InterContinental Hotels Group PLC IHG and Hyatt Hotels Corporation H, are likely to benefit from the factors mentioned above.

Industry Description

The Zacks Hotels and Motels industry comprises companies that own, lease, manage, develop and franchise hotels. Some vacation ownership and exchange firms are also a part of the industry. Several participants own, construct and operate resorts. Some companies develop lodges, villages and mobile accommodations, including modular, skid-mounted ones and central amenities that provide long-term and temporary workforce accommodations. Some industry players develop, market, sell and manage vacation ownership and associated products. Few hoteliers also offer studios, one-bedroom suites and accommodations to mid-market business and personal travelers.

3 Trends Shaping the Future of the Hotels & Motels Industry

High Costs & Inflation Remain a Woe: Higher costs remain a concern for industry participants. Rising salaries, wages and benefits have been adding to labor costs. High inflation is likely to curb consumer spending, which will hurt the industry. Heightened geopolitical risks and persistent macroeconomic uncertainty remain a concern for the industry. Increases in food & beverage and non-operating costs, increased renovation costs and high interest rates are also hurting the industry. At the same time, the outlook for midweek travel is uncertain, as certain companies are indicating potential changes to their business travel policies to manage expenses and adhere to sustainability objectives.

RevPAR & ADR: Although both RevPAR and ADR are expected to grow year-over-year in 2024, the projected growth rate has decreased compared to the forecast made in January. Per STR, the forecast for revenue per available room now predicts a 2% year-over-year increase, a decrease from the 4.1% projected in January. On the other hand, ADR is now expected to witness a growth of 2.1%, a decrease from the 3.1% projected in January. Amanda Hite, president of STR, said the updated forecast followed an unexpectedly low growth in hotel demand compared to U.S. GDP growth, which is unusual as these metrics usually align closely. Hite suggested that persistent inflation might be dampening travel spending among lower- and middle-income Americans.

Digitalization to Drive Growth: Hotel owners are focused on maintaining the balance between maximizing hotel profitability and driving guest satisfaction. To this end, hoteliers have leveraged mobile and web check-in and mobile key technologies. These hoteliers also increased the use of these digital tools to strengthen infrastructure, grow online package sales, enable self-service bookings, make real-time offerings and enhance the overall customer experience. This and an emphasis on pricing optimization and merchandising capabilities will likely help hoteliers capture additional market share.

Zacks Industry Rank Indicates Dismal Prospects

The Zacks Hotels and Motels industry is grouped within the broader sector.

The group's Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. The Zacks Hotels and Motels industry currently carries a Zacks Industry Rank #215, which places it in the bottom 14% of the 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry's position in the bottom 50% of the Zacks-ranked industries results from a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, analysts are gradually losing confidence in this group's earnings growth potential. Since Dec 31, 2023, the industry's earnings estimate for 2024 dropped 0.2%.

Before we present a few stocks you may want to keep an eye on, let's look at the industry's recent stock-market performance and valuation picture.

Industry Outperforms the Sector

In the past year, the Zacks Hotels and Motels industry has outperformed its sector. Over this period, the industry appreciated by 32.8% compared with the sector's increase of 5.9%. Meanwhile, the Zacks S&P 500 composite has increased 24.7%.

Hotels & Motels Industry's Valuation

On the basis of the forward 12-month EV/EBITDA, which is a commonly used multiple for valuing Hotels and Motels stocks, the industry is currently trading at 19.87X compared with the S&P 500's 25.63X. It is also below the sector's trailing 12-month EV/EBITDA ratio of 9.32X.

Over the last five years, the industry has traded as high as 23.97X and as low as 10.02X, with the median being at 14.94X, as the chart below shows.

3 Hotels & Motels Stocks to Watch Out For

InterContinental Hotels Group: InterContinental Hotels has been gaining from robust demand and expansion efforts. Regarding system size, over 3,000 rooms were opened in the Americas during first-quarter 2024, up more than 60% from the year-ago period’s tally. However, it's important to note that the first quarter is typically a smaller quarter for openings.

InterContinental Hotels Group currently carries a Zacks Rank #2 (Buy). In the past seven days, the Zacks Consensus Estimate for 2024 earnings has been revised upward by 0.2%. The Zacks Consensus Estimate for InterContinental Hotels 2024 earnings per share and sales suggests growth of 14.1% and 26.6%, respectively, from year-ago period’s figures. IHG's shares have gained 54.7% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

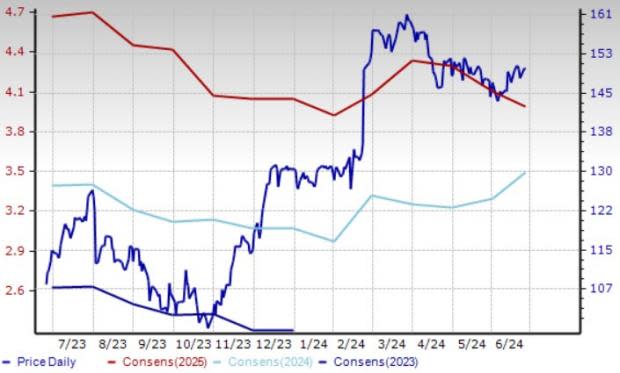

Price and Consensus: IHG

Hyatt Hotels: The company is benefiting from solid leisure transient demand, recovery in business travel demand, increased system-wide group travel and a loyalty program. Also, focus on new hotel openings and acquisition efforts bodes well. Hyatt continues to anticipate system-wide 2024 RevPAR to increase in the range of 3-5% year over year. Much optimism prevails on account of group bookings and confidence in the ongoing recovery of business transient demand, as well as the steady levels of leisure transient demand.

H currently carries a Zacks Rank #3 (Hold). In the past seven days, the Zacks Consensus Estimate for 2024 earnings has been revised upward by 1.2%. The Zacks Consensus Estimate for Hyatt 2024 EPS suggests growth of 35.9% from the year-ago period’s figure. Hyatt's shares have gained 36% in the past year.

Price and Consensus: H

Hilton: The company is benefiting from a solid improvement in RevPAR on the back of increased occupancy rates and ADR. Also, its focus on unit expansion, hotel conversions, strategic partnerships, loyalty programs and asset-light business model bodes well. Owing to the improving trend, management anticipates system-wide RevPAR to increase in the 2-4% band on a year-over-year basis for second-quarter 2024. For 2024, Hilton Worldwide expects net unit growth in the range of 6-6.5%.

Hilton currently carries a Zacks Rank #3. The Zacks Consensus Estimate for Hilton 2024 EPS suggests growth of 13.9% from the year-ago period’s levels. HLT's shares have jumped 52.2% in the past year.

Price and Consensus: HLT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance