3 Key German Dividend Stocks Offering Up To 7.1% Yield

Amidst a backdrop of modest gains in global markets and easing political uncertainties in Europe, the German market has shown resilience with a notable 0.90% increase in the DAX index. In this environment, dividend stocks remain a compelling option for investors seeking steady income streams, particularly when considering Germany's robust industrial performance and favorable economic indicators.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.87% | ★★★★★★ |

Brenntag (XTRA:BNR) | 3.31% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 6.56% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.62% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 4.97% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.83% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.29% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.36% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.20% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

OVB Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OVB Holding AG operates in Europe, offering advisory and brokerage services to private households, with a market capitalization of approximately €0.28 billion.

Operations: OVB Holding AG generates its revenue primarily from insurance brokerage, with a total segment revenue of €368.28 million.

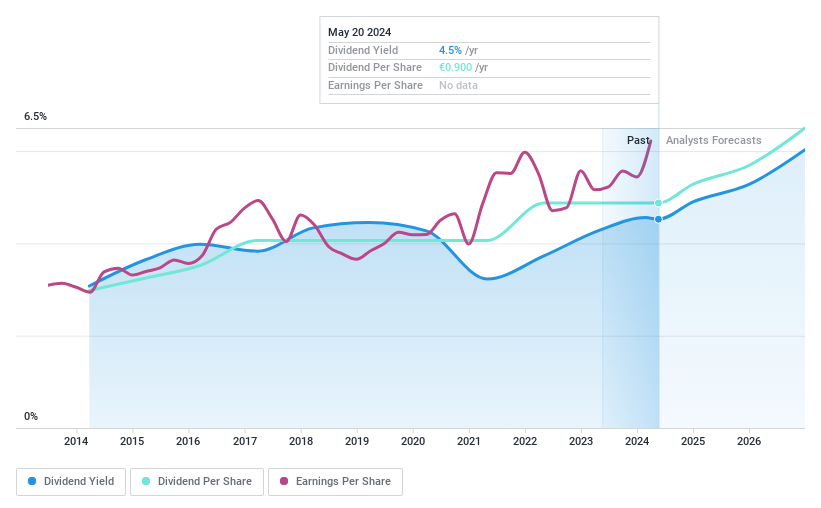

Dividend Yield: 4.6%

OVB Holding AG offers a modest dividend yield of 4.64%, slightly below the top quartile in Germany's dividend market at 4.74%. Despite a stable history of dividends over the last decade, current payouts are not well-supported by cash flows, with a high cash payout ratio of 107.3%. Earnings have shown growth, increasing by 20.5% over the past year and are expected to continue growing annually by 5.31%. However, dividends are currently not covered by earnings or free cash flow, indicating potential sustainability issues despite trading at a value perceived to be 17.1% below its fair value.

ProCredit Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG operates as a commercial bank offering services primarily to small and medium enterprises and private customers across Europe, South America, and Germany, with a market capitalization of approximately €0.53 billion.

Operations: ProCredit Holding AG generates its revenue primarily through banking services, totaling €414.50 million.

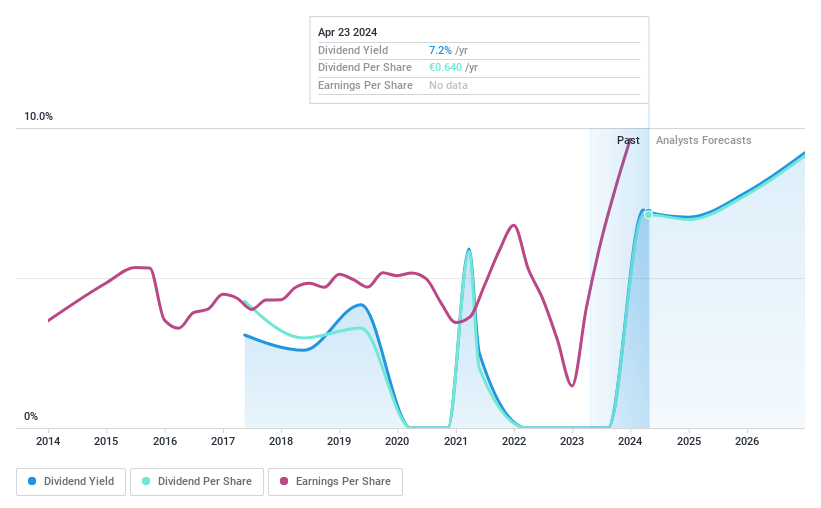

Dividend Yield: 7.1%

ProCredit Holding AG reported a net income increase to €33.5 million in Q1 2024, up from €29.5 million the previous year, reflecting a robust earnings growth of 146.2%. Despite this, the company's dividend history is marked by volatility and unreliability over its seven-year dividend-paying period. With a high bad loans ratio at 2.7%, and dividends only partially covered by earnings (33.2%), sustainability concerns persist even though the stock trades at significant undervaluation (65.1% below fair value) and analysts predict substantial price growth (94.6%).

Sixt

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE operates globally, offering mobility services to both private and business customers through a network of corporate and franchise stations, with a market capitalization of approximately €2.92 billion.

Operations: Sixt SE generates its revenue primarily from operations in Germany (€1.21 billion), Europe (€1.49 billion), and North America (€1.14 billion).

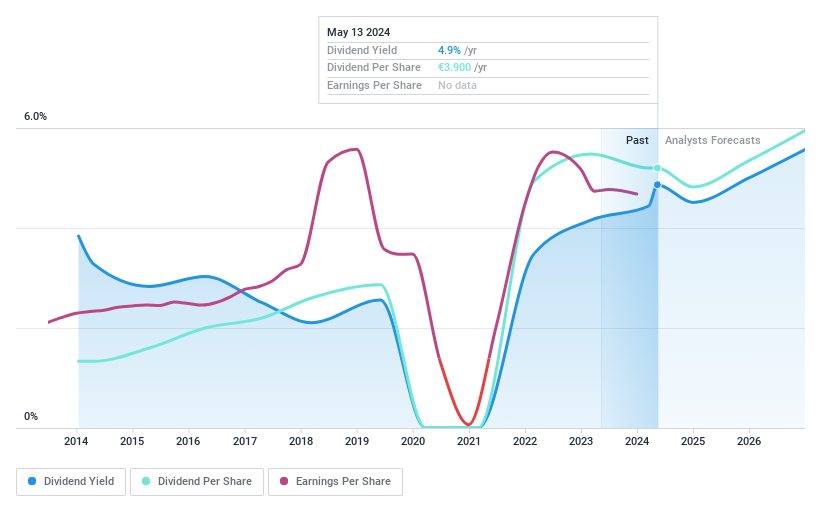

Dividend Yield: 5.8%

Sixt SE, recently impacted by index adjustments, faces challenges with a net loss of €23.12 million in Q1 2024 despite increased sales to €780.24 million. The company's dividend yield stands at 5.78%, higher than the German market average, but concerns about sustainability arise as dividends are not well covered by earnings or cash flows. Sixt's expansion in North America and partnerships like with Blacklane may bolster future prospects, yet its financial position is strained with debt poorly covered by operating cash flow.

Click to explore a detailed breakdown of our findings in Sixt's dividend report.

The valuation report we've compiled suggests that Sixt's current price could be quite moderate.

Make It Happen

Click through to start exploring the rest of the 27 Top Dividend Stocks now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:O4BXTRA:PCZ XTRA:SIX2 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance