3 Leading Chinese Dividend Stocks With Yields Up To 7.1%

As global markets navigate through fluctuating inflation and interest rates, China's economy presents a unique landscape with its recent government interventions aimed at stabilizing the property sector and spurring domestic demand. Amid these conditions, investors might find appeal in Chinese dividend stocks, particularly those offering substantial yields in a market ripe with government-backed economic stimuli.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 5.95% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.51% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.23% | ★★★★★★ |

Jiangsu Yanghe Brewery (SZSE:002304) | 4.81% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.12% | ★★★★★★ |

Changchun High-Tech Industry (Group) (SZSE:000661) | 3.90% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.37% | ★★★★★★ |

Shenzhen Fuanna Bedding and FurnishingLtd (SZSE:002327) | 5.19% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.33% | ★★★★★★ |

Click here to see the full list of 182 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

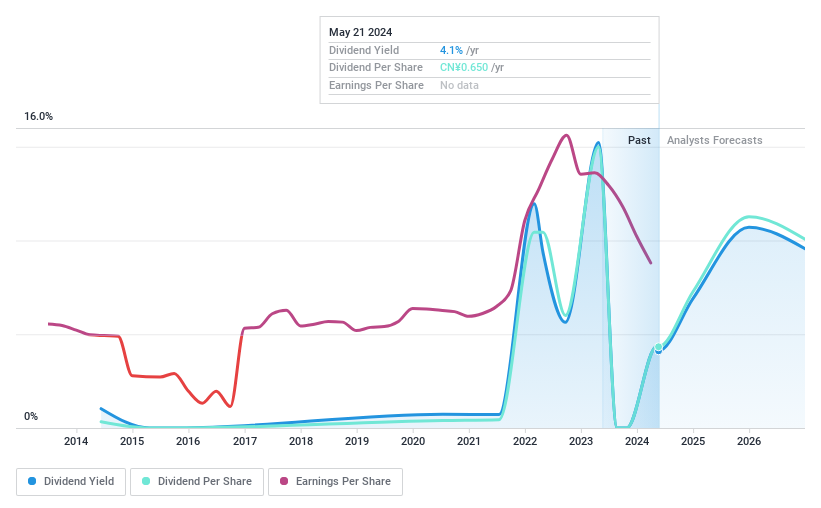

Shanxi Coal International Energy GroupLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanxi Coal International Energy Group Co., Ltd operates in the coal production sector both within China and globally, with a market capitalization of approximately CN¥31.30 billion.

Operations: Shanxi Coal International Energy Group Co., Ltd primarily generates revenue from its coal production operations across both domestic and international markets.

Dividend Yield: 4.1%

Shanxi Coal International Energy Group Co., Ltd has experienced a significant decline in both quarterly and annual financial performance, with recent Q1 2024 sales dropping to CNY 6.36 billion from CNY 10.65 billion the previous year, and net income decreasing to CNY 583.22 million from CNY 1.71 billion. Despite this downturn, the company continues to pay dividends, recently declaring a cash dividend of CNY 0.65 per share payable in May 2024. However, the volatility in dividend payments over the past decade raises concerns about their reliability and sustainability moving forward.

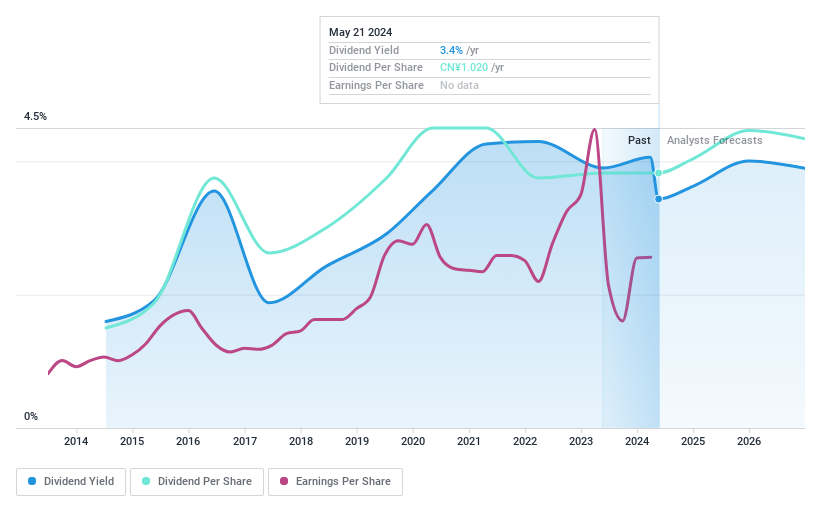

China Pacific Insurance (Group)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Pacific Insurance (Group) Co., Ltd. offers a range of insurance products to both individual and institutional clients across the People’s Republic of China, with a market capitalization of approximately CN¥257.49 billion.

Operations: China Pacific Insurance (Group) Co., Ltd. generates its revenue primarily through the sale of various insurance products across the People's Republic of China.

Dividend Yield: 3.4%

China Pacific Insurance (Group) Co., Ltd. maintains a stable dividend with a recent declaration of RMB 1.02 per share, payable on 12 July 2024. The company's dividends are well-supported by both earnings and cash flows, with payout ratios indicating sufficient coverage. Despite this, the dividend history has been marked by inconsistency over the past decade, reflecting some volatility in payments. Recent financials show a slight increase in quarterly net income to CNY 11.76 billion from CNY 11.63 billion year-over-year, suggesting modest financial growth amidst broader strategic changes including amendments to company bylaws anticipated at the upcoming annual general meeting on 6 June 2024.

Dive into the specifics of China Pacific Insurance (Group) here with our thorough dividend report.

Our valuation report here indicates China Pacific Insurance (Group) may be undervalued.

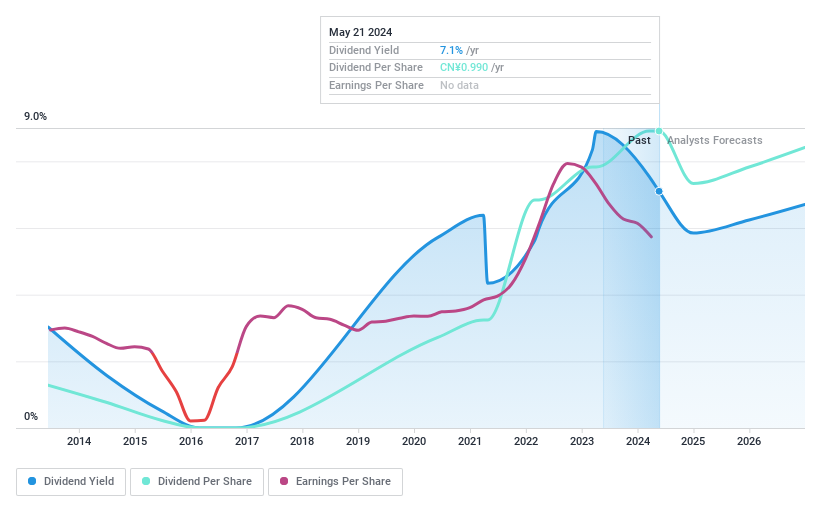

Pingdingshan Tianan Coal. Mining

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pingdingshan Tianan Coal Mining Co., Ltd. is a China-based company primarily engaged in the mining, washing, processing, and sale of coal, with a market capitalization of approximately CN¥34.52 billion.

Operations: The revenue segments for Pingdingshan Tianan Coal Mining Co., Ltd. are not specified in the provided text.

Dividend Yield: 7.1%

Pingdingshan Tianan Coal. Mining Co., Ltd. faces challenges with a declining net income reported at CNY 740.48 million in Q1 2024, down from CNY 1,146.24 million the previous year. Despite this, the company maintains a high dividend yield of 7.1%, which is attractive but raises sustainability concerns given its volatility and lack of free cash flow coverage. The firm's share buyback program shows shareholder return commitment but doesn't mitigate the fundamental earnings decline and dividend coverage issues highlighted by a reasonable payout ratio of 63.9%.

Taking Advantage

Click through to start exploring the rest of the 179 Top Dividend Stocks now.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600546 SHSE:601601 and SHSE:601666.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance