3 Leading Euronext Paris Dividend Stocks Yielding Up To 5.6%

As the French CAC 40 Index climbed nearly 3.9% recently, buoyed by China's robust stimulus measures and hopes for interest rate cuts in Europe, investors are increasingly looking towards stable income-generating options such as dividend stocks. In this favorable market environment, identifying strong dividend stocks can provide a reliable income stream while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 8.07% | ★★★★★★ |

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.00% | ★★★★★☆ |

Vicat (ENXTPA:VCT) | 5.67% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.08% | ★★★★★☆ |

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.87% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.69% | ★★★★★☆ |

Samse (ENXTPA:SAMS) | 6.49% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.72% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.78% | ★★★★★☆ |

Trigano (ENXTPA:TRI) | 3.04% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

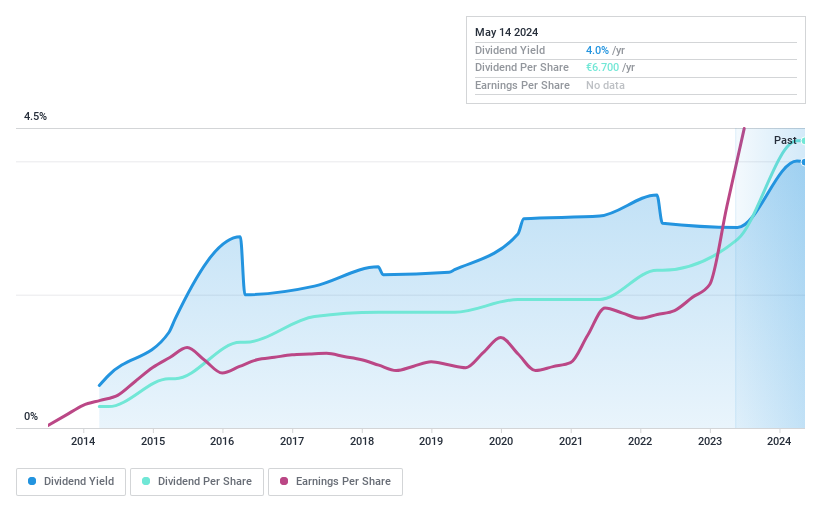

Exacompta Clairefontaine

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. engages in producing, finishing, and formatting papers in France, Europe, and internationally with a market cap of €160.67 million.

Operations: Exacompta Clairefontaine S.A. generates revenue from two main segments: Paper (€354.56 million) and Conversion (€597.58 million).

Dividend Yield: 4.7%

Exacompta Clairefontaine offers a reliable dividend, with payments growing steadily over the past 10 years and a current yield of 4.72%. Despite lower profit margins this year (2.6% vs. 6.5% last year), dividends remain well-covered by both earnings (payout ratio: 35.4%) and cash flows (cash payout ratio: 10.7%). Recent half-year earnings show sales at €408.42 million, down from €421.86 million, and net income at €16.5 million compared to €38.22 million previously.

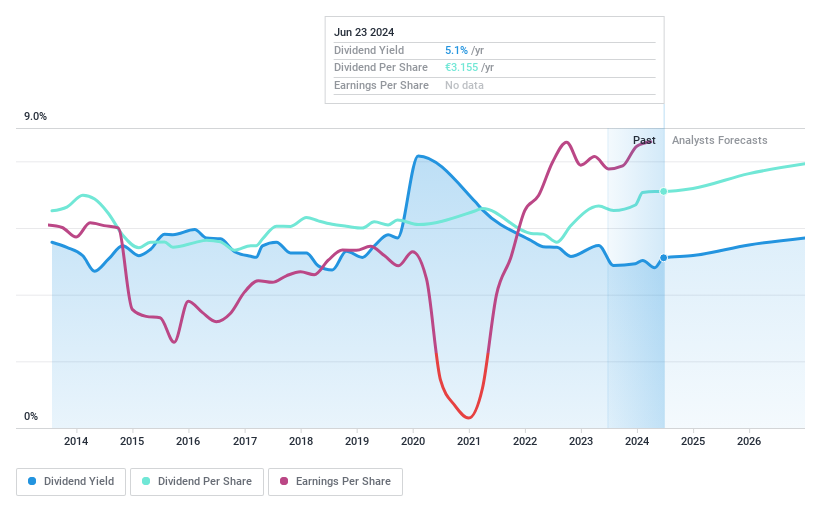

TotalEnergies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TotalEnergies SE, with a market cap of €135.50 billion, is a multi-energy company involved in the production and marketing of oil, biofuels, natural gas, green gases, renewables, and electricity across France, Europe, North America, Africa, and globally.

Operations: TotalEnergies' revenue segments include Integrated LNG ($21.46 billion), Integrated Power ($27.01 billion), Marketing & Services ($71.38 billion), Refining & Chemicals ($134.98 billion), and Exploration & Production ($47.20 billion).

Dividend Yield: 5.2%

TotalEnergies' dividend payments are well-covered by earnings (payout ratio: 37.7%) and cash flows (cash payout ratio: 37.4%), despite a history of volatility over the past decade. Recent expansions, including the $10.5 billion GranMorgu project in Suriname and solar farms in Texas, highlight its commitment to growth and sustainability. However, analysts forecast a slight decline in earnings over the next three years, which may impact future dividend stability.

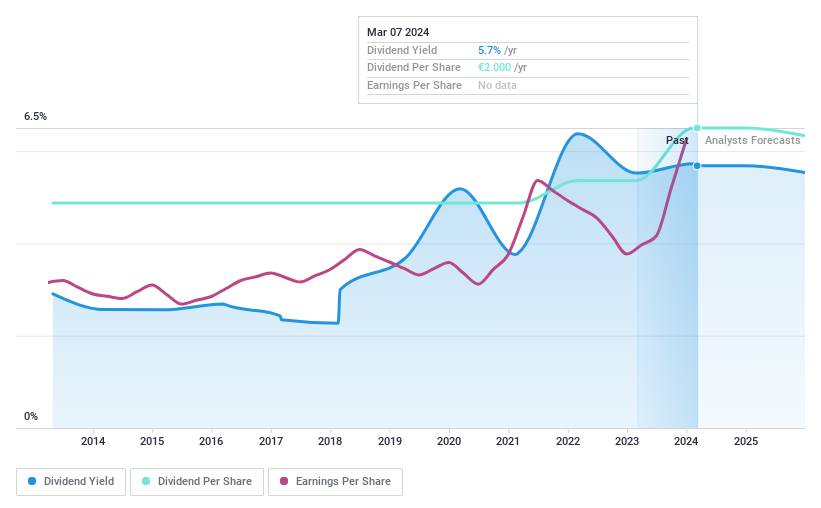

Vicat

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Vicat S.A., with a market cap of €1.57 billion, operates in the production and sale of cement, ready-mixed concrete, and aggregates for the construction industry through its subsidiaries.

Operations: Vicat S.A.'s revenue segments include €2.52 billion from cement and €1.55 billion from concrete and aggregates.

Dividend Yield: 5.7%

Vicat's dividend payments are well-covered by earnings (payout ratio: 33.4%) and cash flows (cash payout ratio: 45.7%), offering a reliable yield of 5.67%. The company's dividends have been stable and growing over the past decade, supported by recent earnings growth, with net income reaching €103.54 million for H1 2024 compared to €94.05 million a year ago. However, Vicat carries a high level of debt, which investors should monitor closely.

Unlock comprehensive insights into our analysis of Vicat stock in this dividend report.

Our expertly prepared valuation report Vicat implies its share price may be lower than expected.

Summing It All Up

Reveal the 32 hidden gems among our Top Euronext Paris Dividend Stocks screener with a single click here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALEXA ENXTPA:TTE and ENXTPA:VCT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com