3 Pollution Control Stocks to Watch Despite Industry Headwinds

Increased adoption of renewable sources of energy with rising preference for alternative fuels, the growing popularity of electric vehicles and high costs related to frequent product upgrades have marred the outlook of the Zacks Pollution Control industry. The shortage of skilled labor in the United States is another concern for the industry participants.

However, the industry is benefiting from growing health-related concerns and efforts to adhere to pollution-related national and international norms. Tetra Tech, Inc. TTEK, Donaldson Company, Inc. DCI and Atmus Filtration Technologies Inc. ATMU appear well-poised to capitalize on the opportunities.

About the Industry

The Zacks Pollution Control industry comprises companies engaged in providing innovative filtration systems, replacement parts, solutions for managing medical wastes, energy recovery devices and other products. These products are primarily used in commercial, automotive repair, industrial, home healthcare, retail, construction, pharmaceutical and hospitality end markets. A few industry participants offer solutions to deal with industrial waste and commercial chemical products and technologies to tackle air pollution. One of the companies also delivers services related to infrastructure, water, resource management, energy, etc., to government and commercial clients. These companies are enhancing investments in developing innovative technologies, improving customer and employee experience and enhancing supply-chain modernization programs.

3 Trends Shaping the Future of the Pollution Control Industry

Rising Preference for Alternative Fuels: Higher utilization of alternative fuels for power generation to reduce dependency on coal in the United States and other developed countries across the world is restraining the demand for industrial emission-abatement products and technologies. Factors like supportive government policies related to renewable energy, increased renewable investments, a reduction in overall costs of generating renewable electricity and the rapid adoption of electric vehicles (EV) have made the prospects of the industry players gloomy.

Costs Related to Investments in Product Updates: Based on the guidelines of the pollution control boards in several countries, pollution-control equipment manufacturers frequently update their products and services. Such frequent investments often hurt the margins and profitability of the industry participants. The lingering effects of supply-chain constraints might continue weighing on the profitability of several industry participants. The shortage of skilled workers in the United States is another persistent concern for the industry.

Stringent Government Regulations: Strong demand for pollution abatement technologies and services across manufacturing plants, owing to their adherence to industrial regulatory compliances, has been benefiting industry participants. Europe has some of the strictest pollution control laws in place. The heightened focus on climate change across the globe is also expected to create business opportunities for the industry players. Solid demand for medical, pharmaceutical and hazardous waste management services is also boosting the prospects of some industry participants.

Zacks Industry Rank Indicates Gloomy Prospects

The Zacks Pollution Control industry, housed within the broader Zacks Industrial Products sector, currently carries a Zacks Industry Rank #164. This rank places it in the bottom 34% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Underperforms Sector & S&P 500

Over the past year, the Zacks Pollution Control industry has underperformed the Zacks S&P 500 composite index and the broader Industrial Products sector.

Over this period, the industry has gained 7.6% compared with the broader sector and the S&P 500 Index’s growth of 14.5% and 26.1%, respectively.

One-Year Price Performance

Industry's Current Valuation

Based on forward P/E (F12M), a commonly used multiple for valuing pollution control stocks, the industry is currently trading at 25.35X compared with the S&P 500’s 21.44X. It is also above the sector’s P/E (F12M) ratio of 18.12X.

Over the past five years, the industry has traded as high as 33.02X, as low as 19.93X and at the median of 25.45X, as the chart below shows:

Price-to-Earnings Ratio vs SP500

Price-to-Earnings Ratio vs Sector

3 Pollution Control Stocks to Keep a Close Eye On

Tetra Tech: Headquartered in Pasadena, CA, the company is a leading provider of consulting, engineering, program management and technical services. It serves clients by providing cost-effective and innovative solutions for dealing with the fundamental needs for water, environmental and alternative energy services. The U.S. government’s priorities on infrastructure development and its focus on climate change, water and environment are likely to benefit TTEK in the quarters ahead. Tetra Tech boasts a strong pipeline of projects on clean energy, environmental services and decarbonization.

This Zacks Rank #2 (Buy) company’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 11.1%. The Zacks Consensus Estimate for TTEK’s 2024 earnings has been revised upward by 2.1% in the past 60 days. The stock has gained 31% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

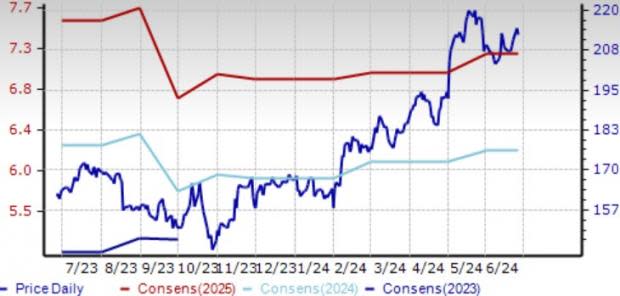

Price and Consensus: TTEK

Donaldson: Based in Bloomington, MN, the company is engaged in the manufacturing and selling of filtration systems and replacement parts across the world. DCI is well-positioned to benefit from its focus on innovation, growth investments and a healthy demand scenario in the quarters ahead. Continued strength in dust collection sales and power generation verticals within the industrial filtration solutions business bodes well for the company. Recovery in Disk Drive demand is boosting the Life Sciences segment. The acquisitions of Univercells Technologies and Isolere Bio, which have strengthened DCI’s Life Sciences segment, are expected to boost its top line.

Donaldson’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters and matched the same once, the average surprise being 6.2%. The consensus estimate for its fiscal 2024 (ending July 2024) earnings has increased by 2.7% in the past 60 days. This Zacks Rank #3 (Hold) company has gained 15.8% in the past year.

Price and Consensus: DCI

Atmus Filtration: Headquartered in Nashville, TN, the company is a leading designer and producer of filtration solutions primarily in North America, Europe and Asia. Atmus Filtration’s leading position in the industrial filtration market, effective pricing actions and sound capital allocation strategy are expected to support its growth. Its investments in manufacturing capacity to improve automation and provide its customers with industry-leading products should bolster growth.

Atmus Filtration’s earnings surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 15.6%. The consensus estimate for ATMU’s 2024 earnings has inched up 0.9% in the past 60 days. Shares of this Zacks Rank #3 company have rallied 27.4% in the past year.

Price and Consensus: ATMU

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

Atmus Filtration Technologies Inc. (ATMU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance