3 Stocks You Should Not Avoid Despite Their Layoff Announcements

U.S. companies are witnessing waning demand for their products and services as high inflationary pressure and rising interest rates have been hurting consumer spending. Moreover, the ongoing Russia-Ukraine war has further increased worries for investors about a global economic recovery.

As a result, companies across various industries, including technology, retail, and media have either initiated layoffs or stalled hiring in the wake of a looming recession. Over the past few months, tech behemoths like Meta Platforms META, Amazon AMZN and Salesforce CRM have announced their layoff plans.

Though a workforce-trimming strategy might hurt employer brand and employee morale, it is often a necessary evil that companies consider adopting to stay afloat during turbulent times. The layoffs announced by the aforementioned companies do not mean that they are in bad shape. These organizations are leaders in their respective niches. Therefore, it is wise to keep holding these stocks despite their unpopular workforce-trimming initiatives.

Let us see why the three stocks could rebound once the macroeconomic and geopolitical headwinds subside.

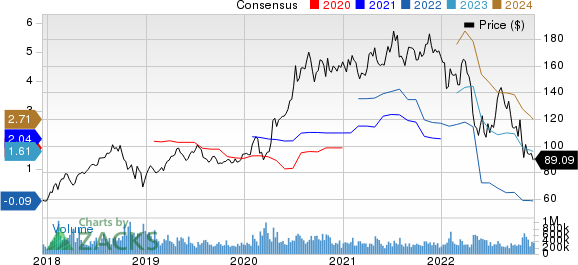

Meta Platforms: In early November, the social media giant announced its plan to trim the global workforce count by 13%. The announcement came after the company reported dismal results for third-quarter 2022 wherein adjusted earnings plunged 49% and missed the Zacks Consensus Estimate as well. Revenues managed to surpass the consensus mark but decreased 4.5% year over year.

Meta is facing its worst downfall in many years, suffering from challenging macroeconomic conditions, which are affecting its advertising spending. Unfavorable forex, targeting and measurement headwinds due to Apple’s iOS changes, normalization of e-commerce after the pandemic peak and higher inflation are hurting Meta’s financials.

However, it does not mean that investors should offload META stock. The company has carved out a lucrative niche in the realm of social networking market. Meta has taken measures to drive penetration in emerging markets of South East Asia, Latin America and Africa.

Of all places, India deserves special mention in terms of user growth. The world’s second-largest populated country offers tremendous potential for the company. With China off the radar, India can prove to be a terrific growth engine for Meta. This is primarily due to a burgeoning well-educated middle class, increasing spending power and rapid adoption of smartphones in the country. Meta’s investment in Reliance Jio is a step toward gaining a significant footprint in the country.

Moreover, once the global macroeconomic and geopolitical headwinds subside, the company is likely to witness a strong rebound in advertising revenues, given its dominance in the social media market.

Additionally, Meta is heavily investing in artificial intelligence (AI) technology, which will help build the metaverse as a commercial virtual reality (VR) independent of the real world. The move will also help this Zacks Rank #3 (Hold) company diversify its business and move away from being just a mere social media platform provider. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

VR technology is fast emerging as a lucrative business opportunity in which the company plans to invest more than $3 billion in the next 10 years. The company is investing heavily in developing a VR content ecosystem. The launch of VR headset, Rift and Oculus Quest, its first all-in-one headset with no wires and full freedom of movement, is a step forward toward that goal. The company also announced a multi-year partnership with Rayban-parent EssilorLuxottica. The two companies, in collaboration, released a pair of Ray-Ban branded smart glasses in 2021. Meta also unveiled Project Aria, which will help it develop the first generation of wearable AR devices.

The drastic decline in the share price has made the stock even more lucrative to hold on to for solid long-term gains. META stock has plunged 65.6% year to date and is currently trading at 67.1% lower than its 52-week high of $352.71. Moreover, the stock currently trades at a forward 12-month P/E multiple of 14.87, significantly lower than the one-year high of 24.96.

Meta Platforms, Inc. Price and Consensus

Meta Platforms, Inc. price-consensus-chart | Meta Platforms, Inc. Quote

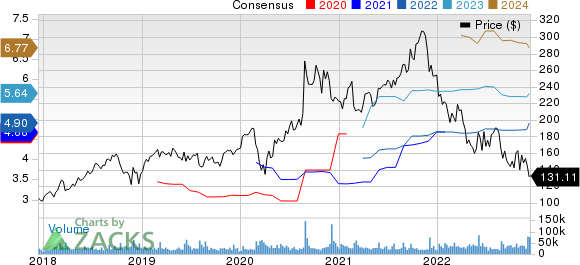

Amazon: Headcount reduction at the world’s largest e-commerce company has already started and the company’s CEO Andy Jassy stated in mid-November that layoffs would continue in the coming year too. This Seattle-based Zacks Rank #3 company reportedly intends to lay off about 10,000 employees across the entire company.

Amazon’s move can be seen as rightsizing of workforce as the company had hired rapidly and expanded aggressively during the pandemic when people were needed to shop online only amid the lockdowns and social distancing measures. With the reopening of economies around the world, revenue growth of the e-commerce company has slowed down. Therefore, the headcount reduction strategy will help it in maintaining profitability.

Additionally, the company’s strategy of diversifying its business across multiple areas, including smart devices and cloud infrastructure markets, will drive growth over the long run. Amazon’s Alexa-powered Echo devices are going great guns and helping the company sell products and services. Artificial intelligence driven Alexa has already been integrated into a host of everyday devices for the digital home, which has converted the nascent smart home market into a potential area of growth in a very short time. Moreover, the company is benefiting from an increasing number of Alexa compatible smart devices.

Furthermore, Amazon is the leading provider of cloud infrastructure as a service to enterprise customers. The expanding customer base of Amazon Web Services, driven by its strengthening cloud offerings, will continue to aid Amazon's dominance in the global cloud space. Even more encouraging is the fact that AWS generates much stronger margins than the traditional retail business, which should remain a positive for the company’s profitability as it continues to grow in the mix.

A YTD decline of 46.6% in share price also makes Amazon a lucrative stock to hold on for long-term potential gains. Moreover, the stock is trading 48.8% lower than its 52-week high of $174.17. Additionally, it trades at forward 12-month P/E multiple of 58.64, significantly lower than the one-year high of 84.13.

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Salesforce: This cloud-based software solution provider revealed in early November that it has cut hundreds of jobs but claimed that the number is less than a thousand. However, a report by the online media company, Protocol, suggests that Salesforce’s job cut initiative would have affected as many as 2,500 workers.

The company’s move could be in the wake of slowing down sales growth. In the latest reported quarterly results, the company reported revenue growth of around 14%, much less than the percentage growth in 20s or more witnessed over the past several quarters.

We believe that macroeconomic headwinds are taking a toll on Salesforce’s financial results. Enterprises are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues as evident from Gartner’s latest report on IT spending. The research firm’s report highlights that 2022 IT spending growth will be much slower than 2021 due to spending cutbacks across devices, software, IT services and communication services areas.

However, we believe that organizations will accelerate digital transformation and invest aggressively in adopting cloud-based solutions once the macroeconomic headwinds subside.

Additionally, Salesforce headcount reduction plan could also be seen as a measure to reduce costs amid mounting pressure from activist investors to improve profitability. In October 2022, activist investor Starboard Value revealed buying a significant stake in Salesforce and advocated for an increased profit through cutting costs.

Considering the company’s long-term growth potential along with efforts to improve profitability by reducing costs, it is advisable to investors to stay invested in this Zacks Rank #3 stock for long-term gains. Additionally, the stock has lost 48.4% of its market value YTD and currently trades 51.5% lower than the 52-week high of $270.56. Moreover, it trades at a 12-month P/E multiple of 23.67, significantly down from the one-year high of 120.70.

Salesforce Inc. Price and Consensus

Salesforce Inc. price-consensus-chart | Salesforce Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance