Savers pile cash into Isas ahead of Labour landslide

Savers have piled a record amount into tax-free Individual Savings Accounts (Isas) amid fears of a Labour landslide.

The amount stashed into cash Isas soared £1bn year-on-year to hit £4.2bn – the biggest influx ever recorded in May.

It comes after Prime Minister Rishi Sunak announced the summer general election on May 22, with Labour now well ahead in the polls and feared to win a “supermajority”.

Experts said the flood of money into tax-free wrappers showed savers were looking for ways to protect their cash from a new government – and any possible tax changes.

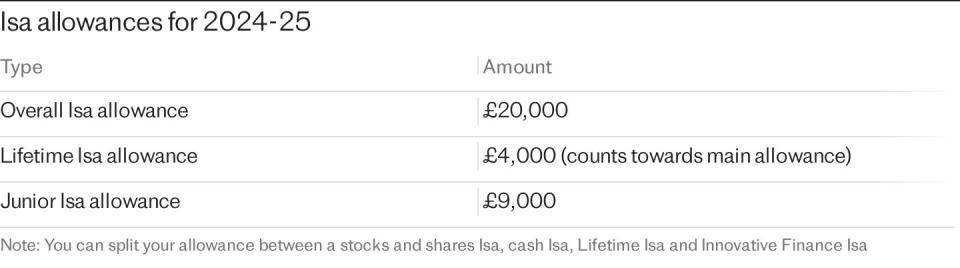

Cuts to the Isa allowance and also the personal savings allowance are among the options open to Labour.

The Resolution Foundation, a think tank, has previously urged the Government to cap the amount that can be saved into an Isa at £100,000. Its leader, Torsten Bell, is now the Labour candidate for Swansea West.

Savers can pay £20,000 per year, but there is currently no limit on how much they can stash away over their lifetime. The Resolution Foundation argued this mainly benefits those with high levels of disposable income.

Returns on cash Isas do not trigger a tax bill, but tax can be owed on interest earned from ordinary savings accounts if it exceeded the personal savings allowance.

The allowance is £1,000 for basic-rate taxpayers and £500 for those in the higher-rate band. Additional-rate taxpayers get no allowance.

Yet frozen tax thresholds have dragged millions into higher tax brackets, slashing their personal saving allowance dramatically.

At the same time, the average rate of an easy-access savings account has leapt from 2.21pc to 3.12pc over the last year.

Sarah Coles, of investment service Hargreaves Lansdown, said: “The general election has meant a great deal of talk about taxes, and whether or not they will rise after the election.

“So far, no party has mentioned the personal savings allowance, and it would be a particularly tricky change to make because it’s so popular and so commonly used. However, savers won’t want to take any chances, and may well be protecting their allowance ahead of the election.”

Higher interest rates have also driven savers to max out their Isa allowance.

Ms Coles added: “Savers were tempted to tie up their annual allowance while rates were so generous.”

After offering measly rates for years, the top cash Isas now provide returns of around 5pc.

Shaun Moore, of wealth manager Quilter, said: “For many years due to low interest rates, [the personal savings allowance] was not a problem for most people unless they had vast cash savings but now many more people might find they end up having to pay tax without seeking the safety of the Isa.”

As a result, people are expected to pay a record-breaking £10.3bn in tax on their savings in 2024-25, according to HM Revenue and Customs – up about £1bn since last year.

Labour was contacted for comment.

Yahoo Finance

Yahoo Finance