3 Stocks on the Verge of Breaking Out

In choppy markets, combining technical and fundamental strength becomes paramount. Below are 3 stocks that hold these characteristics and are on the verge of breaking out:

DXCM

Dexcom (DXCM) is a medical device company that designs and develops continuous glucose monitoring (CGM) systems. CGMs are for ambulatory use by people with diabetes and by healthcare providers for the treatment of diabetic and non-diabetic patients.

Unique Product Leads to Strong Growth

Dexcom’s unique monitoring system is used to continuously measure a patient’s blood glucose level and transmit that information to a small cell phone-sized receiver in real-time. Though the blood glucose monitoring Dexcom is highly competitive, DXCM is the leader. Last quarter, EPS grew 113% year-over-year on revenue growth of 18%.

Image Source: Zacks Investment Research

The company’s EPS of $0.17 beat Zacks estimates of 15 cents by 13.3%. The positive surprise was nothing new. DXCM has a strong history of beating estimates – in 17 out of the last 19 quarters, the company has surprised to the upside.

Image Source: Zacks Investment Research

“The Longer the Base, The Higher in Space”

A stock that has sound fundamentals and breaks out from a long base can produce robust results. DXCM fits the criteria – the stock is emerging from a consolidation dating back to October 2022. Should the breakout hold, expect fireworks to the upside in the coming weeks.

Image Source: Zacks Investment Research

With diabetes rates increasing in the U.S. and worldwide, DXCM should benefit from solid healthcare tailwinds.

RMBS

Rambus (RMBS) is an industry-leading chip producer. The company’s chips are used for interface, memory, security, and display architectures for computing, gaming, graphics, and more.

Strong Industry

From a performance, growth, and price performance perspective, the leading industry in the stock market today is the chip sector. Though Rambus may get less attention than Advanced Micro Devices (AMD) or Nvidia (NVDA), the company has strong growth and even more robust price and volume action.

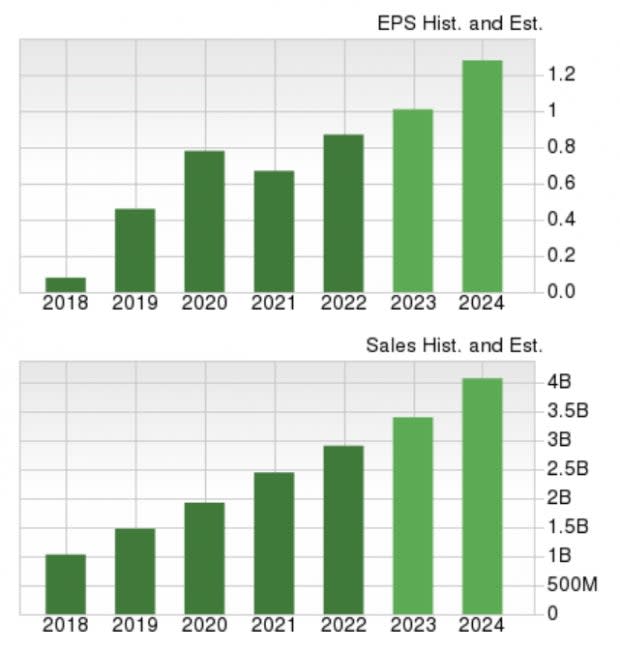

Fundamentals

RMBS has grown top and bottom-line results at a double-digit clip for several quarters in a row, and the stock’s strong Zacks #2 (Buy) ranking suggests that may continue.

Price & Volume

The most intriguing part of RMBS is its strong price and volume action. RMBS has been hugging the 50-day moving average for all of 2023. The recent post-eps pullback and subsequent rebound off the 50-day moving average is a golden opportunity, in my opinion.

Image Source: Zacks Investment Research

VIPS

Zacks Rank #1 (Strong Buy) stock Vipshops (VIPS) is China’s third largest e-commerce platform. Vipshops benefits from the massive market it serves (300 million customers) and the many companies it counts as partners (more than 20,000).

The End of China’s Zero-Covid Policy

China had one of the most stringent COVID-19 lockdown policies in the entire world. In fact, at times, Chinese President Xi was willing to allow the Chinese economy to come to a screeching halt to tamp down coronavirus cases. Throughout this time, Vipshops and most other Chinese companies suffered. However, in the past three quarters, VIPS has turned around its EPS picture and has grown EPS by 12%, 55%, and 27%. Despite the widely publicized reopening of the Chinese economy, analysts seem slow to change course. VIPS has delivered positive surprises in four straight quarters, including big beats of 42.31% and 33.33%.

Image Source: Zacks Investment Research

Finally, it appears that analysts are catching on to Vipshop’s renewed growth trajectory. In the past seven days, Zacks Consensus Estimates for 2023 and 2024 have been revised higher.

Technical View

When searching for a monster stock, two of the most powerful traits to look for are a strong uptrend and relative strength. VIPS holds both of these characteristics. Over the past year, the stock is up 91.1% while the S&P 500 Index is +2.9% - impressive when considering the volatility that occurred in global markets.

Image Source: Zacks Investment Research

The stock has been consolidating for the past five months and is pulling into the rising 50-day moving average – an attractive reward-to-risk zone. VIPS is scheduled to report earnings Wednesday.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Rambus, Inc. (RMBS) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Vipshop Holdings Limited (VIPS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance