3 Swedish Dividend Stocks Offering Yields From 3.6% To 5.9%

As global markets navigate through fluctuating inflation rates and interest rate adjustments, Sweden's market offers a unique blend of stability and opportunity. This environment sets the stage for considering dividend stocks, which can be appealing for those seeking potential income streams in a landscape marked by cautious monetary policies and economic indicators.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.28% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.65% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.58% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.13% | ★★★★★☆ |

Duni (OM:DUNI) | 4.41% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.59% | ★★★★★☆ |

AQ Group (OM:AQ) | 4.70% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.38% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.04% | ★★★★★☆ |

Husqvarna (OM:HUSQ B) | 3.33% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

AQ Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AQ Group AB operates as a manufacturer and seller of components and systems for industrial customers across Sweden, other European countries, and internationally, with a market capitalization of SEK 12.97 billion.

Operations: AQ Group AB generates its revenue primarily through two segments: Components, which brought in SEK 7.89 billion, and Systems, contributing SEK 1.87 billion.

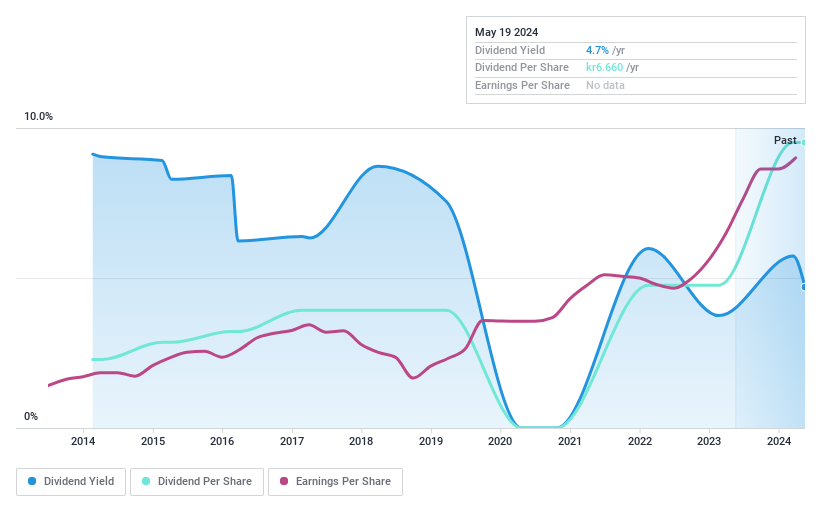

Dividend Yield: 4.7%

AQ Group AB, a Swedish company, recently increased its dividend to SEK 6.66 per share and has maintained a consistent dividend growth over the past decade. Despite this growth, the dividends have shown volatility and unreliability in their distribution patterns. The company's current payout ratio stands at 18.5%, indicating that dividends are well covered by earnings, with a cash payout ratio of 78.8%. Additionally, AQ Group is actively seeking acquisitions to bolster its market position, supported by strong quarterly earnings growth of 38.7% and low net debt, enhancing its financial flexibility for future expansion and shareholder returns.

Click to explore a detailed breakdown of our findings in AQ Group's dividend report.

Upon reviewing our latest valuation report, AQ Group's share price might be too optimistic.

Softronic

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) specializes in providing IT and management services mainly in Sweden, with a market capitalization of approximately SEK 1.19 billion.

Operations: Softronic AB generates its revenue primarily through computer services, totaling SEK 834.42 million.

Dividend Yield: 6%

Softronic has demonstrated a mixed performance in dividend sustainability. While its dividend yield of 5.99% ranks high within the Swedish market, the coverage by earnings at a payout ratio of 86.6% and especially cash flows with a cash payout ratio of 138% indicates potential pressure on future payouts. Despite this, dividends have increased over the past decade but have experienced significant volatility. Recent financials show a slight decline in sales and net income, which could impact its ability to maintain current dividend levels.

Zinzino

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company based in Sweden, specializing in dietary supplements and skincare products, with a market capitalization of approximately SEK 2.80 billion.

Operations: Zinzino AB generates its revenue primarily through two segments: Faun and Zinzino (including VMA Life), with revenues of SEK 159.76 million and SEK 1.68 billion, respectively.

Dividend Yield: 3.6%

Zinzino has shown robust financial performance with a significant revenue increase in recent months, reflecting a 20% growth from January to April 2024. The company offers a stable dividend yield of 3.65%, which is modest compared to top Swedish dividend stocks but is well-supported by both earnings and cash flow, with payout ratios of 62.1% and 43.6% respectively. Despite trading at 57.5% below its estimated fair value, the dividend has grown consistently over the past decade, underscoring reliability in shareholder returns amidst its growing profitability.

Summing It All Up

Access the full spectrum of 23 Top Dividend Stocks by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AQ OM:ZZ B

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance