3 Tech Stocks to Buy for Income and Growth: ROP, MU, GOOGL

When thinking of dividends, many investors commonly gravitate toward real estate investment trusts (REITs) and stocks within the consumer staples, utilities or finance sectors. These common targets are known for their dividend-paying natures, whereas technology companies often get overlooked.

But many technology companies reward their shareholders with dividend payouts, including Roper Technologies ROP, Micron Technology MU, and Alphabet GOOGL. In addition to quarterly payouts, all three sport bullish growth expectations, undoubtedly a strong pairing.

For those interested in a blend of growth and income, let’s take a closer look at each.

Roper Technologies Shares up 6% in a Month

ROP shares haven’t fared well year-to-date but have jumped back into favor over the last month, gaining 6% compared to a 2% decline from the S&P 500. The company’s quarterly consistency has been remarkable, exceeding both earnings and revenue expectations in seven consecutive quarters.

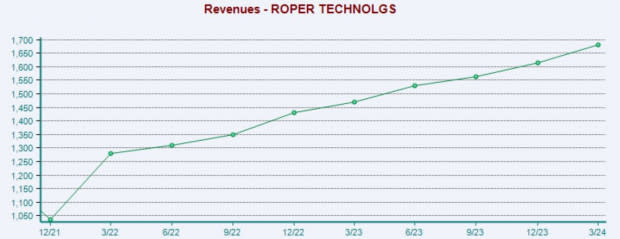

Sales growth has been robust, with ROP posting double-digit percentage year-over-year sales growth rates in each of its last six periods. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

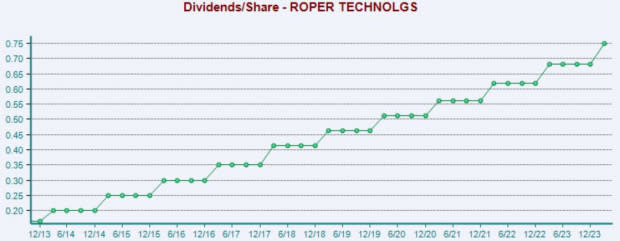

Shares currently yield a modest 0.5% annually, undoubtedly on the lower end of the spectrum. Still, the company’s 10.2% five-year annualized dividend growth rate reflects a notable commitment to increasingly rewarding shareholders.

Image Source: Zacks Investment Research

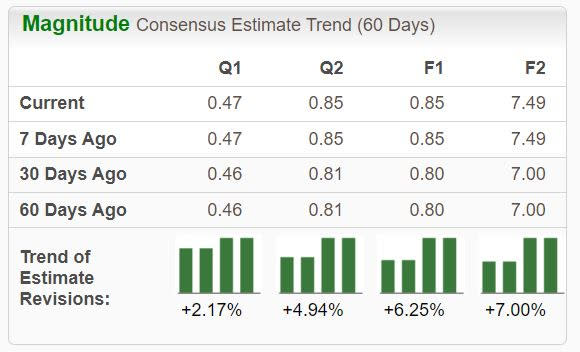

Keep an eye out for the company’s next quarterly release scheduled for mid-July, as consensus expectations presently allude to a 7.8% growth in earnings on 12% higher sales. Revenue expectations have modestly increased by +0.6% since mid-March.

Image Source: Zacks Investment Research

Micron Technology Expected to See Robust EPS Growth

Micron shares have been remarkably strong in 2024, gaining nearly 60% and widely outperforming on the back of the bullish semiconductor trade fueled by the AI boom. The company recently enjoyed a strong quarter, with revenue, gross margin, and EPS results all exceeding prior guidance.

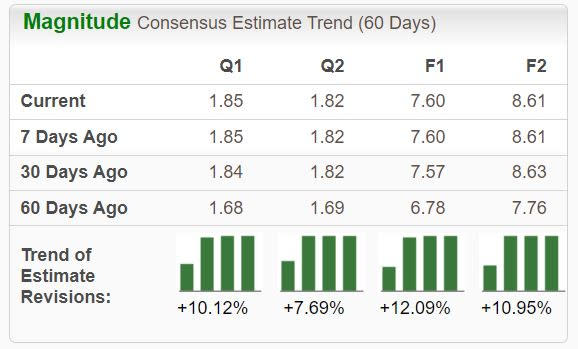

MU has enjoyed favorable earnings estimate revisions following the results, landing the stock into a Zacks Rank #2 (Buy). Strong AI server demand has analysts optimistic.

Image Source: Zacks Investment Research

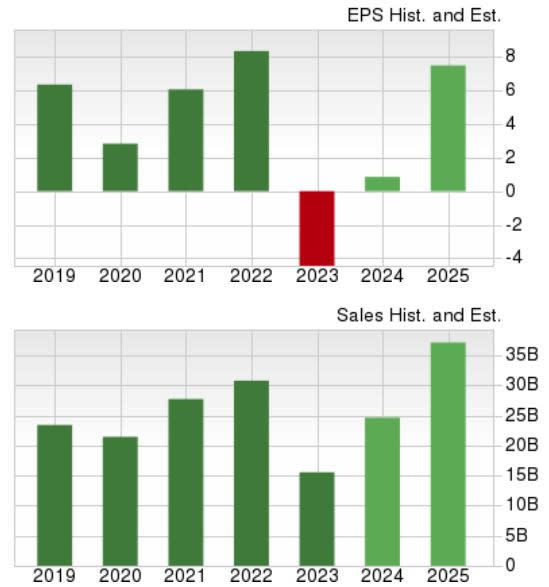

Shares yield a modest 0.3% annually, beneath the respective average of the Zacks Computer and Technology sector. The company has delivered two upgrades to the quarterly payout over the last five years, reflective of a shareholder-friendly nature.

In addition, Micron is expected to return to its growth nature in its current fiscal year, with current consensus expectations alluding to 120% growth in earnings on 60% higher sales. Peeking ahead to FY25, estimates suggest an additional 780% pop in earnings on 50% higher revenues.

Image Source: Zacks Investment Research

Alphabet Starts Quarterly Dividend Payouts

Enjoying a spot in the beloved ‘Mag 7’ group, Alphabet shares have been strong year-to-date, gaining 25% compared to a 7% move in the S&P 500. The stock continues to hold a Zacks Rank #1 (Strong Buy), with analysts bullish following consistently strong quarterly results.

Image Source: Zacks Investment Research

The company positively shocked investors when it announced the initiation of a quarterly dividend back in April, just like what we saw with Meta Platforms. Alphabet’s cash-generating nature allows for future dividend growth, with the company posting $16.8 billion in free cash flow throughout its latest period.

And to little surprise, the mega-cap giant remains firmly in growth mode, as consensus expectations suggest a 31% pop in earnings on 15% higher sales in FY24. Growth spills over to FY25, with earnings and revenue forecasted to climb 13% and 12%, respectively.

Image Source: Zacks Investment Research

Bottom Line

Dividend-paying stocks don’t always have to be ‘boring’ as many high-growth technology companies also reward their shareholders with quarterly payouts.

And for those interested in a blend of income and growth, all three stocks above – Roper Technologies ROP, Micron Technology MU, and Alphabet GOOGL – fit the criteria.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance