Questor: Investors aren’t happy with this company’s strategy, but should stay patient

It is fair to say that last week’s strategic update from Legal & General is going down like a rattlesnake in a lucky dip with investors, and as a result much of our (paper) capital gain is ebbing away.

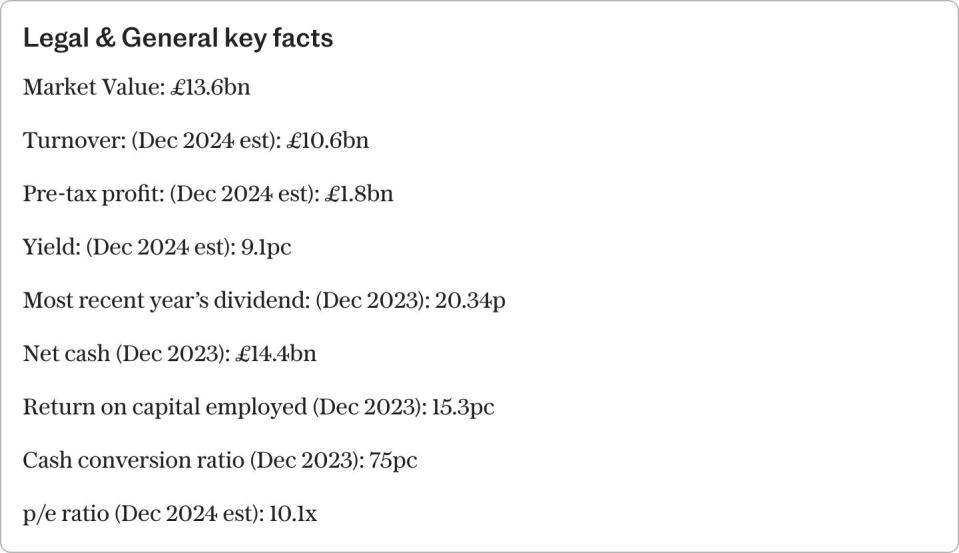

However, we are still holding a stock where the forecast dividend looks safe and well backed by both the balance sheet and cash flow, so the prospective yield of 9.1pc seems more than enough justification to stay patient, especially for those investors who are seeking income.

On the face of it, Legal & General’s refined strategy seems perfectly sensible. New chief executive officer António Simões is focusing the life insurance and investment giant on three core divisions, selling non-core assets such as its housebuilder Cala, and seeking to enhance shareholder returns through dividend growth and share buybacks.

This column is particularly pleased to see an emphasis on pension risk transfers for workplace pension schemes as our initial investment thesis of last summer is at least partially based upon this being a growth driver for the FTSE 100 member over the long term.

However, the share price reaction has been one of disappointment, especially after a five-month build-up to the announcement.

This may be because the sale of Cala had already been anticipated, thanks to rumours that Persimmon (PSN) for one was an interested buyer, and it may be because there was nothing to match the break-up enacted by Prudential (PRU) over the past few years. Perhaps, most tangibly, the goal to grow the dividend by 2pc a year and supplement that this year with a £200 million share buyback, is the source of investor discontent, as Legal & General’s prior target had been to grow its dividend at a compound rate of 5pc, for the period of 2020 to 2024.

The idea is to generate compound earnings growth of 6pc to 9pc a year out to 2027, and that should support the dividend growth plan. Even the revised trajectory for the shareholder distribution leaves the stock on a yield of more than 9pc, and Legal & General has the regulatory surplus capital and balance capital to back up such a figure.

As such, we shall simply sit tight and await the next update due from the company, which will come in the form of the half-year results for 2024 on August 7.

Questor says: hold

Ticker: LGEN

Share price at close: 228p

Update: Crest Nicholson

Last week’s first-half results from housebuilder Crest Nicholson (CRST) were poor, as they prompted a rash of downgrades and added to the impression that the housebuilder simply cannot get out of its own way.

Martyn Clark, Crest Nicolson’s new chief executive, may at least be setting a low bar for expectations as they get ready to start cleaning house. And with the stock looking cheap on an asset basis, we will stick with it – especially as the all-paper offer from rival, and fellow portfolio holding Bellway (BWY), suggests that if Crest Nicholson cannot get its own act together then someone will do it for them.

Analysts have dashed to cut their earnings forecasts by more than a third for this financial year, to October 2024, and by more than a quarter for fiscal 2025, in light of ongoing issues at legacy sites and low-margin sales on newer estates.

These issues, coupled with lower completions thanks to higher interest rates and mortgage costs, hammered earnings and also led to an expected dividend cut in the first half of the current fiscal year.

Investors were also spooked by management’s candid comment that sales per outlet per week had softened once more. Yet rate cuts from the Bank of England will surely come at some stage and that should help to lower mortgage costs and give a boost to the building industry. The latter seems to be an area of focus for both Labour and the Conservatives, so Government support remains a possibility regardless of who prevails on July 4.

Crest Nicholson has very little debt, so it should be able to withstand this difficult trading period without undue stress on its balance sheet, while its shares are the cheapest in the building sector on the basis of its assets: even Bellway’s 253p-a-share offer values them at slightly more than 0.8 times historic book value per share.

The latest mishaps may justify this, but the lowly valuation could also provide upside potential if the company can get its house in order.

Questor says: hold

Ticker: CRST

Share price at close: 248p

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance