3 Top Stocks Wall Street Is Overlooking

The stock market has been on a once-in-a-generation run. The Nasdaq Composite Index, for instance, is up 425% since March 2009. While that has been great for investors, it leaves those with money to put in the market in a tough situation. "Where are the deals today?" they may wonder.

There's no way we can answer that question with 100% certainty, but our Motley Fool investors believe they have found three stocks that Wall Street is seriously overlooking. Read on to see why Ormat Technologies (NYSE: ORA), Bitauto (NYSE: BITA), and IBM (NYSE: IBM) are all stocks to get on your radar before Wall Street catches on.

Wall Street may have overlooked these three, but we haven't. Image source: Getty Images

An alternative investment in renewable energy

Tyler Crowe (Ormat Technologies): So much of the talk around renewable energy has to do with wind and solar. That's not too surprising when you consider that the two have grown at breakneck speeds in recent years and dominate the fossil fuel vs. renewables conversation. One of the challenges of investing in wind and solar, though, is that the two are incredibly cyclical businesses that suffer from the commoditization of technology. Granted, there are some good investments in this industry, but they are few and far between.

One renewable energy investment that doesn't get much attention is geothermal energy -- using the natural heat of the earth below the ground. This isn't a huge industry because it is very limited by geography. Where it can be used, though, it is a consistent, low-cost power source that can be quite profitable. That's where Ormat Technologies comes in. Ormat is an interesting investment because it is an engineering and construction company that specializes in building geothermal plants, and it also owns several geothermal power plants around the world.

The construction business is incredibly lumpy, but the nature of geothermal power makes it a stable source of revenue with relatively high margins. According to Ormat's most recent earnings report, the electricity segment of the business had gross margins above 40%. Management has plans to increase total electric power production 48% between now and 2022, which will give the company a large, steady stream of high-margin revenue to reinvest in its newest venture: Building and operating battery storage as service facilities for utility companies.

There are some really interesting things going on at Ormat Technologies that should produce results over the next five to 10 years. Perhaps now is a time to take a look at this stock before Wall Street catches on to what is going on here.

Powering a booming Chinese auto market

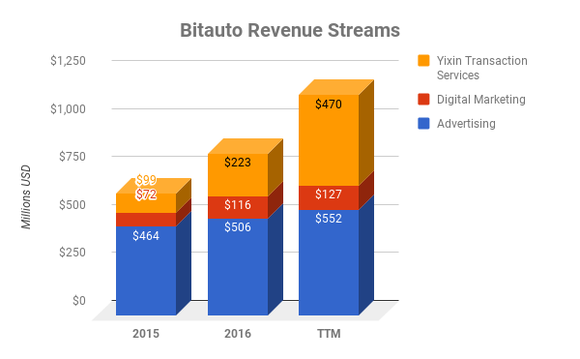

Brian Stoffel (Bitauto): When it got its start, Bitauto was primarily concerned with helping Chinese car dealers create their own virtual showrooms and run advertising campaigns. It also sold ad space to help bring in more revenue.

But starting in 2015, the company made a concerted effort to expand into auto lending and financing. By providing a platform to connect auto buyers, dealers, and financiers, Bitauto is growing via the network effect: With each additional auto buyer joining the site, dealers and financiers are incentivized to join, which further encourages others to participate.

The subsidiary responsible for this platform -- Yixin Capital -- recently went public on the Hong Kong market. As you can see, it has performed exceptionally well.

Data source: SEC filings. Chart by author.

So far, however, Wall Street can't decide what to make of this. The stock was up as much as 170% in early November. But it has since fallen 25%. While some are undoubtedly frustrated at the company's widening GAAP loss in the most recent quarter, most of that had to do with options granted to the growing Yixin subsidiary.

If we back those factors out, we have a stock with only three analysts covering it, growing non-GAAP net income by 67%, and trading for just 20 times expected (non-GAAP) earnings.

A languishing tech stock

Tim Green (International Business Machines): Even after a solid earnings report and guidance calling for an end to a five-year streak of slumping revenue, the market still isn't giving IBM any credit. IBM has been transforming itself for years, investing in areas like cloud computing, analytics, and artificial intelligence while shifting resources away from legacy businesses tied to declining markets. These efforts have been painful for investors, but it now looks like there's a light at the end of the tunnel.

IBM expects its fourth quarter to be stronger than last time around to the tune of a few hundred million dollars. That translates into year-over-year growth for the first time in 22 quarters. This growth will be driven by the launch of a new mainframe system and the continued growth of IBM's newer businesses. About 45% of IBM's revenue over the past 12 months came from what it calls "strategic imperatives," a category growing at a 10% clip.

Despite this progress, IBM stock is still languishing. Shares trade for just 11 times the company's adjusted earnings guidance for this year, and they sport a 4% dividend yield. It may take a string of solid quarterly reports for the market to wake up, but by that time it might be too late to lock in a bargain price.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Brian Stoffel owns shares of Bitauto Holdings. Timothy Green owns shares of IBM. Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance