3 US Growth Companies With High Insider Ownership And Up To 96% Earnings Growth

Over the past year, the United States stock market has experienced a robust increase of 21%, though it remained flat in the last week. In this context, growth companies with high insider ownership can be particularly compelling as they often indicate confidence from those who know the company best, aligning well with forecasts of significant earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.6% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Let's uncover some gems from our specialized screener.

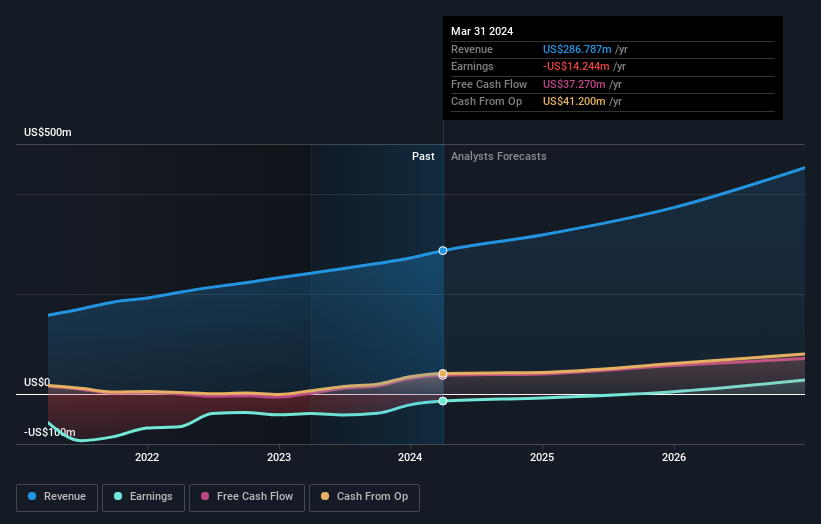

AvePoint

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. operates a cloud-native data management software platform across North America, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately $1.68 billion.

Operations: The company generates its revenue primarily through its software and programming segment, which amounted to $286.79 million.

Insider Ownership: 37.2%

Earnings Growth Forecast: 96.8% p.a.

AvePoint, with substantial insider buying over the past three months, indicates strong confidence from those closest to the company. Despite trading at 68.7% below its estimated fair value and a forecast for revenue growth at 16.5% per year—outpacing the US market—challenges remain, such as a low forecasted Return on Equity of 14.7%. Recent financials show improvement with a reduced net loss of US$1.72 million from US$9.2 million year-over-year and guidance suggesting continued revenue growth up to US$320.3 million annually by end of 2024.

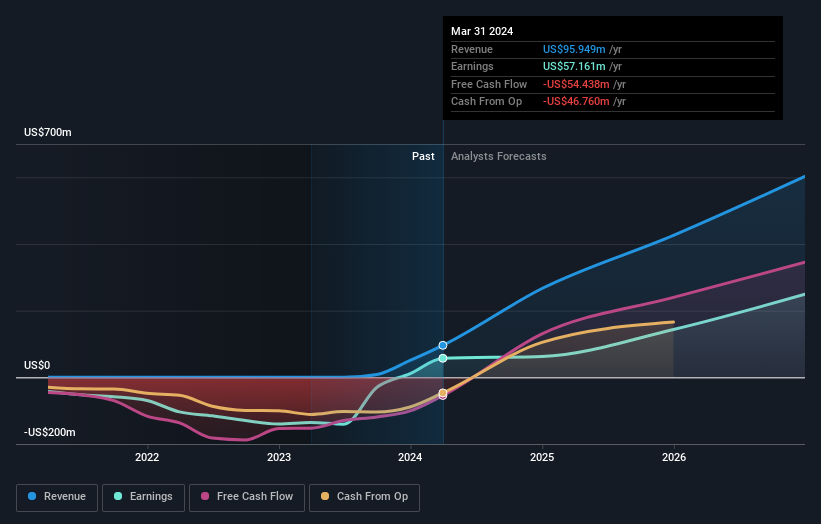

Krystal Biotech

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company based in the United States that focuses on discovering, developing, and commercializing genetic medicines for rare diseases, with a market capitalization of approximately $5.08 billion.

Operations: The company generates its revenues primarily from the development and commercialization of genetic medicines for rare diseases.

Insider Ownership: 11.7%

Earnings Growth Forecast: 37% p.a.

Krystal Biotech, recently profitable with a Q1 net income of US$0.932 million after a significant loss the previous year, is poised for substantial growth with expected annual earnings and revenue increases outstripping market averages significantly. Despite trading at 63.6% below its estimated fair value and experiencing shareholder dilution over the past year, the company's high insider ownership and aggressive conference presentations underscore confidence in its strategic direction, including advancements in cancer treatment therapies like the FDA Fast Tracked KB707.

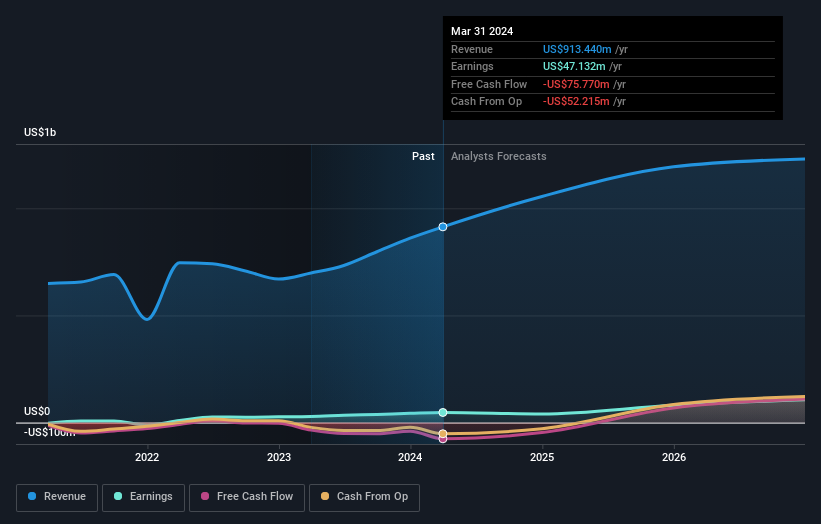

VSE

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VSE Corporation, operating in the United States, is a diversified aftermarket products and services company with a market capitalization of approximately $1.52 billion.

Operations: The company's revenue is generated from two primary segments: Fleet, which contributes approximately $320.27 million, and Aviation, accounting for about $593.17 million.

Insider Ownership: 12.7%

Earnings Growth Forecast: 32.7% p.a.

VSE Corporation, despite a recent net loss of US$6.61 million and executive resignations, is actively engaging the investment community with multiple conference presentations. The company completed a follow-on equity offering raising US$150 million, suggesting confidence in its strategic initiatives. Forecasted to grow earnings by 32.72% annually, VSE trades at 62% below estimated fair value, indicating potential undervaluation amidst operational challenges.

Get an in-depth perspective on VSE's performance by reading our analyst estimates report here.

Our expertly prepared valuation report VSE implies its share price may be too high.

Next Steps

Delve into our full catalog of 181 Fast Growing US Companies With High Insider Ownership here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:AVPT NasdaqGS:KRYS and NasdaqGS:VSEC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance