$33+ Billon Flavours and Fragrances Market - Global Forecast to 2026

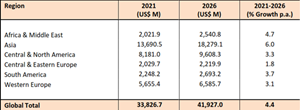

Total Global Consumption of Flavours & Fragrances by Region, 2021-2026 (US$ Millions)

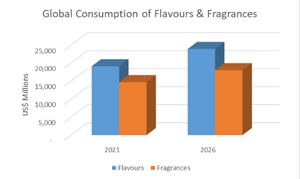

Global Consumption of Flavours & Fragrances

Dublin, Nov. 09, 2022 (GLOBE NEWSWIRE) -- The "A Global Overview of the Flavours and Fragrances Market - Full Report" report has been added to ResearchAndMarkets.com's offering

The global flavours and fragrances market has experienced some ups and downs in the past two years. The total global market reached US$33.8 billion in 2021, an increase of 4.6% compared to 2020; this was considerably higher than the growth of 1.6% achieved in 2020, when the COVID-19 pandemic impacted consumer spending. The fine fragrance category was the worst affected by the pandemic, as there were curbs on travel, retail and socialising.

The fastest growing country markets in 2021 were Bangladesh, India, Indonesia and Vietnam. These countries offer favourable conditions for flavour and fragrance market growth, including a growing middle class, rising incomes, and increasing urbanisation. Venezuela was the only country to see a decline in flavour and fragrance consumption in 2021, but growth was also slow in many mature markets.

For 2022, the analyst is forecasting a growth rate of 4.4% for the global flavours and fragrances market. Flavours are expected to fare slightly better, at 4.5% growth, compared to fragrances at 4.2%.

Of the total world market, flavours account for approximately 57% and fragrances for the remaining 43%.

An average growth rate of 4.4% per annum is expected for the flavours and fragrances market over the next five years. While the West European and North American markets are quite mature, there is still potential for growth as consumers develop more sophisticated tastes and preferences, and as natural flavours and fragrances take greater market share from their synthetic counterparts.

There is still plenty of opportunity for growth in the CEE, MEA and Asia Pacific regions, particularly in parts of Africa and Asia where access to processed foods and consumer goods is still growing. The fastest growth rates in the medium term are expected in Asia-Pacific, with a forecast CAGR of 6%.

The beverages sector was the largest global end-use market for flavours in 2021 with a share of 33%, followed by dairy and savoury/convenience foods.

The soap and detergents industry is the largest user of fragrances in the global market at 32% share, followed by the cosmetics and toiletries sector at 30%.

Givaudan, IFF, Firmenich and Symrise continue to occupy the top four positions in the global flavours and fragrances market. Their combined sales of compound flavours and fragrances in 2021 represented around 55% of the global market; this is higher than previous years due to acquisitions and mergers. The opportunity to supply packages of products to their customers has become ever more attractive for the flavour and fragrance houses, reflected in various sideways and backwards integration moves in recent years. This is exemplified by the merger of IFF and DuPont's Nutrition & Biosciences (N&B) business and the pending merger between Firmenich and DSM.

For only the second time, the analyst has also analysed flavour tonalities. The most significant tonality at the global level is citrus, accounting for 20% of demand, followed by vanilla at 14%. After vanilla come a host of tonalities with similar market shares, including brown, meat/seafood, mint, and other fruit.

This study updates and expands upon the information included in our previous study published in 2020. The information contained within this report is based upon an extensive programme of interviews throughout the industry. The report contains market value data by end-use application, with 2021 as the base year and market forecasts provided to 2026.

The research was undertaken during Q1 and Q2 2022, taking into account as much as possible the impacts of the conflict between Russia and Ukraine. Another trend is the high rate of inflation currently seen across much of the world. It is not yet clear what impact this will have for 2022 as a whole, how much of the price increase will be passed to customers, or whether volumes will decline as a result.

Several categories have been expanded or re-worked for this edition:

In Beverages: Alcoholic, Carbonated Soft, Hot, Juices & Nectars, Powdered, Specialty Soft

In Meat: Meat Alternatives

In Dairy: Dairy Alternatives

In Fine Fragrances: Unisex Fragrances

Companies Mentioned:

DSM

DuPont

Firmenich

Givauda

IFF

Symrise

For more information about this report visit https://www.researchandmarkets.com/r/nd1dll

Attachments

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance