3D Systems' (DDD) DMP Flex 350 Printer Selected by rms Company

3D Systems DDD recently announced that the largest U.S.-based medical device manufacturer, rms Company, has integrated the former’s DMP Flex 350 Dual printers into its contract manufacturing workflow.

The DMP Flex 350 Dual is the latest addition to 3D Systems’ Direct Metal Printing (“DMP”) portfolio. The printer is designed for flexible application use in research and development projects, application development or serial production.

Further, the printer features quick-swap build modules and fast powder recycling that speeds up production. It has a central server that manages print jobs, materials, settings and maintenance for 24/7 productivity.

The DMP solution will ensure an improvement in rms Company’s productivity standard by up to 50%. rms Company also expects that the integration will help it expand the types of implants it produces and accelerate throughput, thereby enabling it to cater to the evolving application needs of the medical industry.

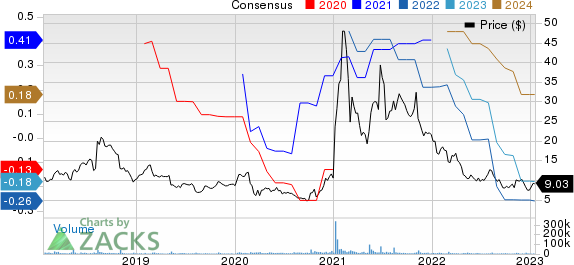

3D Systems Corporation Price and Consensus

3D Systems Corporation price-consensus-chart | 3D Systems Corporation Quote

3D Systems’ DMP Flex 350 Dual technology includes two lasers, which will enable rms Company to produce high-quality, highly reliable end-use Titanium parts for medical device applications. This will allow the company to deliver the sterilized and packaged final product for the surgical suite.

3D Systems is anticipating material science to be a key driver in the transition to 3D production. DDD is investing large sums in material innovation across its portfolio to capitalize on this trend.

Going forward, 3D Systems expects its portfolio of innovative products to drive more than 30% organic growth over the next couple of years, thereby enhancing its margins and earnings.

In September 2022, the additive manufacturer declared the formation of a wholly owned bioprinting startup, Systemic Bio, to accelerate the development of new drugs, which will aid in reducing or eliminating the need for animal testing. This is likely to expand DDD’s growth opportunities in the domain of pharmaceuticals and create a new revenue stream that could reach $100 million annually over the next five years.

Zacks Rank & Key Picks

Currently, 3D Systems carries a Zacks Rank #4 (Sell). Shares of DDD have plunged 50.9% over the past year.

Some better-ranked stocks from the broader technology sector are Paylocity Holding PCTY, Zscaler ZS and Nutanix NTNX. Paylocity sports a Zacks Rank #1 (Strong Buy) at present, while Zscaler and Nutanix each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Paylocity’s second-quarter fiscal 2023 earnings has remained unchanged at 70 cents per share over the past 60 days. For fiscal 2023, earnings estimates have moved up 47 cents to $4.05 per share in the past 90 days.

Paylocity's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 51.2%. Shares of PCTY have risen 1.8% in the trailing 12 months.

The Zacks Consensus Estimate for Zscaler's second-quarter fiscal 2023 earnings has been revised 3 cents upward to 29 cents per share over the past 60 days. For fiscal 2023, earnings estimates have moved up by a penny to $1.24 per share in the past 30 days.

ZS’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 27.3%. Shares of the company have declined 55.9% over the past year.

The Zacks Consensus Estimate for Nutanix's second-quarter fiscal 2023 earnings has been revised northward by 2 cents to 11 cents per share over the past 60 days. For fiscal 2023, earnings estimates have moved upward by 4 cents to 17 cents per share in the past 60 days.

Nutanix's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 86.1%. Shares of NTNX have slumped 4.5% in the trailing 12 months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

3D Systems Corporation (DDD) : Free Stock Analysis Report

Paylocity Holding Corporation (PCTY) : Free Stock Analysis Report

Nutanix (NTNX) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance