$43+ Billion Worldwide Payment Security Industry to 2031 - Increasing Adoption of Digital Payment Modes is Expected to Propel Growth

Global Payment Security Market

Dublin, Jan. 17, 2023 (GLOBE NEWSWIRE) -- The "Payment Security Global Market Report 2022" report has been added to ResearchAndMarkets.com's offering.

This report provides strategists, marketers and senior management with the critical information they need to assess the global payment security market.

This report focuses on payment security market which is experiencing strong growth. The report gives a guide to the payment security market which will be shaping and changing our lives over the next ten years and beyond, including the markets response to the challenge of the global pandemic.

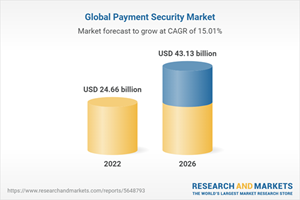

The global payment security market is expected to grow from $21.47 billion in 2021 to $24.66 billion in 2022 at a compound annual growth rate (CAGR) of 14.83%. The payment security market is expected to grow to $43.13 billion in 2026 at a compound annual growth rate (CAGR) of 15.01%.

Reasons to Purchase

Gain a truly global perspective with the most comprehensive report available on this market covering 12+ geographies.

Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

Create regional and country strategies on the basis of local data and analysis.

Identify growth segments for investment.

Outperform competitors using forecast data and the drivers and trends shaping the market.

Understand customers based on the latest market research findings.

Benchmark performance against key competitors.

Utilize the relationships between key data sets for superior strategizing.

Suitable for supporting your internal and external presentations with reliable high quality data and analysis

Major players in the payment security market are CyberSource Corporation, Elavon, Bluefin Payment Systems LLC, Ingenico, SISA Information Security Pvt Ltd, Shift4 Corporation, TokenEx LLC, Signifyd, Broadcom Inc, GEOBRIDGE Corporation, Thales Group, Intelligent Payments, Transaction Network Services (TNS) Inc, Mastercard and SecurionPay.

The payment security market consists of sales of payment security solutions and services by entities (organizations, sole traders, and partnerships) that are used to provide the customer with data security and to avoid unauthorized transactions and data breaches.

It refers to rules, regulations, and security mechanisms in place to safeguard the privacy, data, and transactions of a customer or partner. Payment security aims to prevent money laundering, fraudulent transactions, and data breaches. Payment security can be executed by various methods including tokenization, 3D security, AVS (address verification service), fraud screening tools and others.

The main types of solution provided in payment security market are encryption, tokenization and fraud detection and prevention. The encryption is a technique for security and fraud prevention that automatically breaks apart and reorders data before it is transferred over telephone lines or the internet.

Encryption is used to protect data in transit and data at rest. The services offered by payment security are integration services, support services and consulting services to the large enterprises and small and medium-sized enterprises (SMES). The industries using payment security include retail, travel and hospitality, healthcare, it and telecom, education, media and entertainment, others (automotive, financial services, and manufacturing).

North America was the largest region in the payment security market in 2021. The regions covered in the payment security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

The increasing adoption of digital payment modes is expected to propel the growth of the payment security market. Digital payments offer a quick, safe, and convenient method to buy goods and services. Consumer trust and concerns about fraud and security in digital payment are critical for future use of digital payment cards. Payment security measures ensure to prevent any fraud and concerns regarding payments.

The increasing adoption of digital payment modes will create significant demand for payment security solutions as these are essential for secured payment transactions. For instance, according to the Press Information Bureau (PIB) of India, in March 2022, digital payment transactions have increased exponentially in the last four years, from 3,134 crores (31.34 billion) in FY 2018-19 to 5,554 crores (55.54 billion) in FY 2020-21.

Technological advancement is a key trend gaining popularity in the payment security market. Three-Domain Secure 2.0 (also known as 3-D Secure 2.0 or 3DS 2.0) is a recent improvement in digital transaction security technology. As there is a rise in the adoption of digital payments, technological advancements are growing to secure transactions in digitalized payment platforms. 3-D Secure 2.0 is a security measure that adds an extra layer of fraud protection for online credit or debit card purchases.

This technology detects and prevents fraud using an unprecedented amount of contextual data. It creates an authentication pipeline between online merchants, payment networks, and financial institutions, allowing all parties to more easily share and analyze intelligence about the authenticity of a purchase. Key players are focusing on offering 3-D Secure 2.0 payment security to customers to effectively secure transactions and strengthen their position in the market while enhancing their services.

For instance, in July 2020, Visa Inc., a US-based payments technology company partnered with an Indian banking company Federal Bank to offer 'Visa Secure' to the bank's cardholders. 'Visa Secure' is a technology built on EMVCo 3DS (3D Secure) 2.0 protocol that allows customers to check out faster and with less friction. It provides an extra layer of authentication for issuers and merchants making the e-commerce highly secured at the point of purchase.

In May 2022, TokenEx, a US-based company offering cloud-based data security services for digital payments announced the acquisition of Auric Systems International, for an undisclosed amount. Through this deal, TokenEx will acquire Auric System's AuricVault service, a secure data storage service and aims to expand its presence in Latin America and Africa. Auric Systems International is a US-based company offering tokenization services.

The countries covered in the payment security market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

Report Attribute | Details |

No. of Pages | 175 |

Forecast Period | 2022 - 2026 |

Estimated Market Value (USD) in 2022 | $24.66 billion |

Forecasted Market Value (USD) by 2026 | $43.13 billion |

Compound Annual Growth Rate | 15.0% |

Regions Covered | Global |

Key Topics Covered:

1. Executive Summary

2. Payment Security Market Characteristics

3. Payment Security Market Trends And Strategies

4. Impact Of COVID-19 On Payment Security

5. Payment Security Market Size And Growth

5.1. Global Payment Security Historic Market, 2016-2021, $ Billion

5.1.1. Drivers Of The Market

5.1.2. Restraints On The Market

5.2. Global Payment Security Forecast Market, 2021-2026F, 2031F, $ Billion

5.2.1. Drivers Of The Market

5.2.2. Restraints On the Market

6. Payment Security Market Segmentation

6.1. Global Payment Security Market, Segmentation By Solution, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Encryption

Tokenization

Fraud Detection And Prevention

6.2. Global Payment Security Market, Segmentation By Services, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Integration Services

Support Services

Consulting Services

6.3. Global Payment Security Market, Segmentation By Organization Size, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Large Enterprises

Small And Medium-Sized Enterprises (SMEs)

6.4. Global Payment Security Market, Segmentation By Vertical, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Retail

Travel And Hospitality

Healthcare

IT And Telecom

Education

Media And Entertainment

Others (Automotive, Financial Services, And Manufacturing)

7. Payment Security Market Regional And Country Analysis

7.1. Global Payment Security Market, Split By Region, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

7.2. Global Payment Security Market, Split By Country, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

For more information about this report visit https://www.researchandmarkets.com/r/xqp1yx

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance