5 Growth Stocks to Buy for an Imposing Election Year Rally

The year 2023 was impressive for Wall Street. Heading into 2024, some bottlenecks, including geopolitical upheavals and stretched valuations, raised doubts about whether the rally will endure. However, major bourses shrugged off all these apprehensions and notched record highs.

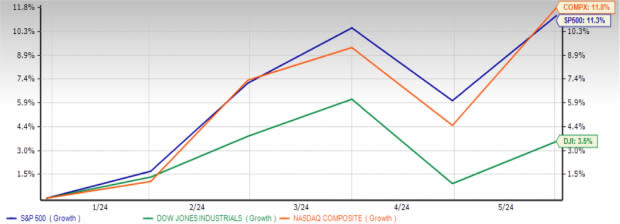

Dow Jones Market Data stated that the S&P 500 is on pace to register its best performance in the first half of an election year since 1976. The broader index has shot up 11.3% this year. Similarly, the Nasdaq has soared 11.8% this year as the tech juggernaut rolls on. The 30-stock Dow has also traded in the green, advancing 3.5% year to date.

Image Source: Zacks Investment Research

Interest rate cut optimism amid easing inflation helped the stock market scale northward this year. Consumer price pressures loosened their grip on the economy, with the consumer price index (CPI) remaining flat in May. Last month, the CPI may have increased by 3.3% from a year earlier, but it is less than April’s rise of 3.4% and much less than the pandemic-era peak of 9.1% in 2022.

Additionally, producer prices fell month over month in May, a tell-tale sign that inflation is receding. This means that the Federal Reserve will remain less hawkish, and is now widely expected to trim interest rates as early as fall. Interest rate cuts bode well for the stock market as they increase consumer outlays, reduce borrowing costs, and propel economic growth.

By the way, at the beginning of the year, market participants expected the Fed to trim rates at least six times this year. Now, the likelihood of a rate cut has been reduced to one by the end of the year. Even though it is unsatisfactory, the stock market has adjusted and kept climbing higher, banking on AI buoyancy. Digital disruption and AI have led to numerous technological progressions, boosting primarily tech company’s profit margins.

Meanwhile, presidential election years tend to be good for stocks. Janus Henderson Investors noted that despite political changeovers, the S&P 500 in election years has generated an impressive average annual return of 9.9%.

Thus, with things predominantly looking up for Wall Street in 2024, astute investors should place their bets on solid growth stocks such as Alphabet Inc. GOOGL, NVIDIA Corporation NVDA, Hanesbrands Inc. HBI, Amkor Technology, Inc. AMKR and Inseego Corp. INSG.

These stocks carry a Zacks Rank #1 (Strong Buy) or 2 (Buy) and a Growth Score of A or B, a combination that offers the best opportunities in the growth investing space. You can see the complete list of today’s Zacks Rank #1 stocks here.

Alphabet has evolved from primarily being a search engine provider to cloud computing. Alphabet currently has a Zacks Rank #1 and a Growth Score of B. The Zacks Consensus Estimate for its current-year earnings has moved up 11.9% over the past 60 days. GOOGL’s expected earnings growth rate for the current year is 31%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. NVIDIA currently has a Zacks Rank #1 and a Growth Score of A. The Zacks Consensus Estimate for its current-year earnings has moved up 12.1% over the past 60 days. NVDA’s expected earnings growth rate for the current year is 106.2%.

Hanesbrands engages in the design, manufacture, sourcing, and sale of apparel essentials for men, women and children. Hanesbrands currently has a Zacks Rank #1 and a Growth Score of A. The Zacks Consensus Estimate for its current-year earnings has moved up 4.6% over the past 60 days. HBI’s expected earnings growth rate for the current year is 666.7%.

Amkor Technology is the world's largest independent provider of semiconductor packaging and test services. Amkor Technology currently has a Zacks Rank #1 and a Growth Score of B. The Zacks Consensus Estimate for its current-year earnings has moved up 9.2% over the past 60 days. AMKR’s expected earnings growth rate for the current year is 21.9%.

Inseego is a provider of software-as-a-service solutions for the Internet of Things. Inseego currently has a Zacks Rank #2 and a Growth Score of A. The Zacks Consensus Estimate for its current-year earnings has moved up 83.8% over the past 60 days. INSG’s expected earnings growth rate for the current year is 92.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Hanesbrands Inc. (HBI) : Free Stock Analysis Report

Amkor Technology, Inc. (AMKR) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Inseego (INSG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance