5 Manufacturing Stocks to Buy Despite Mixed PMI in May

The U.S. manufacturing sector is yet to recover fully from its prolonged contraction. The Institute of Supply Management (ISM) reported that the manufacturing purchasing managers’ index (PMI) came in at 48.7% in May compared with 49.2% in April. Any reading below 50% indicates a contraction in manufacturing activities.

Notably, the ISM manufacturing PMI has been in contraction territory since October 2022 barring March this year. Surprisingly, S&P Global reported that flash U.S. Manufacturing PMI came in at 50.9% in May compared with 50% in April, reflecting a two-month high. Similarly, the flash U.S. Manufacturing Output Index came in at 52.4% in May compared with 51.1% in April, also reflecting a two-month high.

Meanwhile, the Zacks Manufacturing – General Industrial industry is poised for growth on the back of easing supply-chain disruptions. Despite a slowdown in manufacturing activities, strength across prominent end markets should help the industry stay afloat.

The industry is currently in the top 26% of the Zacks Industry Rank. In the past year, the General Industrial industry has provided 18.2% returns. Since it is ranked in the top half of Zacks Ranked Industries, we expect the consulting services industry to outperform the market over the next three to six months.

Companies in this industry provide services to original equipment manufacturing, and maintenance, repair and overhaul customers. These end users belong to the mining, oil and gas, forest products, agriculture and food processing, fabricated metals, chemicals and petrochemicals, transportation, and utilities industries.

While supply-chain disruptions persist, especially related to the availability of electronic components, the situation has improved this year. Easing supply-chain issues should support industrial manufacturing companies’ growth in the future. Additionally, an anticipated reduction in raw material costs should aid the bottom line of the industry participants. A surge in the e-commerce business has also proved beneficial.

U.S. industrial manufacturing companies have been focused on digitizing their business operations with new technologies and business models. Digitization has enabled several manufacturers to boost their competitiveness with enhanced operational productivity, product quality and lower costs.

The industry participants focus on an acquisition-based growth strategy to expand their network and product offerings. This helps them to foray into new markets and solidify their competitive position.

Exposure to various end markets helps industrial manufacturing companies offset risks associated with a single market. Also, continuous investments in product development and innovation, automation, and technological advancements augur well for the industry’s growth.

Our Top Picks

We have narrowed our search to five general industrial manufacturing stocks with strong potential for 2024. These stocks have seen positive earnings estimate revisions in the last 60 days.

Moreover, these companies are regular dividend payers. Finally, each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

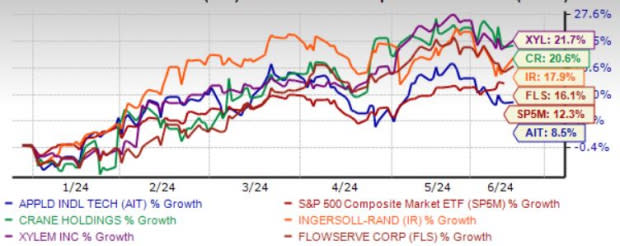

The chart below shows the price performance of our five picks yearto date.

Image Source: Zacks Investment Research

Applied Industrial Technologies Inc. AIT is poised to benefit from an improving product line and value-added services. Strength across the food and beverage, lumber and wood, mining and refining end markets sparks optimism.

An increase in demand for technical MRO support and fluid power MRO services across the U.S. manufacturing sector is aiding the Service Center Based Distribution segment. Acquired assets are driving AIT’s top line. Focus on achieving margin synergies through pricing functions and freight savings augur well for AIT.

Applied Industrial Technologies has an expected revenue and earnings growth rate of 3% and 5.5%, respectively, for next year (ending June 2025). The Zacks Consensus Estimate for next-year earnings has improved 4.4% over the last 30 days. AIT has a current dividend yield of 0.8%.

Crane Co. CR manufactures and sells engineered industrial products in the Americas, Europe, the Middle East, Asia, and Australia. CR has three segments: Aerospace & Electronics, Process Flow Technologies, and Engineered Materials.

Crane has an expected revenue and earnings growth rate of 9.9% and 16.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.8% over the last 30 days. CR has a current dividend yield of 0.6%.

Ingersoll Rand Inc. IR is set to gain from a healthy demand environment, solid product portfolio and innovation capabilities. Higher orders for industrial vacuums and blowers are driving the growth of IR’s Industrial Technologies & Services unit.

Benefits from acquired assets are driving the segment’s performance, of late. IR’s ability to generate strong cash flows supports its measures to reward shareholders through dividends and share buybacks.

Ingersoll Rand has an expected revenue and earnings growth rate of 5.4% and 10.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 30 days. IR has a current dividend yield of 0.1%.

Xylem Inc. XYL is benefiting from strong backlogs, owing to underlying demand. Growth in the transport application business, driven by backlog execution and timing of projects in Western Europe, is driving XYL’s Water Infrastructure unit. Strong momentum in smart metering and other applications end markets is aiding the M&CS unit. Synergies from the Evoqua acquisition bolster XYL’s growth.

Xylem has an expected revenue and earnings growth rate of 16.4% and 12.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days. XYL has a current dividend yield of 1.1%.

Flowserve Corp. FLS is benefiting from solid booking levels due to strong maintenance, repair and operations, and aftermarket activity. FLS logged bookings of more than $1 billion for eight consecutive quarters.

Increased revenues in the original equipment and aftermarket business are aiding both the Flowserve Pump Division and Flow Control Division units. Solid operational execution, pricing actions and improving supply chains are aiding FLS’ margins.

Flowserve has an expected revenue and earnings growth rate of 5.8% and 26.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.8% over the last 30 days. FLS has a current dividend yield of 1.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Xylem Inc. (XYL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance