Five simple New Year's resolutions to make you richer

While most people will naturally have focused their energies and money on Christmas, now is a great time to get your finances in order.

One of the best New Year resolutions you can make is to get financially fit.

Here are five simple steps you can take to make a big difference in how much money you are spending each month – three fewer coffees a week, for example, could save you around £500 a year.

Start a budget

It’s vital to know how much you’ve got coming in each week or month and, crucially, how much is leaving your account.

So you need to establish just how much you are spending on food, credit cards, store cards, your mobile phone contract, the satellite TV, various subscription services such as Netflix, as well as your mortgage or rent, council tax, house and car insurance etc.

Once you’ve got those outgoings totted up, you will see how much you have left. Set a budget and stick to it.

It might be an alarming process to see just how much you are spending and how little is left but only then can you can really start to understand where you are financially and make some informed choices.

Sort out your debts

One of the biggest drains on finances is credit and store cards. While it’s easy to pay off the minimum amount each month by direct debit and it keeps the credit checking agencies happy enough, clearing your debts has to be the better way.

If you do have spare cash, then paying more off your credit card bill than the minimum is a must.

If you’re paying high interest rates, for example on credit cards, then see what steps you can take to reduce these charges – switching to another provider using a 0% balance transfer offer is one idea.

Think about selling some of your less precious items to raise some capital to pay off the debts. All those old CDs and DVDs will fetch a tidy sum.

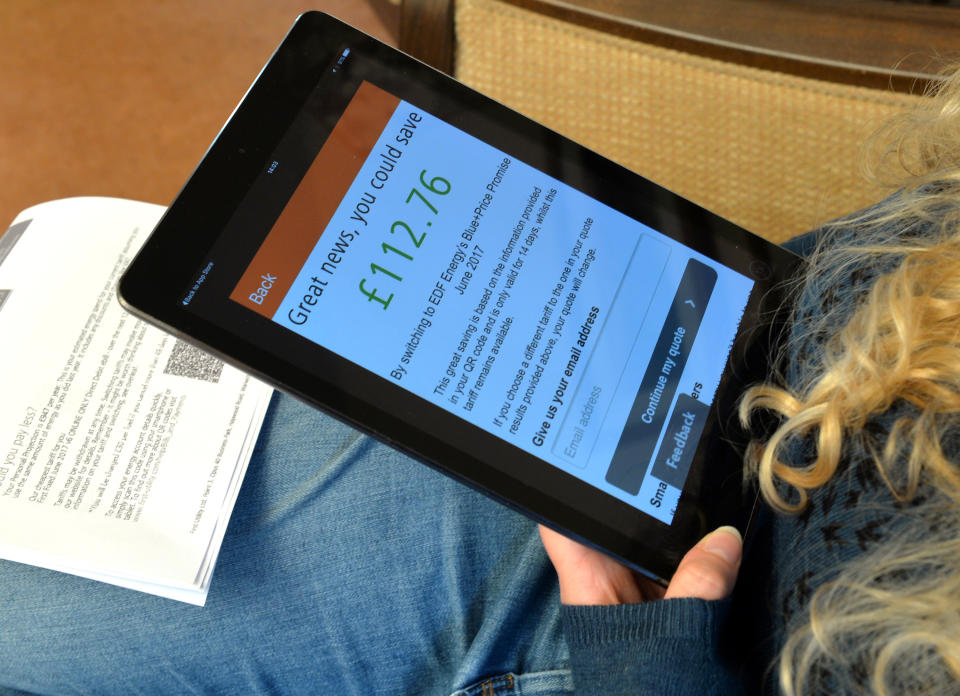

Start switching

Take a look at everything from your broadband to your energy bills and see if you could get them cheaper elsewhere. Even if you aren’t at the end of your contract, some providers may pay your exit fees for you, so it’s always worth seeing if you can beat your current deal.

Check your credit report

Services like Experian, Noodle and Clearscore mean you can check your credit report for free. It’s quick and easy to sign up and you will just need to answer a few questions about your finances.

You need to make sure that everything on your credit report is correct. If there is any wrong information you need to sort it out as it could affect you when applying for credit in the future.

Do a direct debit detox

Go through your bank statements and check you still use all the services you’ve got direct debits set up for. Ask yourself if you really need Amazon Prime, Netflix and Spotify or whether you could get rid of some of them. Also check you aren’t still paying for old insurance policies for items you no longer use.

Hannah Maundrell, editor-in-chief of money.co.uk, says: “Simple habits like cutting down on takeout coffees or remembering to take a packed lunch into work could save you £100s in a year.

“Having a budget will really help to cut down any unnecessary outgoings – but only if you stick to it. The secret is to set aside a little bit of time each week to keep on top of this, even if it’s just 15 minutes.”

And, Martin Upton, director at the Open University Business School, urged people not to make big financial decisions on Fridays and Mondays.

“On Fridays, your mind is full of the fun things you want to do at the weekend,” he says. “On Mondays, you are getting your head around the working week – and perhaps the school week – ahead. You need a clear head when making big financial decisions – not one befuddled with other thoughts and concerns.”

Yahoo Finance

Yahoo Finance