5 Stocks to Watch on Their Recent Dividend Hikes

The U.S. financial markets remain volatile as rising inflation and other key economic data weigh on investors' sentiment. The Consumer Price Index for the month of January rose 0.3%, higher than the streets expectation of 0.2%. Though the Fed Chairman’sdovish comments before the Senate suggests that the central bank is likely to initiate interest rate reduction this year, the timeline for the rate cut is most likely to be delayed.

Meanwhile, the key indexes, the Dow, the S&P 500 and the tech-heavy Nasdaq, have returned 2.7%, 7.4% and 7.2%, respectively, over the year-to-date period.

The Purchasing Managers’ Index (PMI) reported by the Institute of Supply Management (ISM) for the month of February came in at 47.8 against the street expectation of 49.5. A reading below 50 indicates a contraction in manufacturing activities. The Job Openings and Labor Turnover Survey, or JOLTS report of the Department of Labor indicates that were 1.45 jobs for every unemployed person in January up from 1.42 in December.

The Fed intends to create a soft landing for the economy and meet itsinflation target of 2%. The current interest rate is in the range of 5.25-5.5%, the highest level since 2001. By maintaining high interest rates, the Fed wants to cool off demand by making borrowing money more expensive. This would impact corporate performance and, thereby, stock prices. Although investors are expecting the central bank to be less hawkish this year, keeping in mind sticky inflation, the Fed will most probably stretch the interest rate high for longer.

Prudent investors, who wish to invest their money for regular income and capital preservation, can buy dividend stocks. These companies, due to their well-established businesses, pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks in a highly volatile market.

On that note, let us look at companies like Kadant KAI, Ross Stores ROST, Waste Management WM, Eagle Bulk Shipping EGLE and Dell Technologies DELL that have lately hiked their dividend payouts.

Kadant is headquartered in Westford, MA. This Zacks Rank #3 (Hold) company is a leading supplier of a range of products and systems for the global papermaking and paper-recycling industries, including de-inking systems, stock-preparation equipment, water-management systems, and papermaking accessories. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

On Mar 6, KAI declared that its shareholders would receive a dividend of 32 cents a share on May 8, 2024. KAI has a dividend yield of 0.4%.

Over the past five years, KAI has increased its dividend six times, and its payout ratio presently sits at 12% of earnings. Check Kadant’s dividend history here.

Kadant Inc Dividend Yield (TTM)

Kadant Inc dividend-yield-ttm | Kadant Inc Quote

Ross Stores is headquartered in Dublin, CA. This Zacks Rank #3 company operates as an off-price retailer of apparel and home accessories, primarily in the United States.

On Mar 5, ROST declared that its shareholders would receive a dividend of 37 cents a share on Mar 29, 2024. ROST has a dividend yield of 0.9%.

In the past five years, ROST has increased its dividend five times. Its payout ratio at present sits at 24% of earnings. Check Ross Store’s Company’s dividend history here.

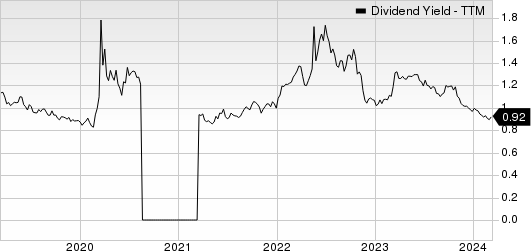

Ross Stores, Inc. Dividend Yield (TTM)

Ross Stores, Inc. dividend-yield-ttm | Ross Stores, Inc. Quote

Waste Management is headquartered in Houston, TX. The Zacks Rank #3 company is a leading provider of comprehensive waste management services in North America.

On Mar 1, WM announced that its shareholders would receive a dividend of 75 cents a share on Mar 28, 2024. WM has a dividend yield of 1.4%.

Over the past five years, WM has increased its dividend five times. Its payout ratio now sits at 45% of earnings. Check Waste Management's dividend history here.

Waste Management, Inc. Dividend Yield (TTM)

Waste Management, Inc. dividend-yield-ttm | Waste Management, Inc. Quote

Eagle Bulk Shipping is headquartered in Stamford, CT. This Zacks Rank #3 company transports a broad range of major and minor bulk cargoes along worldwide shipping routes.

On Mar 1, EGLE declared that its shareholders would receive a dividend of 60 cents a share on Mar 21, 2024. EGLE has a dividend yield of 0.6%.

In the past five years, EGLE has increased its dividend five times. Its payout ratio at present sits at 18% of earnings. Check Eagle Bulk Shipping’s dividend history here.

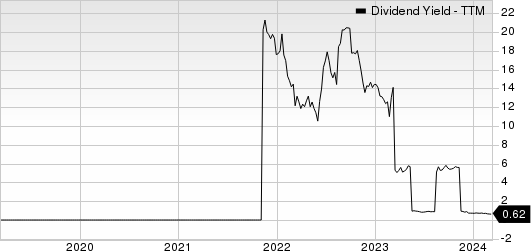

Eagle Bulk Shipping Inc. Dividend Yield (TTM)

Eagle Bulk Shipping Inc. dividend-yield-ttm | Eagle Bulk Shipping Inc. Quote

Dell Technologies is headquartered in Round Rock, TX. This Zacks Rank #2 (Buy) company offers secure, integrated solutions that extend from the edge to the core to the cloud. Dell’s IT solutions support customers both in traditional infrastructure and multi-cloud environments.

On Feb 29, DELL declared that its shareholders would receive a dividend of 45 cents a share on May 3, 2024. DELL has a dividend yield of 1.3%.

Over the past five years, DELL has increased its dividend three times, and its payout ratio presently sits at 24% of earnings. Check Dell Technologies’ dividend history here.

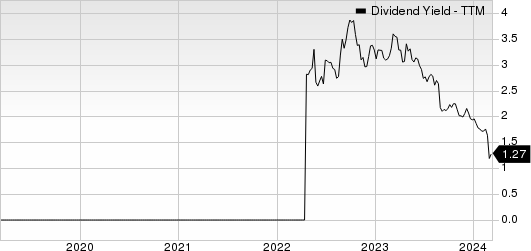

Dell Technologies Inc. Dividend Yield (TTM)

Dell Technologies Inc. dividend-yield-ttm | Dell Technologies Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

Eagle Bulk Shipping Inc. (EGLE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance