5 Top-Ranked Technology Services Stocks With More Room to Run

The U.S. business services space has been benefiting from the strong fundamentals of the economy. Despite facing a record-high interest rate and extremely tight monetary control by the Fed, this sector has provided double-digit returns in the past year.

Within this sector, the technology services industry is mature, with demand for services in good shape. Revenues, income and cash flows are anticipated to gradually reach the pre-pandemic levels, aiding most industry players to pay out stable dividends.

Growth in the technology services industry has increased the number of remote workers in the wake of the pandemic. In this era of digital transformation, enterprises are actively seeking a common ground between on-premise and cloud infrastructure that will enable them to provide flexible and easy-to-adopt hybrid solutions.

The business software industry is gaining from robust demand for multi-cloud-enabled software solutions, given the ongoing transition from legacy platforms to modern cloud-based infrastructure.

The industry players are incorporating artificial intelligence and tools like machine learning in their applications to make the same more dynamic and result-oriented. Elevated demand for enterprise software, which is ramping up productivity and improving the decision-making process, is a key catalyst. According to market.us, the worldwide artificial intelligence market was worth $177 billion in 2023 and is anticipated to reach a staggering $2.75 trillion by 2032.

In the past year, the Zacks Defined Business Services sector has provided a double-digit return of 22.8% and the Technology Services industry has rallied an impressive 64.1%. Year to date, the Business Services sector and the Technology services industry have advanced 6.5% and 14.2 respectively. Since the Technology Services industry ranks within the top 24% of Zacks Ranked Industries, we expect it to outperform the market over the next three to six months.

Our Top Picks

We have narrowed our search to five technology services stocks that have a solid upside left in 2024. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

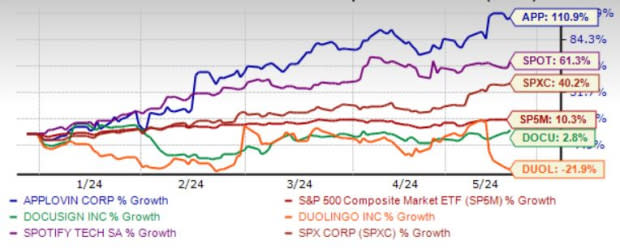

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

AppLovin Corp. APP is engaged in building a software-based platform for mobile app developers to enhance the marketing and monetization of their apps in the United States and internationally. APP provides a technology platform that enables developers to market, monetize, analyze and publish their apps.

AppLovin has an expected revenue and earnings growth rate of 31.7% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 16.4% over the last seven days.

Duolingo Inc. DUOL operates as a mobile learning platform in the United States, China, the United Kingdom, and internationally. DUOL offers courses in 40 different languages, including Spanish, English, French, German, Italian, Portuguese, Japanese, and Chinese through the Duolingo app. DUOL also provides a digital language proficiency assessment exam.

Duolingo has an expected revenue and earnings growth rate of 37.8% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 25.4% over the last seven days.

DocuSign Inc. DOCU provides a cloud-based, e-signature software platform in the United States and internationally that enables businesses to prepare, execute and act on agreements digitally. DOCU’s top line is significantly benefiting from continued customer demand for eSignature, its anchor product.

Despite this rising demand, the market for eSignature remains largely untapped and this keeps DocuSign in a position to expand eSignature around the world. DOCU remains focused on continuously acquiring customers, improving its offerings and expanding internationally.

DocuSign has an expected revenue and earnings growth rate of 5.8% and 8.7%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

Spotify Technology S.A. SPOT provides audio streaming services worldwide. SPOT operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

The Ad-Supported segment provides on-demand online access to its catalog of music and unlimited online access to the catalog of podcasts to its subscribers on their computers, tablets, and compatible mobile devices. SPOT also offers sales, distribution and marketing, contract research and development, and customer support services.

Spotify Technology has an expected revenue and earnings growth rate of 16.5% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 36.2% over the last 30 days.

SPX Technologies Inc. SPXC supplies infrastructure equipment serving the heating, ventilation, and cooling (HVAC) and detection and measurement markets worldwide. SPXC operates in two segments, HVAC and Detection and Measurement.

The HVAC segment engineers, designs, manufactures, installs, and services package and process cooling products and engineered air movement solutions for the HVAC industrial and power generation markets, as well as boilers, heating, and ventilation products for the residential and commercial markets. The Detection and Measurement segment offers underground pipe and cable locators, inspection and rehabilitation equipment, and robotic systems.

SPX Technologies has an expected revenue and earnings growth rate of 14.8% and 24.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.3% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AppLovin Corporation (APP) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Spotify Technology (SPOT) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance