Capital gains tax rise under Labour could cost Treasury £3bn, official data suggests

An increase in capital gains tax under a Labour government would actually cause receipts to the Treasury to decline, HM Revenue & Customs (HMRC) data has suggested.

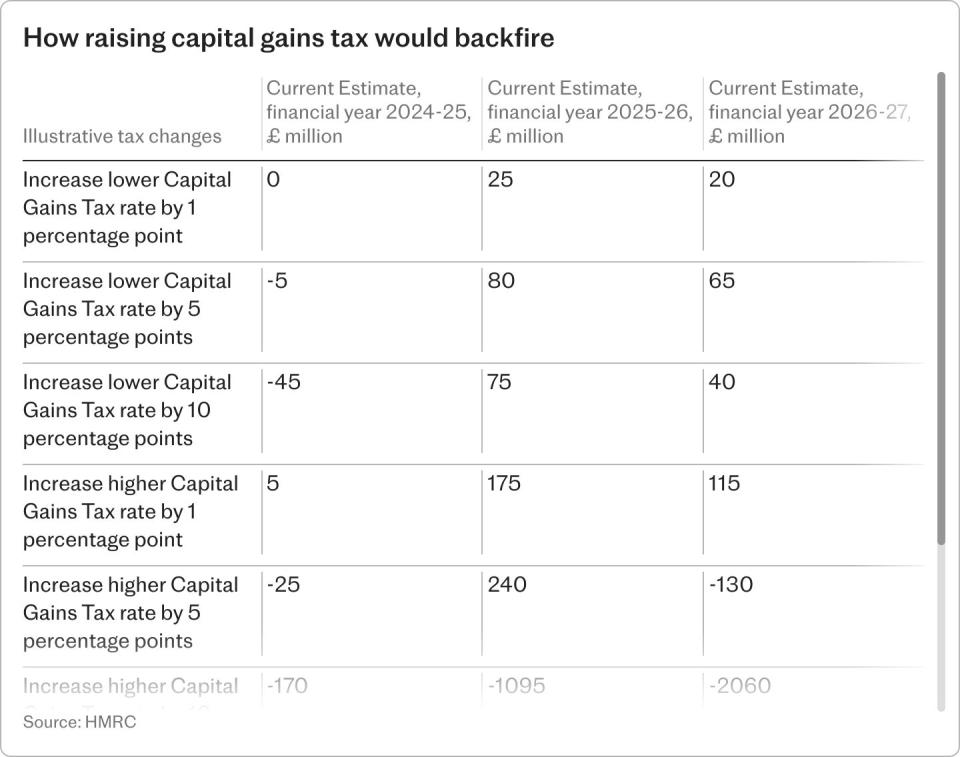

A 10 percentage point increase in the higher rate could lead to a £170m fall in tax take in 2024-25, followed by a £1.1bn drop in 2025-26 and £2.1bn in the year after, figures from HMRC suggest.

Labour has ruled out increasing income tax and National Insurance if it wins the general election on July 4.

However, it has refused to make the same pledge about capital gains tax – fuelling speculation the rates could go up under a Labour government.

The Liberal Democrats have already promised to double rates for higher earners if it gets into power, a proposal they estimate would raise £5.2bn a year for the NHS in 2028-29.

Its plans also include an “inflation allowance” so that gains purely resulting from inflation would not be taxed, as well as targeted relief for small businesses.

But revenue from capital gains tax can be very difficult to predict, as HMRC’s statistics demonstrate.

A one percentage point increase in the higher rate would raise £300m over three years, its estimates say. However, a five percentage point increase would raise three less than a third of that – at just £85m.

The calculations were drawn up by the tax office in January 2024 as part of a regular exercise to show how changes in fiscal policy could impact revenue.

In a note accompanying the data, HMRC said that “very large” rate rises “can reduce exchequer yield due to taxpayer behavioural impacts”.

Christopher Springett, of wealth manager Evelyn Partners, said: “It is not unexpected to see a drop in anticipated capital gains tax revenue when rates are increased, particularly when the announcement is made in advance of the rate change.

“Looking back to 1988 when capital gains tax rates increased from 30pc to 40pc, there was no meaningful increase in yield over that next five-year period.”

This is because individuals have a degree of control around when to sell up and realise their gains.

Sean McCann, of financial advice firm NFU Mutual, said: “Where a new tax threshold or rate is introduced, taxpayers may choose to take a different approach in how they manage their assets or funds.

“In the case of capital gains tax, this may mean that some people decide not to sell or give away assets during their lifetime, as capital gains tax is ‘washed away’ on death.”

Laura Suter, of stockbroker AJ Bell, said: “Tax on gains through the sale of property will be where the lion’s share of the tax take comes from.

“If the higher rate of capital gains tax were to rise by 10 percentage points and a gap between capital gains tax rates and corporation tax rates opened up, you may see an increased number of landlords with multiple properties registering them as a corporation, which would naturally reduce the overall capital gains tax take considerably.”

Investors and property owners are already paying a record amount of capital gains tax due to rising asset prices and successive cuts to the tax-free allowance.

Today, investment profits of more than £3,000 are enough to trigger a capital gains tax liability, following a series of cuts to annual tax free allowances. Tax breaks were slashed from £12,300 to £6,000 last year and then cut it in half again in April 2024.

The levy is forecast to rake in £15.2bn this year, soaring to £18.9bn in 2026-27, according to the Office for Budget Responsibility. Thanks in part to the reform of the non-dom regime – revenue from capital gains tax is expected to rise by an average £700m per year from 2024-25 because of the Chancellor’s decisions, the OBR said.

The Office for Tax Simplification, a now-disbanded government agency, previously recommended aligning the rates with income tax to prevent “distortions” in behaviour, where the rich move their wealth around in order to pay less tax.

Tax-cutting chancellor Nigel Lawson argued in his 1988 budget that taxing capital gains and income differently was “hard to justify”, and “inevitably creates a major tax avoidance industry”.

Currently, basic rate taxpayers pay 10pc on gains after selling investments and 18pc on profits from the sale of a second property. Higher rates of 20pc and 24pc also apply for higher earners and those with the largest gains.

The Government cut this top rate from 28pc in the most recent budget.

Labour was contacted for comment.

Yahoo Finance

Yahoo Finance