5 Undervalued Stocks with Long-Term Potential

As investors, we are forever searching for stocks that are below their intrinsic value, i.e., the value that may be considered reasonable, given their fundamental strengths, market position, growth prospects of the industry in which they operate and so on.

Whether we’re seasoned investors with a lot of experience and a lot of cash to play around with or just starting out, the most important question we’re trying to answer is whether a stock is trading below its potential. Therefore, while on the one hand, we need to study the fundamentals to understand the prospects, on the other, we also need to study its price movements. Then we need to match all this with our own goals, which could be the need to generate some income today, or the need to save for a future event, such as retirement or a wedding, or it could also be a bit of both.

Needless to say, all this studying takes time. To make matters more difficult, there are so many industries, segments within industries, differing reporting structures, etc that make this all the more difficult. Therefore, we have to find a way to shortlist stocks.

For some people, who are risk averse, this shortlisting could mean that they consider only large-cap stocks, because it’s well known that these companies, although offering lower growth rates, are far more stable and also often pay a dividend. Others are more open to some calculated risk, such as the EV space for example, because it is bound to grow in the future on the back of companies that are making no money today. This is one way of doing it.

But it could also be more effective if combined with studying broker ratings and estimate revision trends. This is a quicker way to shortlist stocks and could be a lot more accurate as well. Brokers usually come with knowledge on the particular industry, have field exposure and often experience when studying a particular stock. Therefore, they may know things that are not obvious to us when we analyze the press release, the earnings call or regulatory filings. If there are a number of brokers providing estimates, a consensus between them makes the method all the more reliable.

At Zacks, you also have access to certain proprietary systems that make stock selection much easier. Some examples are the stock ranking system, the industry ranking system and the style scores. These help you jump to stocks with real potential.

Let’s take a look at some examples.

Assurant, Inc. (AIZ)

Atlanta-based Assurant is a global provider of business services that support and protect consumer purchases. The company operates through the Global Lifestyle and Global Housing segments. Under Global Lifestyle, Assurant offers mobile device solutions, extended service plans and insurance products for consumer electronics, appliances and vehicles.

The Global Housing segment provides insurance coverage for homeowners, renters and manufactured housing. Assurant has a strong presence worldwide, serving customers in North America, Latin America, Europe and the Asia Pacific region.

The average broker rating on Assurant shares is 1.50, which roughly translates to a #2 rating. Analysts expect 25.0% earnings growth this year and 13.6% growth in 2024. They’ve taken their 2023 estimate up 24.4% and 2024 estimate up 18.1% in the last 30 days. In the long term, they expect the company to grow 11.6%. Despite these positives, the shares trade at a 17% discount to their median value over the past year. Therefore, this stock would make a good pick, as seen from the Zacks #1 (Strong Buy) rating on it.

EZCORP, Inc. (EZPW)

Austin, TX-based EZCORP, Inc. is a pawn services provider operating in the United States and Latin America. Through its three segments -- U.S. Pawn, Latin America Pawn and Other Investments -- the company offers loans secured by a variety of personal assets such as jewelry, electronics and tools. It also sells forfeited and pre-owned merchandise.

EZCORP provides customers with convenient online management of their pawn transactions through EZ+, a web-based application. With a significant presence in the pawn industry, the company operates numerous pawn stores across the U.S., Mexico, Guatemala, El Salvador and Honduras.

The average broker rating on EZCORP shares is 1.00, which corresponds to the Zacks #1 rating on the shares. Analysts are looking for 13.3% earnings growth this year with 2024 coming in consistent with the 2023 level. However, it’s still early days to be predicting 2024 performance and the estimates keep going up. For the year ending September 2023, they’re up 10 cents 13.3% on average. For 2024, they’re up 6 cents (7.5%) in the last 30 days. Analysts expect long-term growth of 35.0%.

The shares are trading at a 9.3% discount to their median value over the past year. While the current level is a 67.3% premium to the industry, it is also a 45.3% discount to the S&P 500. Net-net, there appears to be upside potential from these levels, especially considering the long-term potential.

Lifetime Brands, Inc. (LCUT)

Garden City, NY-based Lifetime Brands is a leading provider of branded kitchenware, tableware and home products. With a diverse range of offerings, the company designs, sources and sells kitchen tools, gadgets, cutlery, cookware, dinnerware and more. Lifetime Brands owns or licenses popular brands such as Farberware, Mikasa, KitchenAid and Pfaltzgraff, among others. Its products are sold through various channels including mass market merchants, specialty stores, department stores and e-commerce platforms.

Analysts expect earnings to increase 93.6% this year and 73.3% in the next. They expect the company to grow 14% in the long term. Their average rating of 1.00 on the shares corresponds to the Zacks #1 rating. The 2023 estimate has accordingly moved up 5 cents (9.1%) in the last 30 days. The 2024 estimate remains unchanged.

The shares are trading close to their median level over the past year. But this is a significant discount to the industry (40.2%), as well as the S&P 500 (61.6%). Therefore, the shares may be considered undervalued and worth buying as a result.

Stride, Inc. (LRN)

Reston, VA-based Stride is a technology-based education service company that specializes in providing online curriculum, software systems and educational services for K-12 students. With a focus on individualized learning, Stride's products and services support virtual or blended public schools, offer online courses and supplemental educational materials, and provide career learning programs in industries such as IT, healthcare and business. Stride serves a diverse range of clients including schools, districts, employers and government agencies.

Analysts have made significant revisions to their estimates for 2023 and 2024. The 2023 estimate is up 31 cents (12.4%) in the last 30 days, representing 11.9% growth for the year. The 2024 estimate is up 23 cents (8.0%), representing 9.7% growth. The long-term growth rate is 20.0%. The average broker rating is 1.50, which may be understood as a Buy rating. The Zacks Rating on the shares is #1.

The shares are trading at a 7.8% discount to their median value over the past year, which is a 36.5% discount to the industry and a 27.7% discount to the S&P 500. Therefore, they may be considered cheap in every respect.

On Holding AG (ONON)

Zurich, Switzerland-based On Holding AG develops and distributes sports products worldwide. It offers athletic footwear, apparel and accessories. The company offers its products through independent retailers and distributors, online and in stores.

While estimates for both 2023 and 2024 have increased by a mere penny each, current estimates represent 89.7% earnings growth for 2023 and 42.9% growth for 2024. In the long term, analysts expect growth of 37.8%. The average broker rating is 1.50, which translates to a Buy rating on the shares. The Zacks Rank is also #1.

The shares trade at an 18.4% discount to their median value, although the current price is a significant premium to both the industry and the S&P 500. Despite the strong growth expected in the long term, this makes their valuation reasonable.

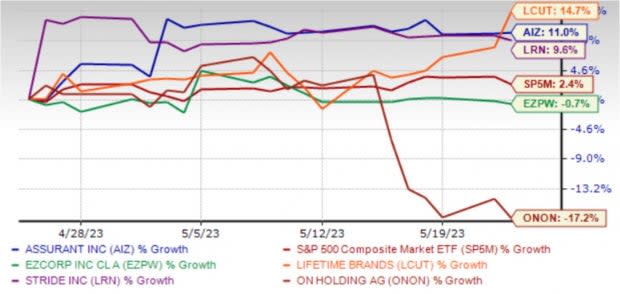

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

EZCORP, Inc. (EZPW) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report

Lifetime Brands, Inc. (LCUT) : Free Stock Analysis Report

On Holding AG (ONON) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance